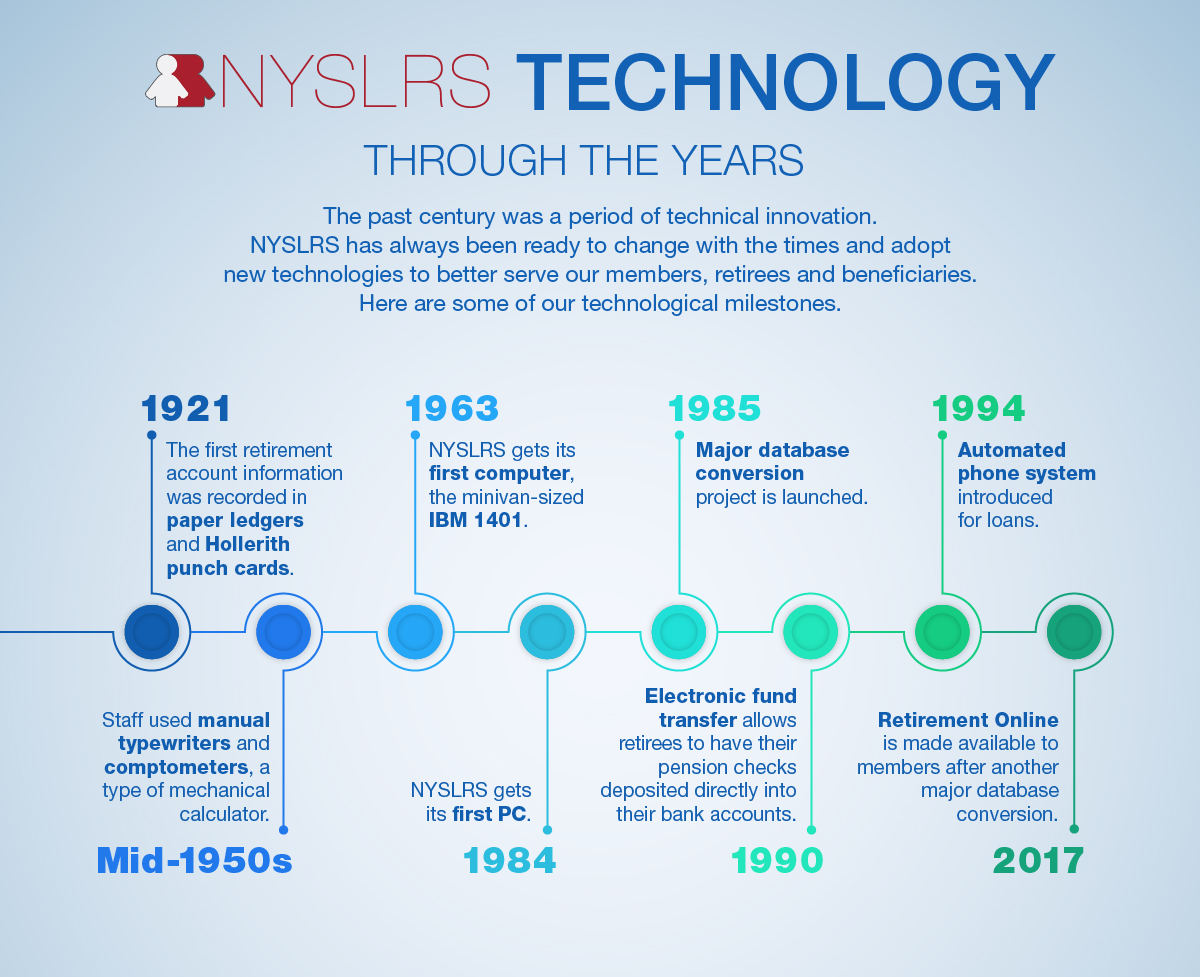

The years since 1921 have witnessed unprecedented advances in technology. Not surprisingly, NYSLRS has taken advantage of many of these innovations to manage a complex and growing retirement system.

The Early Years

When NYSLRS was established a century ago, the business world was still in the age of paper, as it had been for centuries. Individual member information was logged in paper ledger books. A punch card was prepared for each member and retiree, and this data was mechanically tabulated to record statistical information (date of birth, gender, years of service, etc.) about them.

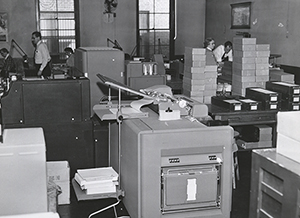

An employee’s desk also looked radically different. Instead of laptops and computer monitors, office technology was limited to adding machines and typewriters, and the use of carbon paper for making copies of documents. Large accounting machines, like the IBM 407, read member punch cards and could print out results.

The Computer Era

In 1963, NYSLRS entered the computer age with its first computer, an IBM 1401. The 1401 was considered revolutionary in its day, offering businesses an affordable general-purpose computer. At the time, it also had 16KB of memory – about as much as a pocket calculator today – and was the length of a minivan. NYSLRS’ early computers were programmed and coded through the use of punch cards, until the late 1970s, when they could be coded through terminals. The first personal computers wouldn’t appear on staff desks until 1984.

In the mid-1980s, NYSLRS launched a major database conversion project, which would result in a computer system that would serve NYSLRS for decades. But that system eventually became outdated. Recently, after years of meticulous research, NYSLRS launched a multi-year project to replace its information technology systems and streamline core services.

Retirement Online is the public face of that project. Launched in 2017, Retirement Online provides members and retirees with convenient, secure access to their account information. Members can update contact and beneficiary information, apply for a loan, generate a pension estimate, apply for a service retirement benefit and more. Retirees can view pension payment and tax withholding information, and additional features will be added in the near future.

The Future

Technology has served NYSLRS well over the years. Certainly, technology will continue to evolve, and NYSLRS will continue to adopt innovations that help us better serve our members, retirees, beneficiaries, and employers.