If you’ve accumulated unused, unpaid sick leave, you may be able to use it toward your NYSLRS pension benefit.

New York State employees are eligible for this benefit. You also may be eligible if your employer has adopted Section 41(j) for the Employees’ Retirement System (ERS), or 341(j) for the Police and Fire Retirement System (PFRS), of Retirement and Social Security Law. Not sure? Ask your employer or check your Member Annual Statement.

Here’s How It Works

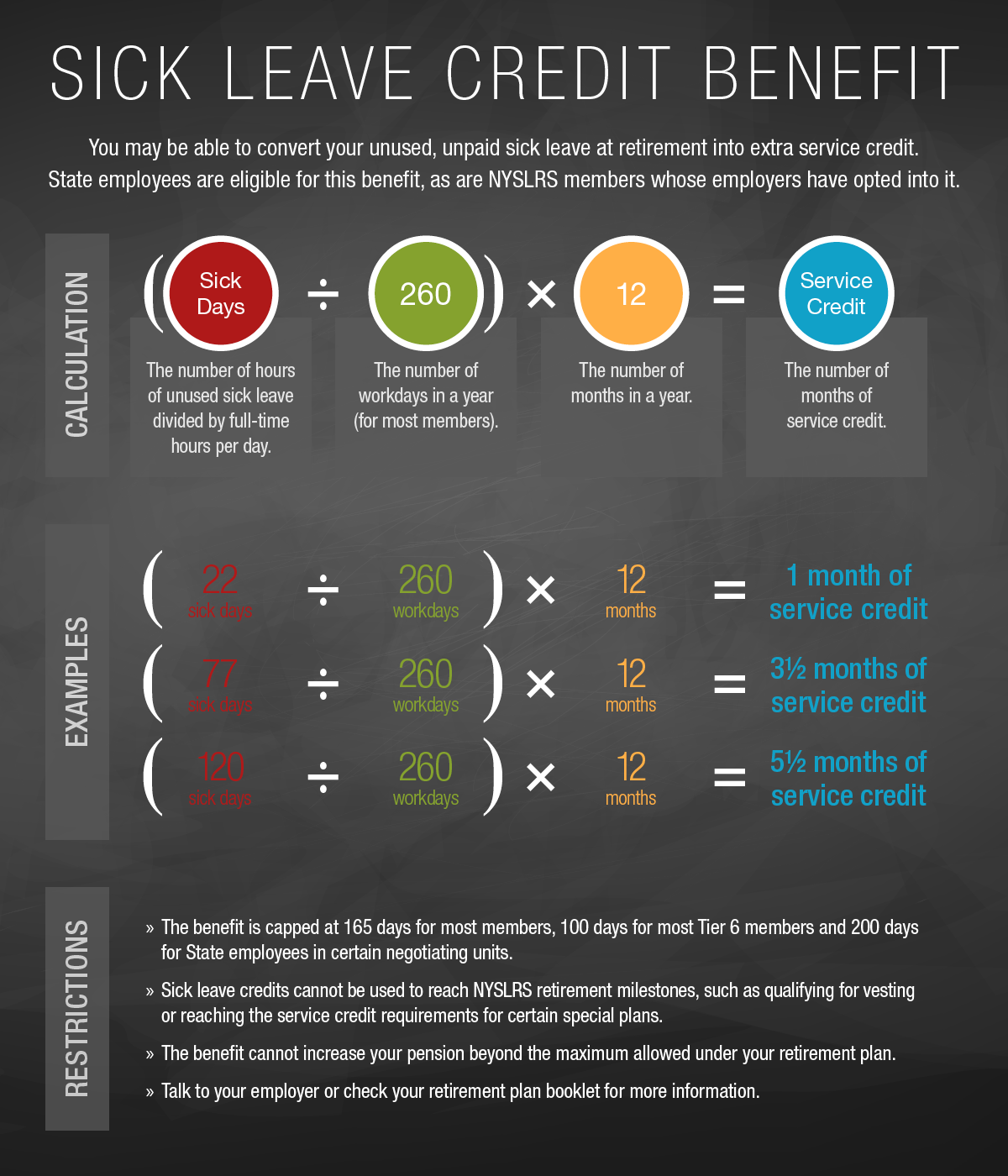

Your additional service credit is determined by dividing your total unused, unpaid sick leave days by 260. Most ERS members can get credit for up to 165 days (7½ months) of unused sick leave. The benefit is capped at 100 days (4½ months) for most Tier 6 members. State employees in certain negotiating units may be able to use 200 days (about nine months). Those extra “months” would be used in calculating your retirement benefit.

