Even if your retirement is years in the future, you should be aware of certain membership milestones that may help you narrow down when to retire.

There are two types of membership milestones: those pertaining to age and those pertaining to service credit. Since most NYSLRS members reach service credit milestones first, we’ll start with them.

Service Credit Milestones

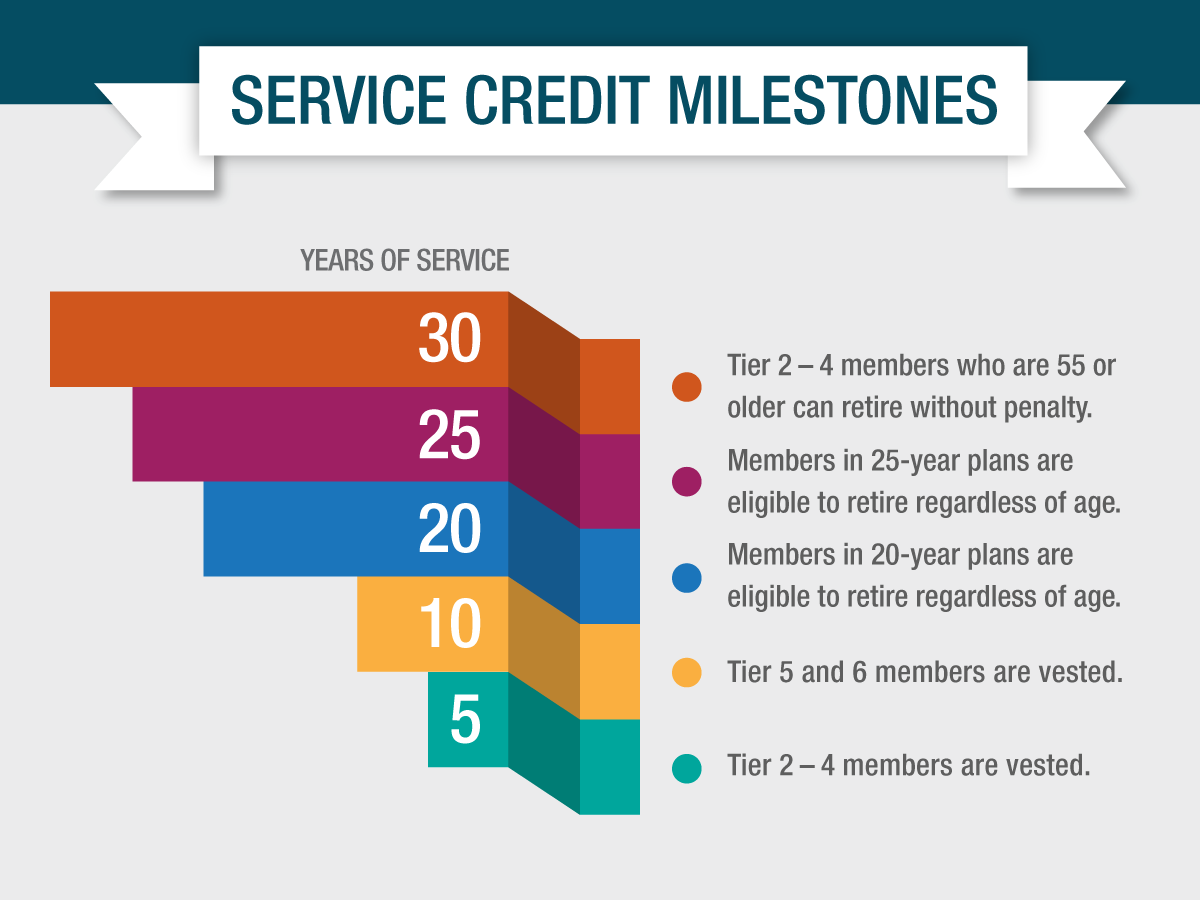

Vesting is a key retirement milestone. Once you become vested, you will be eligible for a NYSLRS pension even if you leave public employment before retirement. Members in Tiers 1-4 with at least five years of credited service are vested. (Most members in these tiers have already reached this milestone.) Tier 5 and 6 members must have ten years of credited service to be vested.

After reaching 20 years of service, most members will be eligible to have a higher percentage of their final average earnings included in their pension benefit. How that benefit is calculated depends on your retirement plan and tier. You can find more information in your retirement plan booklet.

