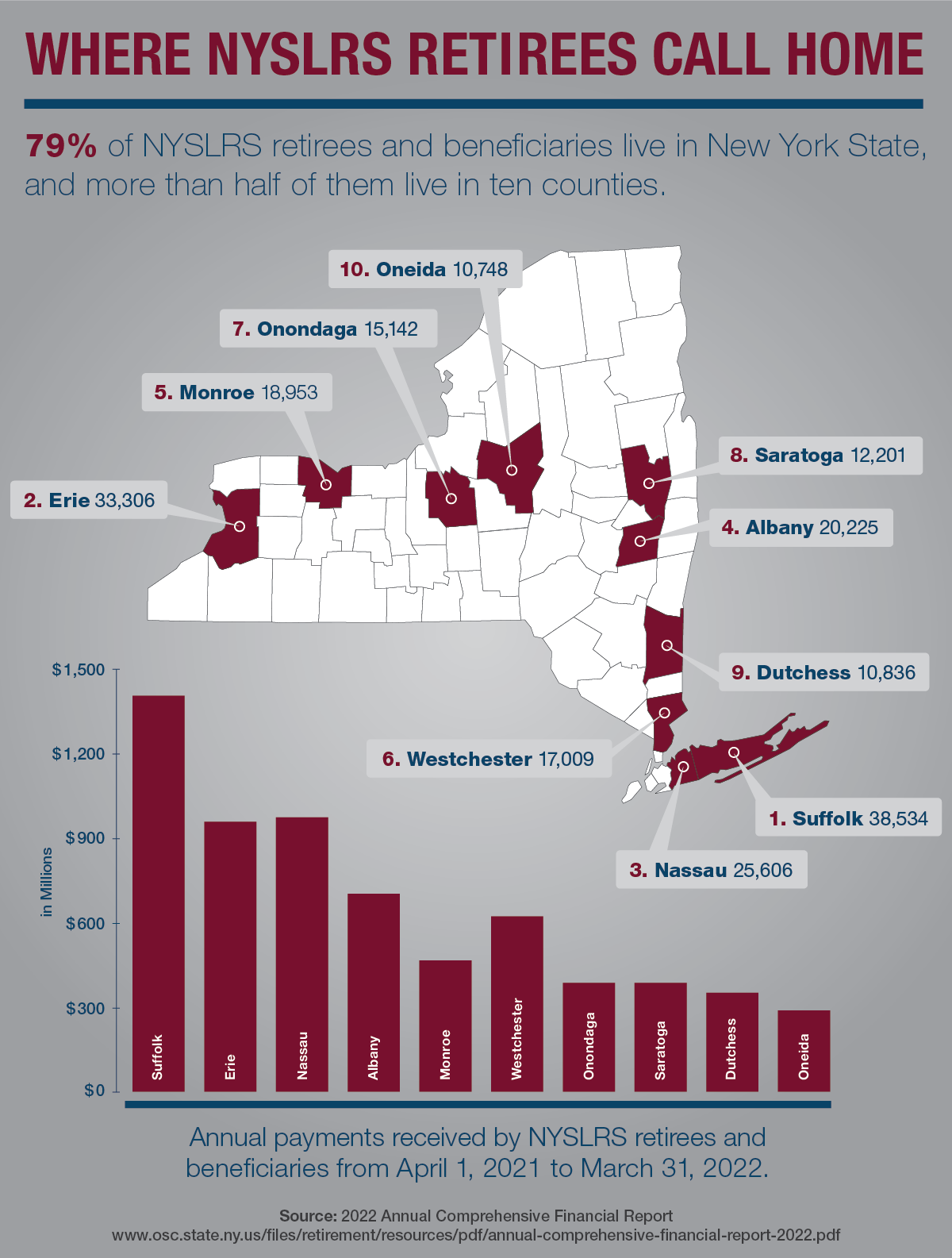

NYSLRS retirees tend to stay in New York, where their pensions are exempt from State and local income taxes. In fact, 79 percent of NYSLRS’ 507,923 retirees and beneficiaries lived in the State as of March 31, 2022. And more than half of them lived in just ten of New York’s 62 counties.

