Looking for some summer reading to add to your e-reader? Check out these publications from NYSLRS for important retirement information.

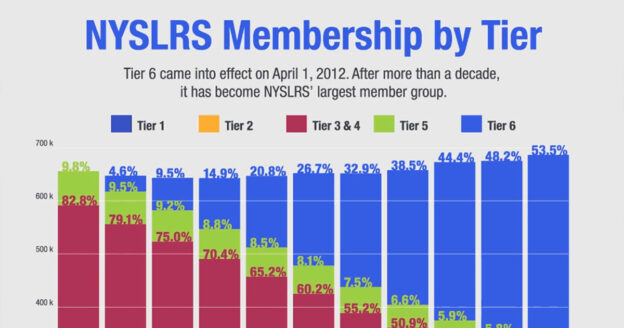

1. Retirement Plan for ERS Tier 6 Members (Article 15)

Are you one of more than 350,000 Tier 6 Employees’ Retirement System (ERS) members covered by Article 15? Your retirement plan publication explains some of the benefits and the services available to you, including service retirement, disability retirement, death benefits and more. Read it now.

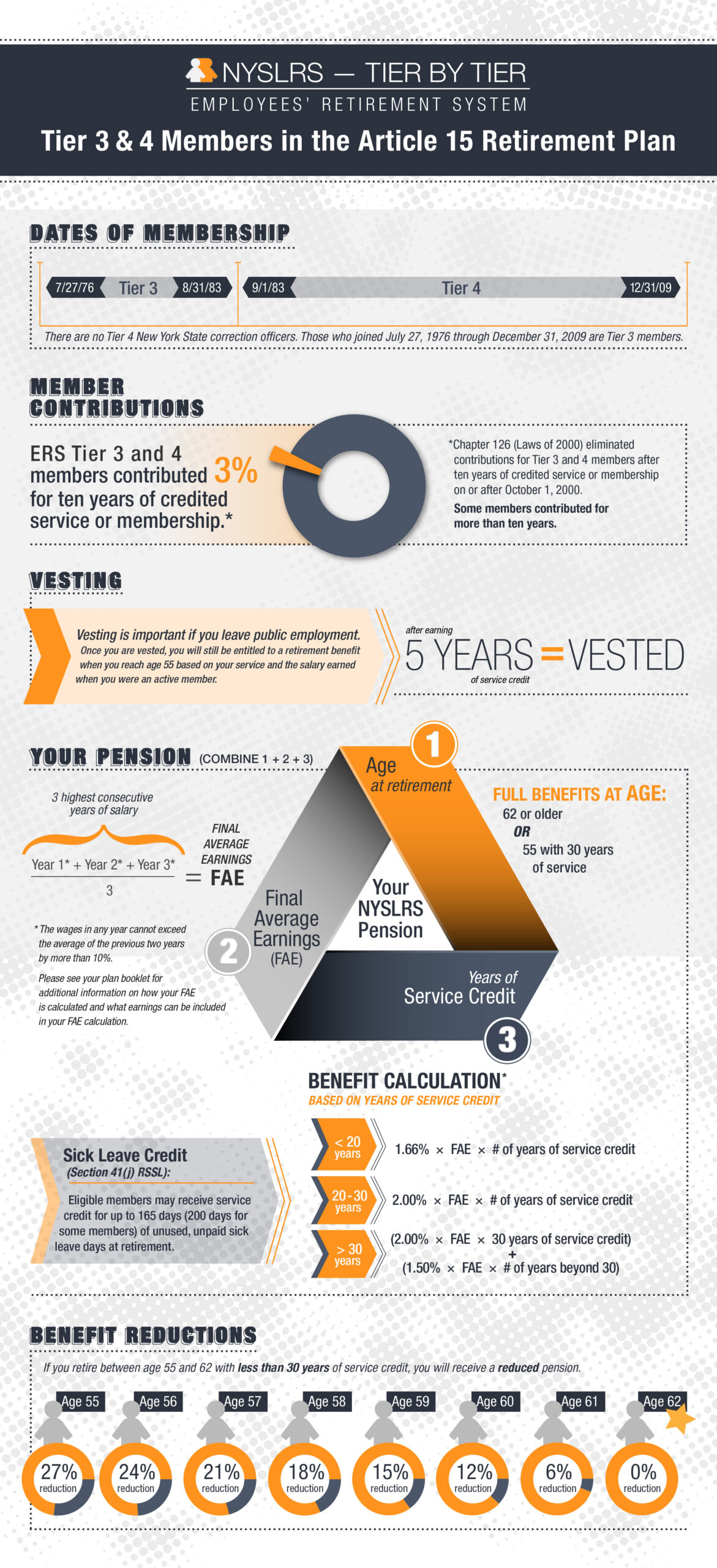

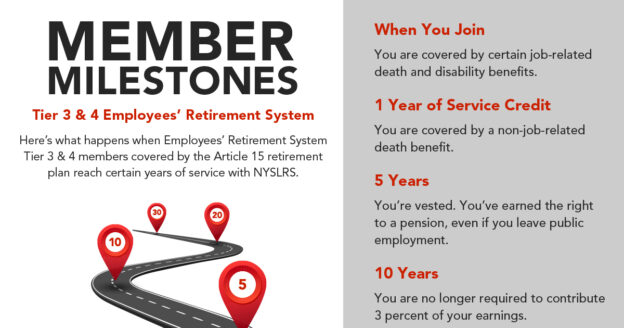

2. Retirement Plan for ERS Tier 3 and 4 Members (Articles 14 and 15)

If you’re not in Tier 6, you’re likely among more than 260,000 Tier 3 and 4 ERS members covered by Article 14 and 15. Check out your publication to find out about the benefits and the services available to you. Read it now.

3. Service Credit for Tiers 2 Through 6

The service credit you earn as a NYSLRS member is an important factor in the calculation of your pension. This publication explains the service you can earn credit for and how you can request to purchase credit for additional public employment or military service. Read it now.

4. What If I Leave Public Employment?

While we hope you stay a NYSLRS member throughout your working career, we understand that circumstances can change. If you leave public employment, this publication explains what you’ll need to do and what happens to your NYSLRS membership. Spoiler: It depends on how much service you have. Read it now.

5. What If I Work After Retirement?

Generally, NYSLRS retirees under age 65 can earn up to $35,000 per calendar year from public employers in New York State without affecting their NYSLRS pension. However, you should be aware of the laws governing post-retirement employment and how working after retirement may impact your retirement benefits. If you are considering working while collecting your pension, you should read this publication. If you already work in public employment as a NYSLRS retiree, read our Update Regarding Retiree Earnings Limit blog post for information about recent legislation and Governor’s executive orders that affect the limit.

Other Publications

Looking for other retirement plans? Maybe you’re a police officer, a firefighter, a sheriff or a correctional officer. You can find your retirement plan publication on our website. Visit our Publications page for more general information topics such as Life Changes: Why Should I Designate a Beneficiary?