While most New York teachers and administrators are in the New York State Teachers’ Retirement System, other school employees are members of the New York State and Local Retirement System (NYSLRS). In fact, 1 out of 5 NYSLRS members works for a school district. Usually, their employment is tied to the school year, which is often 10 or 11 months long.

While most New York teachers and administrators are in the New York State Teachers’ Retirement System, other school employees are members of the New York State and Local Retirement System (NYSLRS). In fact, 1 out of 5 NYSLRS members works for a school district. Usually, their employment is tied to the school year, which is often 10 or 11 months long.

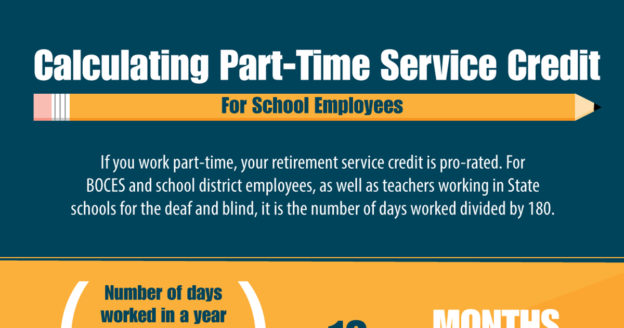

So how do we determine service credit for school employees?

Service Credit for School Employees

As a member, you receive service credit for paid public employment beginning with your date of membership. That credit is based on the number of days you work, which your employer reports to us.

If you’re working full-time, you receive one year of service per school year, even if you only work 10 months of the year.

For part-time work, your employer calculates days worked by dividing the number of hours worked by the hours in a full-time day. The number of hours in a full-time day is set by your employer (between six and eight hours). So, for example, if a 40-hour work week is considered full-time for your employer, and you work 20 hours a week for a given school year, you will receive half a year of service credit.

Calculating Service Credit

Usually, a full-time, 10-month school year is at least 180 days. However, depending on your employer, a full academic year can range from 170 days to 200 days. Whether you work full- or part-time, your service is based on the length of your school year:

For all BOCES and school district employees, as well as

teachers working at New York State schools for the deaf and blind:

Number of days worked ÷ 180 days

For college employees:

Number of days worked ÷ 170 days

For institutional teachers:

Number of days worked ÷ 200 days

Check Your Service Credit

You can sign in to Retirement Online and find your current estimated service credit listed on your Account Homepage under ‘My Account Summary.’

If you’re not sure whether you’re earning full-time or part-time service, you can check your most recent Member Annual Statement to see how much service you earned over the past fiscal year. To view your most recent Statement, sign in to Retirement Online. From your Account Homepage, click the “View My Member Annual Statement” button under ‘My Account Summary.’ If you are receiving full-time service, it will say “1.00 Years” for service credited from 4/1/2022 – 3/31/2023. A reminder: the total credited service you will see listed on your Statement was as of March 31, 2023.

For more information about service credit, read our booklet Service Credit for Tiers 2 through 6 (VO1854) or find your retirement plan publication.