So where in New York do these retirees call home? Well, there are a lot of NYSLRS retirees and beneficiaries on Long Island. Suffolk and Nassau counties are home to more than 64,000 recipients of NYSLRS retirement benefits, with annual pension payments of nearly $2.4 billion. But that shouldn’t be surprising. Suffolk and Nassau counties have the largest and third largest number of pension benefit recipients, respectively, of all the counties in the State outside of New York City by population. (The City, which has its own retirement systems for municipal employees, police and firefighters, had 24,061 residents who were NYSLRS retirees and beneficiaries.)

Erie County, which includes Buffalo, ranked number two among counties in the number of NYSLRS retirees, with more than 33,000. Albany County, home to the State capital, ranked fourth with more than 20,000. Monroe, Westchester, Onondaga, Saratoga, Dutchess and Oneida counties round out the top ten.

All told, retirees and beneficiaries in the top ten counties received $6.5 billion in NYSLRS retirement benefits in 2021-2022.

Hamilton County had the fewest NYSLRS benefit recipients. But in this sparsely populated county in the heart of the Adirondacks, those 505 retirees represent about 10 percent of the county’s population. During fiscal year 2021-2022, $11.5 million in NYSLRS retirement benefits was paid to Hamilton County residents.

NYSLRS Retirees Across the United States and Around the Globe

Outside of New York, Florida remained the top choice for NYSLRS retirees, with 39,885 benefit recipients. North Carolina (10,011), New Jersey (8,302) and South Carolina (7,285) were also popular.

There were 646 NYSLRS benefit recipients living outside the United States as of March 31, 2022. These retirees and beneficiaries live throughout the world, with the most common countries being:

- Canada: 164

- Israel: 56

- United Kingdom: 36

- Italy: 31

- Jamaica: 31

Whether you retire close to home or move away, you’ll always be a part of NYSLRS.

I live in NYS and receiving NYS retirement if I move to Massachusetts will it be state taxed ?

Your NYSLRS pension is not subject to State or local income taxes in New York, but if you move to another state, that state may tax it. To find out which states tax pension benefits, visit the Retired Public Employees Association website.

I live in NYS and receiving NYS retirement if I move to Massachusetts will state tax be taking out ?

NYSLRS cannot withhold state taxes from your pension benefit. If you move to Massachusetts, you would need to make arrangements with the Massachusetts Department of Revenue to pay any state taxes you may owe.

Hmm, I went to a pre-retirement workshop and I could swear that is what was told to us. I will be going to another sometime soon. I have a list of states that don’t tax retirement pensions.

Thank you for the clarification.

For questions about New York State taxes, you can visit the New York State Department of Taxation and Finance website. You may also wish to speak to an accountant or tax preparer.

What about Florida? There are alot of NYS retirees in Florida.

As of March 31, 2022, there were 39,885 NYSLRS retirees and beneficiaries living in Florida.

Im retired and have Empire Insurance and i pay over $5000 a year , and the insurance pays nothing towards my medical bills . WHY ??????????

NYSLRS does not administer health insurance programs for its retirees, so we cannot answer your questions about your health insurance benefits.

The New York State Department of Civil Service administers the New York State Health Insurance Program (NYSHIP) for New York State retirees and some municipal retirees. You can call them at 1-800-833-4344 or 518-457-5754 or email them at pio@cs.ny.gov.

If you retired from a public employer that did not participate in NYSHIP, your former employer’s benefits administrator should be able to answer your questions.

Are you old enough to collect SS and have you started collecting it? If you are 65 or older and are not yet collecting SS, it could have something to do with Medicare. Apparently at age 65, if you are collecting SS, the process of switching to Medicare primary is pretty seamless, and your health insurance will convert to secondary coverage automatically. If you are not collecting SS I am not sure I understand the whole process of converting to Medicare, but I don’t think it is a seamless process. That is the only scenario I can think of.

Where do you live. Both my father and brother pay just their co-pays, which is very reasonable.

I am one of the few 638 retirees that lives outside of the United States. I miss New York very much but I have family obligations which keep me in Madrid, Spain.

I am not happy with the lack of banking flexibility for receiving my monthly pension. My check still goes to an American bank, however my S.Security check is deposted in my bank account here in Madrid. Also, I cannot open my on line account because I don’ t have an American phone anymore.

Help! I would be great if you can place attention to these issues

Thank you!

To safeguard personal information and keep accounts secure, Retirement Online is only accessible to customers in the United States and Canada. If you need to do business with NYSLRS, you can still email us using our secure contact form or download forms you may need from our website.

NYSLRS provides direct deposit through the National Automated Clearing House Association (NACHA) Network, which facilitates batch payment processing within the United States to domestic U.S. financial institutions. If you have questions about direct deposit, please email us.