Also, depending on your employer, your unused sick leave may be used to cover some health insurance costs during your retirement. Please check with your employer for information about health insurance.

Restrictions

Unused sick leave cannot be used to reach NYSLRS retirement milestones. Let’s say you have 19½ years of service credit. At 20 years, your pension calculation would improve substantially. You also have 130 days of unused sick leave. Can you add the six months of sick leave credit to get you to 20 years? No. Retirement law does not permit it. You’ll have to work those extra six months to get the 20-year benefit rate, though sick leave credits can still be used in your final pension calculation.

Also, credit for unused sick can’t be used to:

- Qualify for vesting

- Reach a minimum retirement age

- Increase your pension beyond the maximum allowed under your retirement plan

- Meet the service credit requirement for a special 20- or 25-year plan

Check your retirement plan booklet for more information.

Sick leave can also be used towards paying for medical insurance, when you retire. Do we receive both benefits? Or do we need to chose between the two options?

If your employer offers the option to receive service credit for unused, unpaid sick leave days at retirement, receiving payment for medical insurance will not prevent you from receiving the service credit benefit.

Since NYSLRS doesn’t administer health insurance benefits, you can check with your employer for questions on those.

When retiring, does one need to choose between receiving the service credits and paying toward medical insurance? Or do we receive both benefits?

If your employer offers the option to receive service credit for unused, unpaid sick leave days at retirement, receiving payment for medical insurance will not prevent you from receiving the service credit benefit.

Since NYSLRS doesn’t administer health insurance benefits, you can check with your employer for questions on those.

Does this benefit also apply to retirees who retired in 2016, for example, and are already collecting their pension?

If you were eligible for this benefit and had accumulated unused, unpaid sick leave at retirement, your employer would have reported this information to NYSLRS when you retired.

For account-specific information about your benefit, please message our customer service representatives using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

I retired in March 2022. I had 407 hours of sick time due me. I have yet to see that service credited to my pension (Niagara County). When contacting NYSLRS three times and with a call, I was told “they are working on it”. I was also told via phone that there are people who are still waiting for theirs since 2020. How can that be?

Virtually all initial pension payments are made timely by the end of the month following retirement. These payments are closer than ever to a retiree’s final calculation. NYSLRS often receives adjustments to earnings for retirees well after the date of retirement and is working hard to recalculate pension amounts and provide retroactive payments as quickly as possible. We apologize for the length of time this has taken for some retirees. Thank you for your patience.

Retired 42 months still waiting for recalculation was told today I will receive retroactive UNLESS you pass away your beneficiary gets ZERO if the retroactive

If a retiree dies before their final calculation is completed, any money owed to them would be paid to their estate.

How long dose it take to get your sick days credit.

When you retire, your pension payment is based on the salary and service information we have on file for you at retirement. In some cases, slight adjustments are made to the initial amount after we receive and process final payroll information from your employer. These recalculations are processed in date order and are generally minimal compared to the overall benefit amount.

Once we have all the information we need and we finalize your benefit amount, if your payment increases, you will receive a retroactive payment for the amount you are owed back to your date of retirement.

I am still waiting on my final numbers 25 months after retiring.

What if you are switching jobs from a State university to a local city government, does my sick leave or vacation transfer?

For questions about your vacation and sick leave, please contact your employer’s human resources (personnel) office.

I understand that I will receive a reduction in my health insurance cost based on unused sick leave, would I also be eligible for this benefit, or does it depend if my employer (SUNY) has opted in to it?

For questions about eligibility, please contact your employer’s human resources (personnel) office.

You can also email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

Does this apply to NYSDOT PEF employee ?

New York State employees are eligible for this benefit.

For information about how this may apply in your particular situation, please email our customer service representatives using our secure email form http://www.emailnyslrs.com. Filling out the secure form allows them to safely contact you about your personal account information.

