NYSLRS, which administers the Employees’ Retirement System (ERS) and the Police and Fire Retirement System (PFRS), had 685,450 members as of March 31, 2022. Our members are State government, local government, school district and other public-sector employees from across New York — 650,251 in ERS and 35,199 in PFRS. About 74 percent of our members were active, which means they were on a public payroll as of March 31.

NYSLRS Membership Over Time

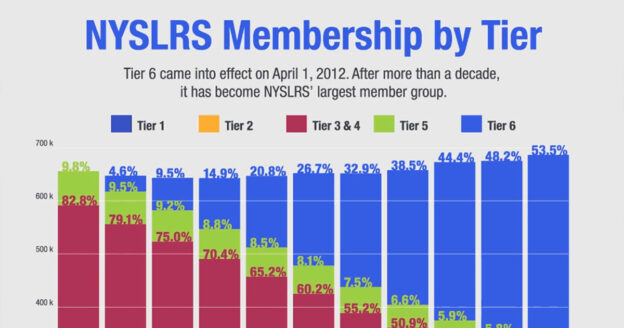

A decade ago, more than 80 percent of NYSLRS members were in Tiers 3 and 4. Now, those tiers represent less than 40 percent of our membership. Tier 6, which includes members who joined NYSLRS since April 1, 2012, now has 367,013 members, or 53.5 percent of total membership.

Here’s a look at our NYSLRS membership by tier, as of March 31:

Tier 1: NYSLRS’ oldest tier, whose members first joined the system before July 1, 1973 (July 31, 1973, for PFRS members), is dwindling. Tier 1 represented only 0.2 percent of our membership. There were only 1,043 Tier 1 ERS members and 17 Tier 1 PFRS members.

Tier 2: With 18,074 members, Tier 2 represented 2.6 percent of membership. Ninety-four percent of Tier 2 members were in PFRS.

Tiers 3 & 4: Tiers 3 and 4, which have similar retirement plans, had 263,734 members, 38.5 percent of the total membership. Tiers 3 and 4 are primarily ERS tiers. There is no Tier 4 in PFRS, and only 173 PFRS members were in Tier 3.

Tier 5: Tier 5 covers members who joined from January 1, 2010, through March 31, 2012. With 35,569 members, Tier 5 represented 5.2 percent of membership.

Tier 6: This tier covers members who joined since April 1, 2012. Its ranks grew by about 13 percent during the last fiscal year.

Why Your Tier Matters

Your tier is an essential component of your NYSLRS membership because it is one of the factors that determines your benefits. You can find out more by reading your retirement plan booklet. Our recent blog posts explain how to find your plan booklet and how to get the most out of it.

How do I get a hold of the matrimonial unit\ DRO\ to submit a question?

You can email our Matrimonial Bureau at dro@osc.state.ny.us.

You can also email our customer service representatives using the secure email form on our website. One of them will review your account and respond to your questions. Filling out the secure form allows us to safely contact you about your personal account information.

My husband was Tier 0. Do they still have any Tier 0 members, or their Beneficiaries left? We had 7 kids, so we took this Tier in Order to have a little more cash each month. Of course, it was a mistake. Couldn’t afford to buy extra Life Ins. Policy. So when he died, 2 yrs. Ago., It left me, with no retirement & only a small social security check each month. We weren’t thinking right, at the time, & didn’t receive any advice, so I’m paying for it now. Just wanted to warn, the young Police officers, Not to make the Mistake, that We did. Thanks. Lorraine

I dont see anything about Tier 0 as you mention cause when I started in DOCS in 1964 I was in Tier 1

Sorry for your loss and your situation.

I believe you meant that your husband chose option 0.

Sorry for your loss. But you are confusing the retirement option number with the tier. Option 0 is to take the full pension amount with no provision for a beneficiary. It gives the largest payout, but on your death all payments stop. Other options would give you a reduced monthly payment, but your beneficiary can continue getting those payments after you die.

Option 0 is available regardless of the tier you are in.