Even if your retirement is years in the future, you should be aware of certain membership milestones that may help you narrow down when to retire.

There are two types of membership milestones: those pertaining to age and those pertaining to service credit. Since most NYSLRS members reach service credit milestones first, we’ll start with them.

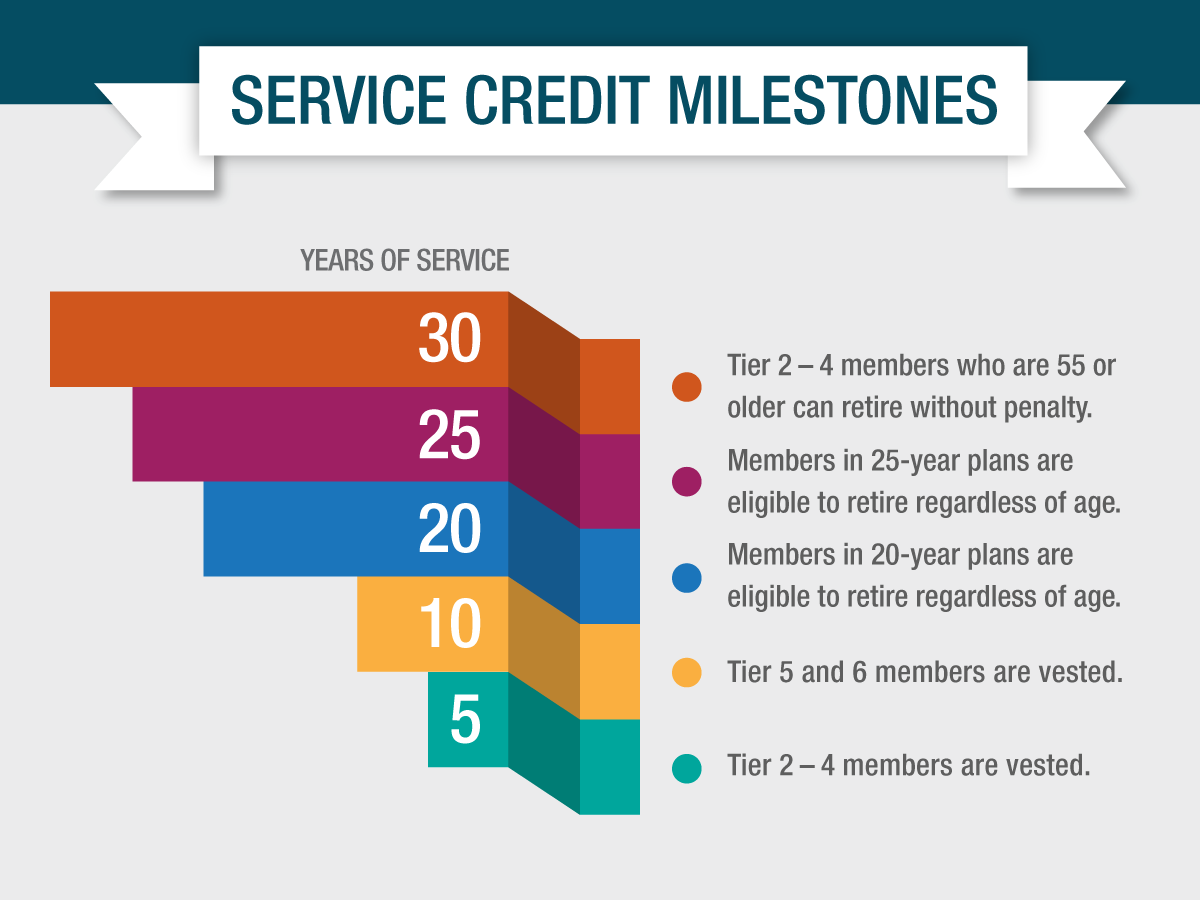

Service Credit Milestones

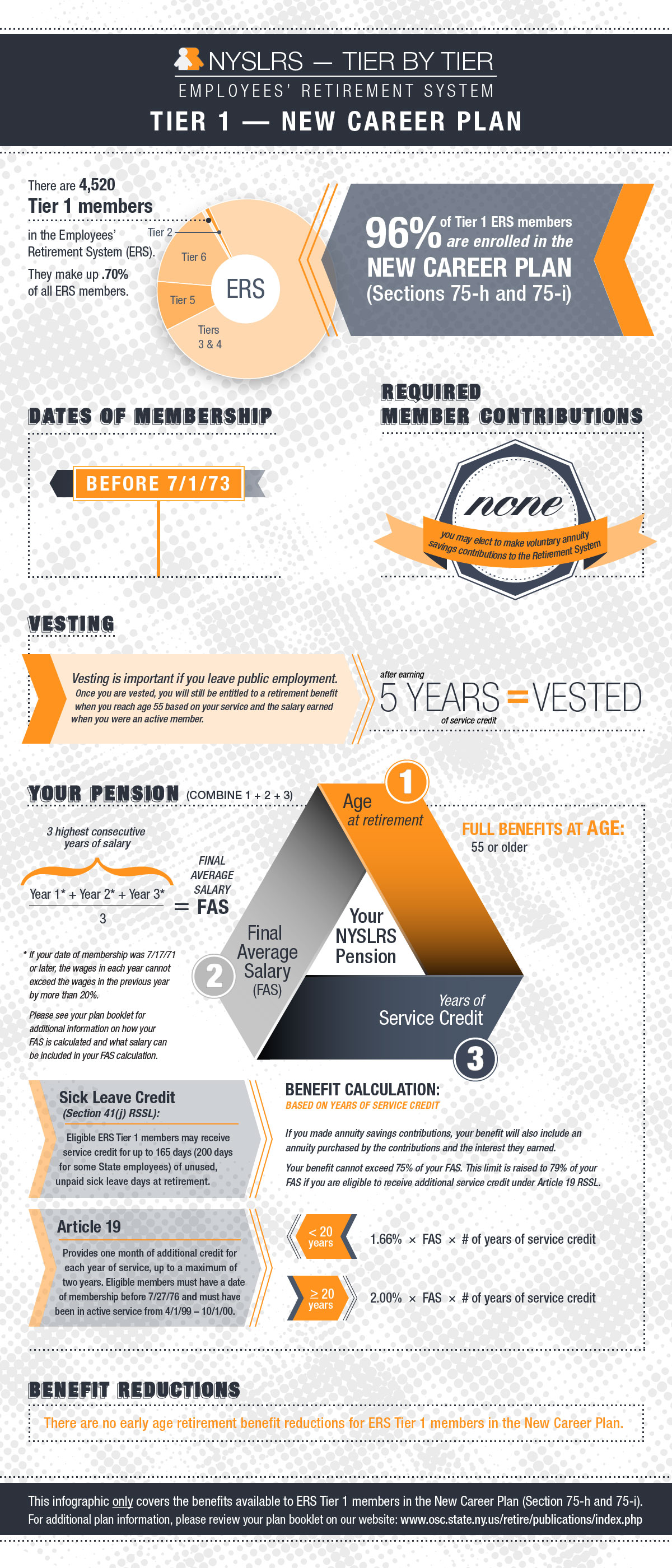

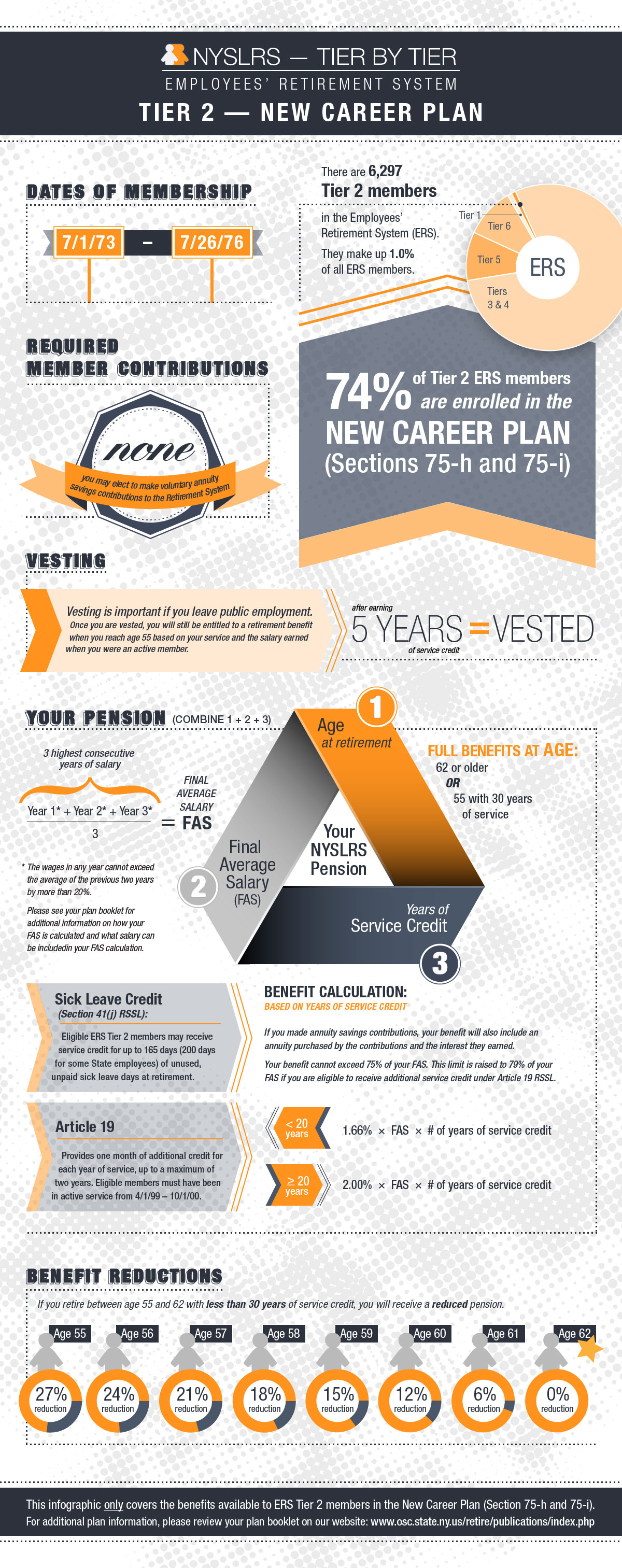

Vesting is a key retirement milestone. Once you become vested, you will be eligible for a NYSLRS pension even if you leave public employment before retirement. Members in Tiers 1-4 with at least five years of credited service are vested. (Most members in these tiers have already reached this milestone.) Tier 5 and 6 members must have ten years of credited service to be vested.

After reaching 20 years of service, most members will be eligible to have a higher percentage of their final average earnings included in their pension benefit. How that benefit is calculated depends on your retirement plan and tier. You can find more information in your retirement plan booklet.

Members in some special plans can retire with 20 years of service, regardless of their age. Other special plans allow for retirement after 25 years, regardless of age.

At 30 years of service, Tier 2-4 members who are at least 55 years old can retire without a pension reduction.