Members in some special plans can retire with 20 years of service, regardless of their age. Other special plans allow for retirement after 25 years, regardless of age.

At 30 years of service, Tier 2-4 members who are at least 55 years old can retire without a pension reduction.

Age Milestones

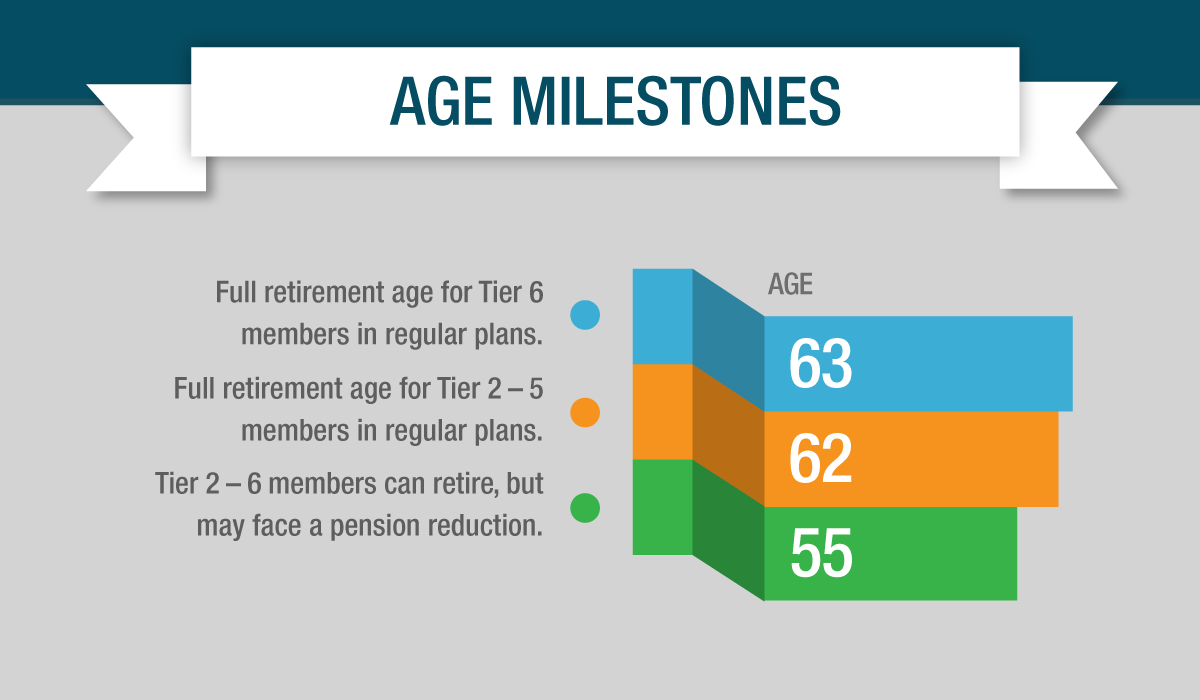

Once you reach your full retirement age, you can retire without a pension reduction. For Tiers 2-5, the full retirement age is 62. The full retirement age for Tier 6 members is 63.

Members in regular retirement plans can retire as early as age 55, but they may face a pension reduction if they retire before their full retirement age. The closer you are to your full retirement age at retirement, the less the reduction will be.

If you would like to see what your pension would be at different ages, use Retirement Online’s pension benefit estimator.

More About NYSLRS Membership Milestones

For more information about NYSLRS milestones, please see:

I retired early at age 55 as a tier-4 from Local Government employment and received retirement payments. 10-moths later I accepted a position with NY State. I was told that I can be “reinstated” if I repay the monies that were paid to me, which I did. However, I received a different Registration number than the one I originally had, and my recent Statements (past 7 years) show a $0 balance in my retirement account. This year I turned 62 and have a combined 25-years of service in Local & State Government as a tier-4. I’m considering retirement and I was told that the money I paid back was placed in a “special fund”. That money never shows up in my Retirement statements. What happened to that money? How is that money factored into my retirement at age 62 with 25-years of service? Thank you.

For assistance, please call our customer service representatives at 1-866-805-0990 (or 518-474-7736 in the Albany, NY area), press 2, then follow the prompts. You can also email them using our secure email form. One of our representatives will be able to answer your questions. Filling out the secure form allows them to safely contact you about your personal account information.