Unused sick leave cannot be used to reach NYSLRS retirement milestones. Can unused Vacation or Personal time be used for say the last month of work before a milestone? Such as working 19 years and 11 months and then take the last month off for vacation? Or would you have to show up for a last day after the milestone date?

For questions about your service credit and vacation leave, please email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

Hello, Im a NYC employee with over a thousand hours of sick time and I can retire next March. Can I use this unused sick time toward my retirement date?

We are the New York State and Local Retirement System (NYSLRS), the retirement system for employees of New York State and municipalities outside New York City. If you are trying to reach the New York City Employees’ Retirement System (NYCERS), you can call them at 347-643-3000.

I’m a Federal government employee, 66 years old with 45 years of service. My question is…Can I role my sick leave (1 1/2 year) into a IRA?

We are the New York State and Local Retirement System (NYSLRS), the retirement system for New York State employees and municipal employees outside of New York City. For questions concerning retirement rules for federal government employees, please contact your employer.

So if I retire at 57 with 30.13 years of services in July, but have 133 days of unused sick time that can be applied toward retirement, would that raise my age of retirement to 58? If so, what is the percentage penalty for retiring at 58 versus 57 despite having 30+ years of service credit?

Disregard. 55 YOA + 30 years for full retirement benefits. Going at 62 just maxes out the total pension amount.

Whether you have a cap on the number of years you can use toward your pension depends on your retirement plan and tier. For account-specific information, you can email our customer service representatives using the secure email form on our website. Filling out the secure form allows us to safely contact you about your personal account information.

For most Tier 3 and 4 members, if you are already over age 55 with 30 years of service you can retire at any time without any penalty. Eligible members may be able to convert unused, unpaid sick leave into extra service credit, which generally would increase your pension. For more information about your retirement plan, you can read your retirement plan booklet, which is available on our Publications page.

Unused sick leave cannot be used to reach NYSLRS retirement milestones. Let’s say you have 19½ years of service credit. At 20 years, your pension calculation would improve substantially. You also have 130 days of unused sick leave. Can you add the six months of sick leave credit to get you to 20 years? No. Retirement law does not permit it.

What if you retire at 55 from job but dont take pension until 62? Do you still get 41j or must you immediately retire and collect?

To receive service credit for your unused, unpaid sick leave days at retirement (41j), you must retire (collect your pension) directly from public employment or within a year of separating from service.

Is there a maximum dollar amount that can be used for sick leave credit? I heard there is a limit of $80,000. is this true? so if my daily pay rate is $500 x 165 sick days = $82,500 i would be over the $80,000 limit

The NYSLRS sick leave credit benefit converts unused, unpaid sick leave into service credit, so the limit is a number of days (up to 165 days—7½ months—for most ERS members), not a dollar amount.

Some employees have a benefit that allows them to convert unused sick leave into a health insurance credit, however NYSLRS doesn’t administer health insurance benefits. If this is the benefit you’re asking about, you should check with your employer about any limits.

If you have questions about a NYSLRS benefit, we recommend emailing our customer service representatives using our secure email form. One of our representatives will review your account and respond to your questions. Filling out the secure form allows us to safely contact you about your personal account information.

How is sick leave calculated for Instutional Teachers?

Your additional service credit is determined by dividing your unused sick leave days by 260.

To get account-specific information, you can email our customer service representatives using our secure email form, and one of them will review your account to address your questions. Filling out the secure form allows us to safely contact you about your personal account information. Please allow five to seven business days for a response.

Is accumulated annual leave applied towards service credit?

Unused accumulated annual leave isn’t applied toward service credit. However, some tiers may include payment for up to 30 days of unused vacation in your final average salary (FAS).

For more information, please check out our Final Average Salary page on our website, or check out your retirement plan booklet on our Publications page.

Does the FAS calculation, (36 consecutive months of highest wages), include the months, & salary of extra service credit, for unused sick time, or is the FAS calculated back from last day worked ?

If you are eligible for this benefit, your unused, unpaid sick leave may be used to increase your service credit. It would not affect your FAS.

Your FAS calculation would be based on the 36 months when your earnings were the highest. For most members, the highest earnings come in the last years of employment.