I live in the UK and totally agreewith you! To date 3 times in last year my paper cheques never arrived due to postal issues in both USA and UK. Haf to have them reissued. Its ridiculous in this day and age that NYS cannot direct deposiwhen the federal government can and does.

I love in the UK and face the same issues .plus with no USA bank account or address I get my payments by snail mail ! Ridiculous in this day and age

I’ll always love Long Island, but… between the outrageous property taxes, high cost of living, horrific traffic, cold weather 6-7 months of the year and people’s poor attitudes, New York is NOT the place to retire! Upstate may be different, but NOT Long Island!

Get out of NY entirely. You don’t realize what a horrible place it is to live until you live somewhere else. The tax savings aren’t worth the grief, and many States either don’t charge tax on the pension, or will allow a several thousand dollar deduction. Here in SC you can deduct $15,000 from your pension, and after 65 all of it.

Lindsey Graham country?? NO THANKS!

You can’t beat the medical care here. Even in my small town, my friend can up from SC after having skin biopsy over 6 weeks ago. Her wound was terrible, and its seems they were unable to give her proper care. Visited my Urgent Care few times, within 7 days felt better and her wound is not infected anymore. I am willing to pay for few extra dollars for wonderful roads, schools, parks and Libraries. I love NY

Present and future retirees living in the Empire State have an important voice. Speak up on the issues by calling your elected officials. Retirees are a strong voting block. Get involved by joining your union retiree organization. Yes your union has a retiree organization. And they have great benefits above and beyond advocacy with your elected officials. The list includes but not limited to Alliance of Public Employee Organizations of NY, PEF Retirees, CSEA Retirees, NYSARA etc.

Join to be empowered.

I have found that PEF Retirees does nothing for retirees and doesn’t stay in contact with members regarding any events or issues. I was a member soon after retiring.

RPEA (Retired Public Employee Association) is very proactive and offers many benefits for members, has an informative newsletter and lobbies the NY legislature on retirees’ behalf. They work very hard for retirees and have accomplished specific changes that have improved the lives of retirees. Look them up, for you won’t be disappointed!

Excellent points Sharon. I should add the following in response. None of these retiree organizations have been successful in passing any of their proposed bills in the past 20 yrs or so to help protect the dignity and security public retirees have earned.

But if these public retiree organizations find common ground on bills they can mutually support it could result in the passing mutually agreed upon bills into law. These organizations meet together on a regular basis with the NYS Comptroller, State AFL/CIO, NYSARA, Capital Area District Labor Federation and Labor Parade Group first Friday of the month at the Desmond. At these meetings they can come to agreement on consolidating the many proposed COLAs, Health Insurance and other bills. Provide letters of support for bills they agree on and lobby together. It is a challenge but must be done to achieve passage of bills.

RPEA has been successful in passing concrete things that help retirees. They helped defeat the New York Health bill to replace NYSHIP, the bill to gives retirees the same skilled nursing care in rehabilitation facilities as regular employees is now on Gov Hochel’s desk waiting to be signed. They also helped retirees get the maximim cost of living raise bases on 21,000 instead of 18,000 ( not great but better than what we had), and continue to advocate and lobby for retirees. They also have better benefits than what PEF Retirees offer in dental, vision, and hearing. Google them and get on their website if you want to learn more about them. They are working diligently for retirees.

Under current law, the cost of living adjustment is applied to the first $18,000 of your pension as if you had chosen the Single Life Allowance pension payment option, even if you selected a different pension payment option at retirement. You can find more information on our Cost-of-Living Adjustment page.

Again, I agree with much you have stated. I hope the bills such as the COLA base get changed to $21K, skilled nursing care and others are signed by our new governor. If not, I would again opine that these organizations might want to try something tried and true, that clearly worked when the Constitutional Convention (ConCon) and IRMAA got defeated. Working together on common interests such as COLA and protecting Health Insurance cost and coverage. I know it is a challenge for these groups to work together. But I believe if they focus on the common ground and the needs of their membership they will come together and succeed as they did with defeating the ConCon and every year the IRMAA.

As I have stated before, retirees are a solid voting bloc and 79% of public retirees stay in NYS and spend in NYS. Adding along with the well-funded NY Pension a not fully recognized but powerful economic engine. These two powerful economic forces provide unmatched financial stability during good times and especially during cyclical economic downturns. Time to make these powerful voices heard in unison through these organizations.