I need to take beneficary off of my retirement so how can I do it.

If you are still working and not yet retired, you can sign in to Retirement Online to update your beneficiaries.

If you are retired, there are a few possible death benefits that may be available. The specific death benefit you have determines whether you can change your beneficiaries after retirement. Visit our Death Benefits page for retirees for general information about death benefits and whether you can change your beneficiary.

For information specific to your circumstances, please email our customer service representatives using the secure email form on our website (http://www.emailNYSLRS.com). One of our account representatives will be able to answer your question. Filling out the secure form allows them to safely contact you about your personal account information.

I find it very difficult to get my retirement on line in, and NO one answers the phone for such a long time. I want to apply from home, but there is no one to call after 5pm or on weekends with questions at these times.

I have been on hold for over 15 minutes right now. I do not find this user friendly.

We apologize for the trouble you had trying to reach our Call Center. Your message is important to us and we have sent you a private message in response.

I would like to know two things. One how do I get credit for working as a proctor for the NYS Board of Lae Examiners. I did sign the Notice of right to membership in public retirement system. My full time work is at the Rockland County Board of elections.

Second , I have worked 18 yrs and I’m short 2 yrs. Can buy those two years? Or one year, if I get one yr as proctor.

You may be able to purchase credit toward your retirement benefit for additional public employment or military service. To request additional service credit, sign in to your Retirement Online account, scroll down to the ‘My Account Summary’ area of your Account Homepage and click the “Manage my Service Credit Purchases” button.

You can also apply by mail by submitting a Request to Purchase Service Credit (Including any Military Service) (RS5042).

Include as much information as you can about the period of employment for which you are seeking credit.

As a reminder, we must receive your service credit request before your date of retirement.

I will be 58 at the end of July with 34 years of service. If I decided to retire then will there be a pension reduction or should I wait until 62 with 38 years of service.

If you are an ERS Tier 2, 3 or 4 member in a regular retirement plan, you can retire between 55 and 62 with 30 or more years of service credit with no benefit reduction.

If you would like to see what your pension could be, most Tier 2 – 6 members can use Retirement Online to create a NYSLRS pension estimate based on the salary and service information we have on file for you. You can enter different retirement dates to see how your choices affect your potential benefit.

For account-specific information about your benefit, please email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

My understanding is that the incentive for this year has passed the Assembly and is on hold for the Governor.

If it is designated for this school year only, will that be extended into another year if it doesn’t pass soon?

Also, is it true that the School District has to accept it, even if it is passed at the State level?

While a statewide retirement incentive bill has been introduced, we are not aware of any progress through the legislative process.

If a State retirement incentive program is approved by both houses of the Legislature and signed into law by the Governor, NYSLRS will notify your employer and provide details for our members on our website and on social media.

Does the life insurance that we have use the same beneficiary as we use for retirement?

The beneficiary for a post-retirement death benefit can be different than the beneficiary for any pension payment option benefit you may have chosen. Please visit our Death Benefits for Retirees page for more information.

if the early retirement bill is passed, and you only have 22 years of service, but are 64 years old, there is no incentive, correct?

If a State retirement incentive program is approved by both houses of the Legislature and signed into law by the Governor, NYSLRS will notify your employer and provide the kind of details you are looking for on our website and on social media.

What is this early retirement incentive program about? Did it pass? I am 56 and starting my 33 year in june 2021 for Greene County.

The recently approved New York State budget includes retirement incentives for some New York City retirement systems, but those incentives do not apply to NYSLRS members. At this time, we are not aware of any retirement incentive that applies to NYSLRS members.

If a State retirement incentive program is approved by both houses of the Legislature and signed into law by the Governor, NYSLRS will notify your employer and provide details or our members on our website and on social media.

I would urge future retirees that are focused on taking single payer and dismiss other options to think again. If I were smart, taking one of the pop up options could have been a manageable/affordable choice for me.

Right, Larry! Don’t forget about your loved ones. We won’t live forever.

I would like to use retirement online but for some reason the system does not recognize me, please advise

We apologize for the trouble you are having.

For help with Retirement Online, please call our customer service representatives at 1-866-805-0990 (or 518-474-7736 in the Albany, NY area), press 2, then follow the prompts.