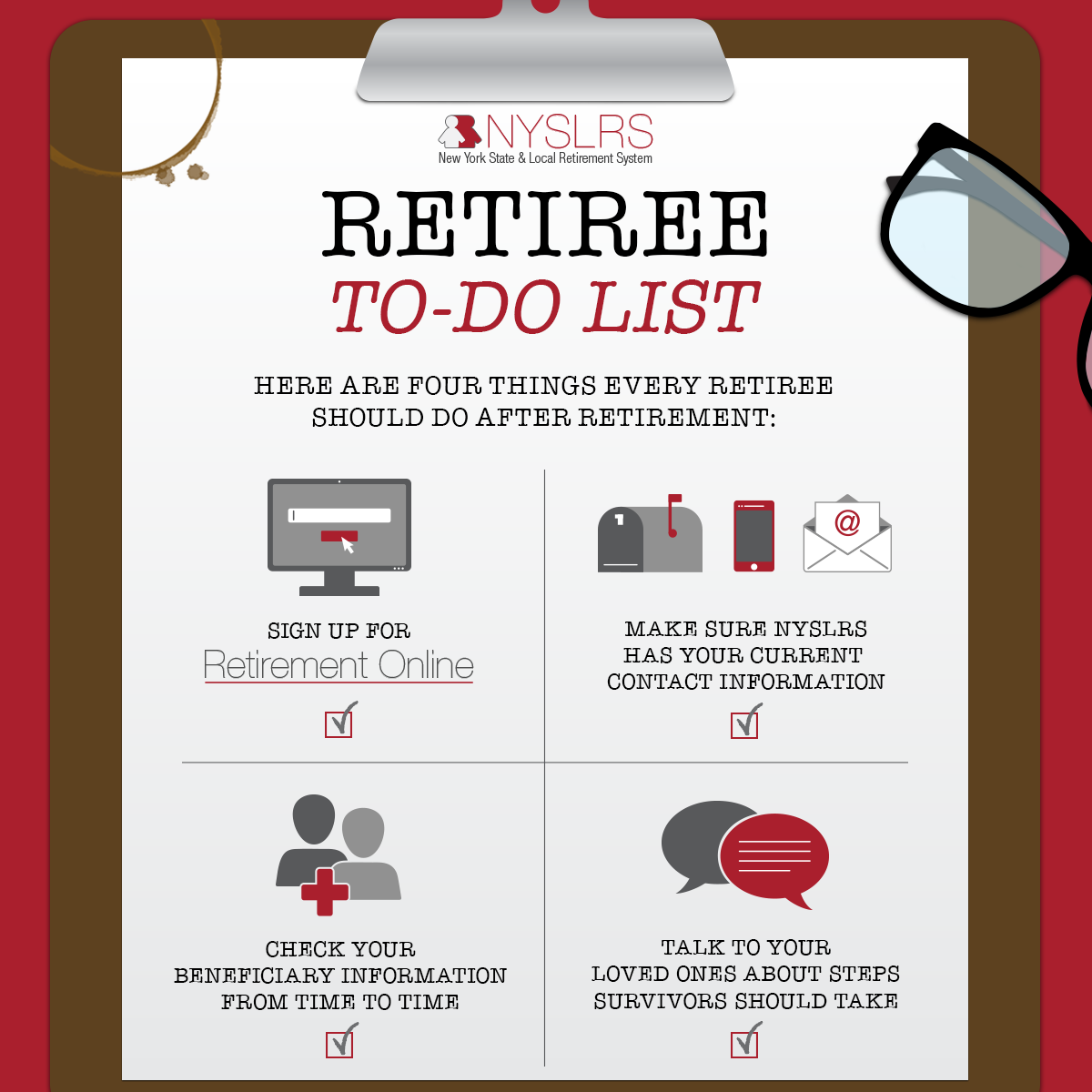

There are a few things you should do regarding your NYSLRS benefits after you retire. This way, wherever your retirement takes you, we can continue to provide you with the benefits and services available to our retirees.

Sign Up for Retirement Online

If you don’t already have a Retirement Online account, this is a great time to sign up. Retirement Online provides a secure and convenient way to check important NYSLRS information, like the deductions from your latest payment and a summary of your benefits. You can also view or update beneficiary information and generate pension income verification letters right from your computer. We’ll be adding additional online features for retirees in the near future, so stay tuned.

Have New Contact Information? Let Us Know

If you move after you retire, let NYSLRS know your new address so you can be sure to get important communications about your benefits.

The Post Office usually won’t forward pension checks to another address. If you haven’t already, you can sign up for our direct deposit program. It’s the safe, hassle-free way to receive your monthly benefit. But there are other things you’ll want to receive from us after you retire, such as:

- Your 1099-R form. Your pension isn’t taxed by New York State, but it is subject to federal income tax.

- Your Retiree Annual Statement. It’s a helpful reference that spells out the benefits, credits and deductions you receive each year.

- Any official notifications such as a net change in your benefits.

- Your Retiree Notes newsletter.

There are several ways to update your address. The fastest way is through Retirement Online. Or, you can complete our secure contact form for street addresses within the United States. Be sure to fill out the entire contact form and provide both your old and new addresses.

You can also complete a Change of Address Form (RS5512) and mail it to:

NYSLRS

110 State Street

Albany, NY 12244-0001

You should also make sure we have your current email address. Having an email address on file means we can contact you quickly if we need to notify you about an update to your NYSLRS benefits. If you haven’t updated your email address with NYSLRS, update it in Retirement Online, send it to us using the secure email form or send it to us with your Change of Address Form (RS5512).

Keep Your Beneficiary Information Current

Reviewing your beneficiary designations periodically is important. By keeping them up to date, you ensure that any post-retirement death benefit will be distributed to your loved ones according to your wishes. You can use Retirement Online to change your death benefit beneficiaries at any time, or contact our Call Center and we will send you the necessary form.

Read Our Guide for Retirees

Check out our publication, Life Changes: A Guide for Retirees (VO1705), for information about other benefits you may be entitled to and the services we offer after you retire.