At this time (2023 legislative session) none of the COLA enhancements have passed. Need to push all entities to work together to consolidate COLA enhancements to help the low income public retirees.

Correction: Alliance of Public Retiree Organizations on NY

NY always will be my home

Can’t afford to retire in NY. Long time 9/11 disabled retirees are stuck with greatly reduced benefits instead of the 3/4 salary benefits afforded uniformed personnel and current civilian employees who retire due to 9/11 related disabilities, thus those who suffered most and longest are treated much more poorly and unfairly.

Unfortunately, benefits available under different retirement plans are determined by State law. NYSLRS administers benefit programs, including disability benefits, that are signed into law. Any changes to State law must be approved by both houses of the State Legislature and signed by the Governor.

How does residency outside of NYS affect your pension.

NYSLRS retirees live all across the United States and around the world. It doesn’t affect their pensions directly. However, a move out of state may have tax implications.

While NYSLRS pensions have been (and continue to be) subject to federal income tax, they are not taxed by New York State. If you move out of New York, your pension will be subject to the tax laws of your new home state, and you may have to pay state taxes on your pension. The Retired Public Employees Association tracks which states tax pensions.

If you want more information, check out our Taxes and Your Pension page.

You may wish consult a tax advisor for details.

Why are we still Required to file and have to pay for Preparation of NYS Taxes after we retire even tho we don’t have to pay them year round?

For questions about State tax law, please visit the New York State Department of Taxation and Finance website.

I’m looking forward to my move to SC. Better weather and my property taxes the 1st year will be less than 1/7th of what I pay in the Vampire State. After one year those will go down along with the SC income taxes which at the max the first year may be $2300. Have friends and a warm, loving church group that I look forward to spending more time with. While gasoline prices have gone up down there, no where near the price up here. And the biggie, SC totally supports the US Constitution and all its amendments.

If you’re anything like a typical Republican, you probably don’t even begin to understand the amendments and change their meaning to suit your whims.

Amen Ann!!!!!

LOL Don’t let the door hit you on the way out!

I am not retired but I concur with Ann and Patricia, I have no problem letting the door hit me in the a** on the way out!! NYS has the 7th highest tax rate in the country(2021). NYS taxes the crap out of you your whole working life and then if you don’t stay in NY to retire, they keep taxing you.,. No reward for working for the state. I will be making tracks when the door hits me!

New York State does not tax your NYSLRS pension. However, if you move to another state, that state may tax your pension.

To find out which states tax pension benefits, visit the Retired Public Employees Association website.

Isn’t your pension taxed (Stat e Tax) then in SC?

SC has oppressive heat, humidity, snakes, alligators, and Lindsey Graham. What is there to like about SC?.

Wonderful news and you are correct! It is considered a “Free State” unlike the Socialist State of New York. God Bless You!

Enjoy one less large family worth of traffic here

Vampire State…love it!

Don’t let the hurricanes, polluted flood waters of pig waste (see tank storage spillover into the water drinking supply due to FLOODING from Hurricane Ida) and absence of medical specialists in SC (ie oncology, endocrinology, pulminology, etc) affect your decision. I checked these out before NOT moving to the south. BTW, NYC and surrounding area have almost a dozen I can name for you. This should be among a senior’s top priorities. I love NY

I moved to one of the other states that has a lower cost of living and doesn’t tax our pension or social security. This state has no income tax and it resembles the upper Hudson Valley without monstrous snowfall! It’s not a democrat state and that’s why we moved!

I moved out of state 15 years ago but I could never afford to move back because of the high property taxes and cold winters.

Merry Christmas!

I wish it were more affordable for retirees in NYS. It is hard to make a decision as a retiree to relocate, where life will be more affordable, or to stay in NY where family and friends are, but the cost is prohibitive.

ONLY I WANT TO SAY. I LOVE NEW YORK AND WESTCHESTER HEALTH DEPT. GOD BLESS ALL OF YOU.

Nothing for Otsego County?

As of March 31, 2017, Otsego County is home to 2,167 retirees and beneficiaries. You can find numbers for all of New York’s counties on page 29 of the 2017 Comprehensive Annual Financial Report (see URL below).

http://osc.state.ny.us/retire/word_and_pdf_documents/publications/cafr/cafr_17.pdf

Looks like it’s the top 10 counties, I’m sure Otsego has NYSLRS.