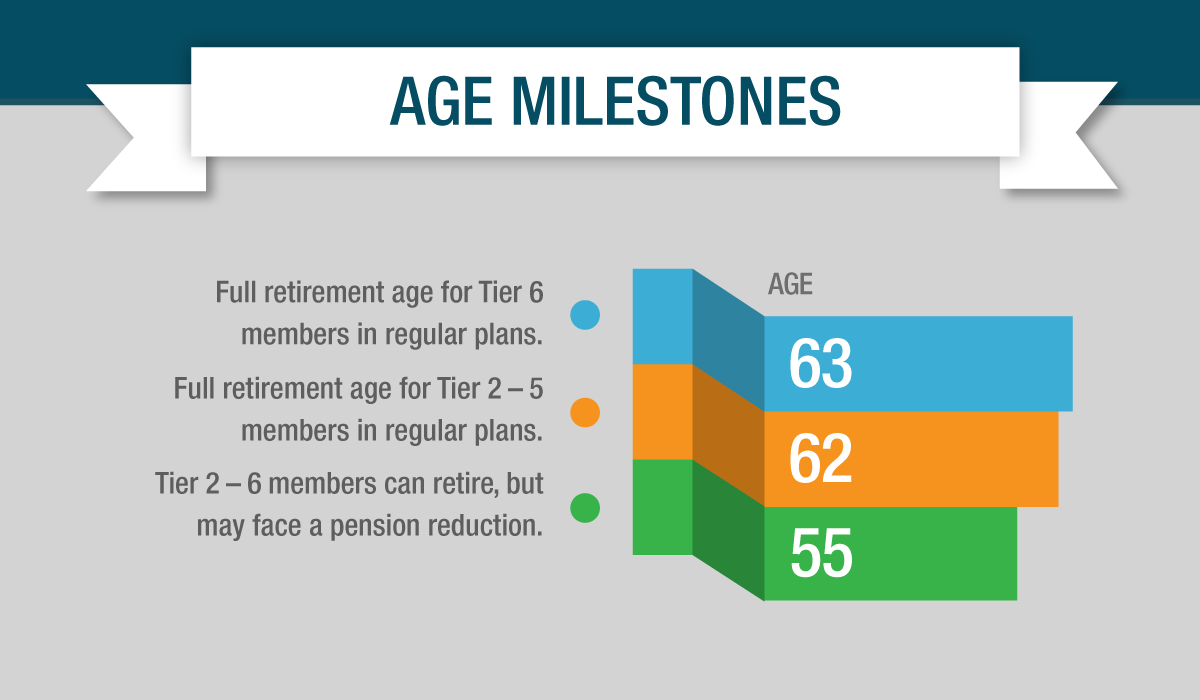

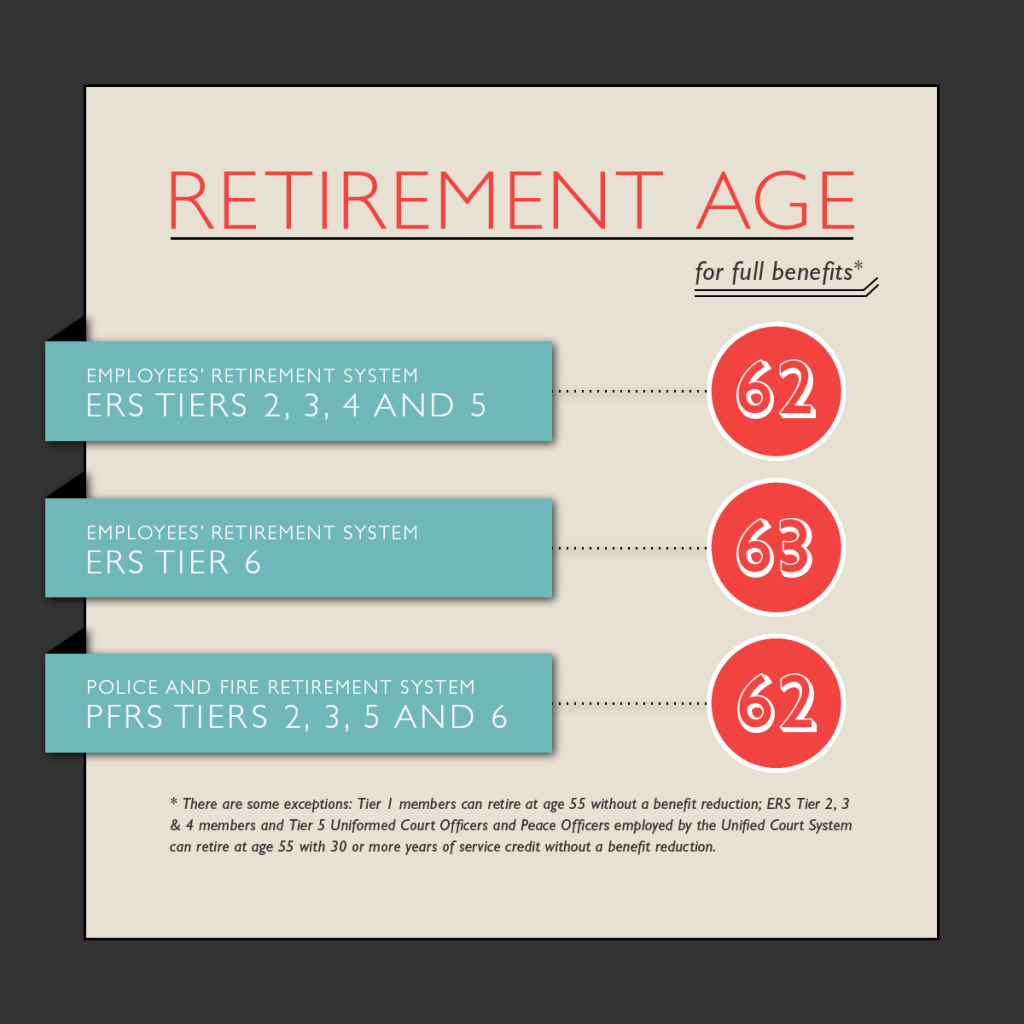

Age Milestones

Once you reach your full retirement age, you can retire without a pension reduction. For Tiers 2-5, the full retirement age is 62. The full retirement age for Tier 6 members is 63.

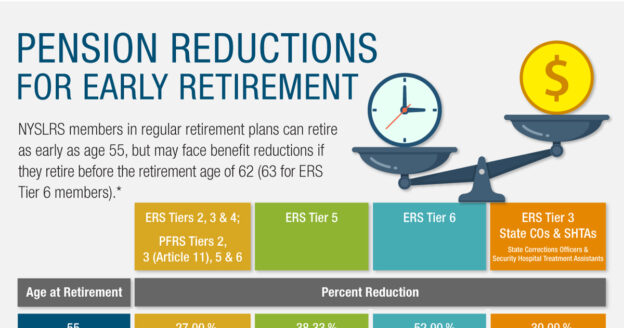

Members in regular retirement plans can retire as early as age 55, but they may face a pension reduction if they retire before their full retirement age. The closer you are to your full retirement age at retirement, the less the reduction will be.

If you would like to see what your pension would be at different ages, use Retirement Online’s pension benefit estimator.

More About NYSLRS Membership Milestones

For more information about NYSLRS milestones, please see:

If you’re an ERS Tier 2 member in an alternate plan, you can find your retirement plan publication below for more detailed information about your benefits:

If you’re an ERS Tier 2 member in an alternate plan, you can find your retirement plan publication below for more detailed information about your benefits: