We accumulate a lot of important documents over a lifetime — things such as birth certificates, diplomas, deeds, wills, insurance policies and more. If you’re like many people, you may have papers stuffed in drawers, filing cabinets or boxes in the attic. If you need an important document, will you be able to find it? What’s more, when you pass away, will your loved ones be able to find what they need?

Organize Your Important Documents

Important documents should be kept in a secure but accessible place in your home. This includes personal documents, such as your passport, birth certificate, marriage certificate, will and burial instructions. You should also include information about your NYSLRS retirement benefits, income taxes, bank accounts, credit cards and online accounts. Important contact information, such as the names and phone numbers of your attorney, accountant, stockbroker, financial planner, insurance agent and executor of your will should also kept in a secure location.

Our fillable form, Where My Assets Are, can help make organizing your important documents a little easier. It will help you or your loved ones locate these documents when they are needed. It’s a good idea to review and update this information regularly.

Be aware that a safe deposit box may be sealed when you die. Don’t keep burial instructions, power of attorney or your will in a safe deposit box, because these items may not be available until a probate judge orders the box to be opened. However, a joint lessee of the box, or someone authorized by you, would be permitted to open the box to examine and copy your burial instructions.

Review Death Benefits and Beneficiary Designations

Depending on your tier and retirement plan, your beneficiaries may be eligible to receive a death benefit. Visit our member and retiree death benefit pages for more information.

Then, sign in to your Retirement Online account to review your named beneficiaries and update their contact information if needed. From your Account Homepage, click “View and Update My Beneficiaries” to get started.

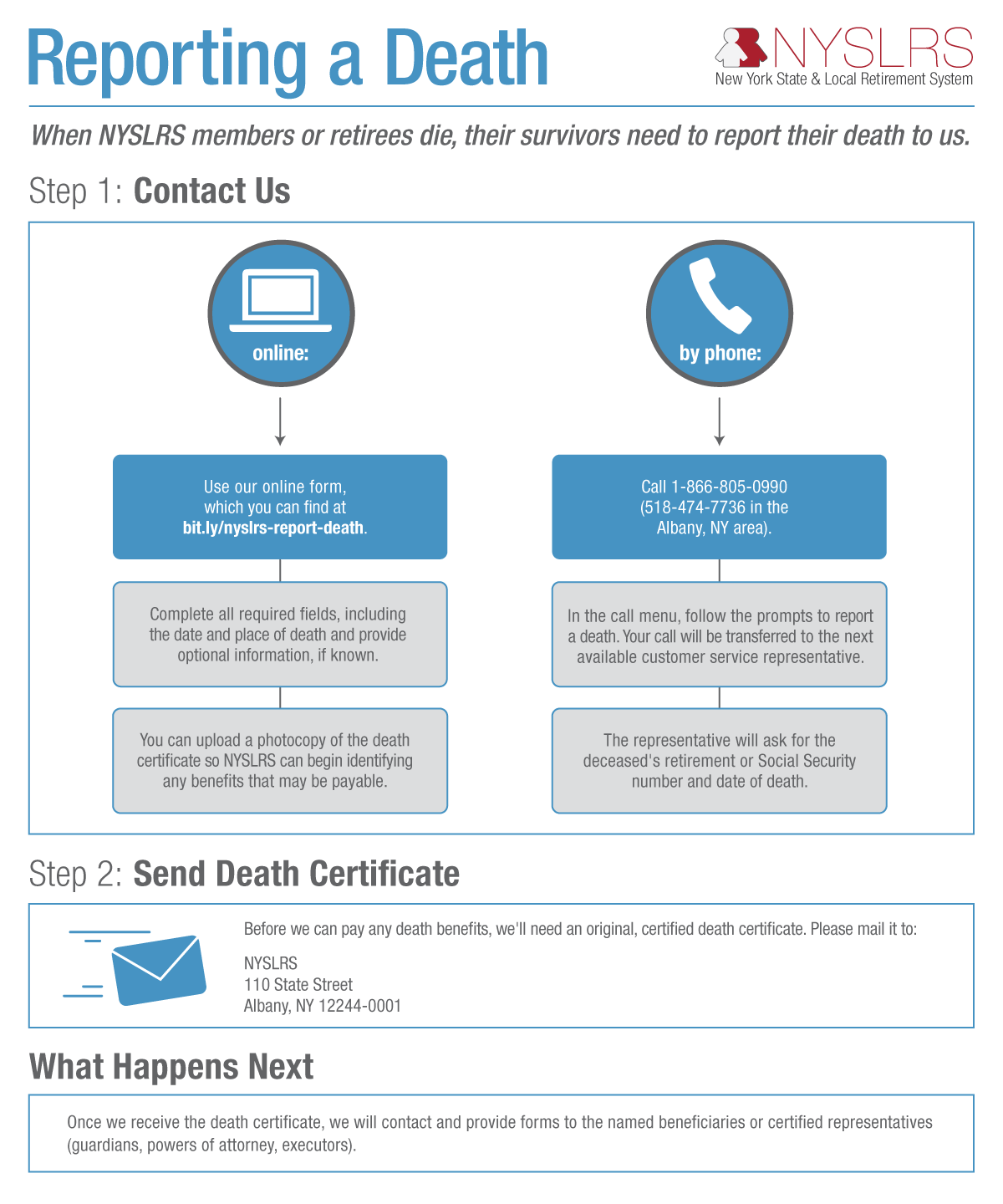

Please note, when a NYSLRS member or retiree dies, it is important that survivors report the death to NYSLRS as soon as possible. Before any death benefits can be processed or paid, NYSLRS will need an original, certified death certificate.