If you’re already building your retirement savings, you already understand how those savings, along with Social Security, work together with your pension to help provide financial stability in retirement. Financial advisors call this the “three-legged stool.”

But why not take it a step further and give your retirement savings a boost? Even a small increase could make a big difference over time, while having minimal impact on your take-home pay.

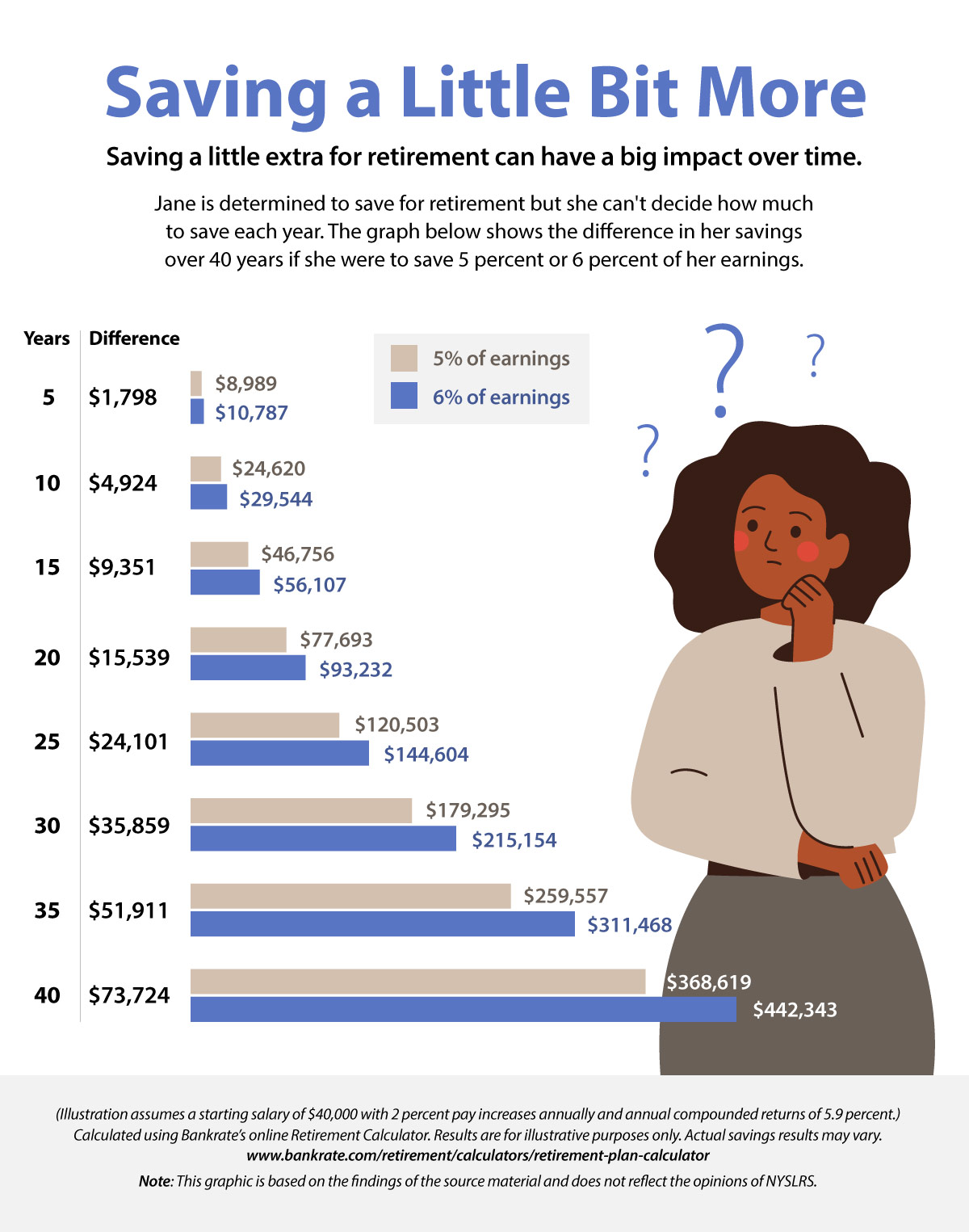

How much of a difference would it make? You can check it out yourself using this online calculator and your own salary and savings information. Calculate the impact of your current savings, then try the same calculation with an additional 1 percent of your earnings. For example, if you’re saving 5 percent of your pay, see what saving 6 percent would do by the time you expect to retire.

Impact on Your Paycheck

Fortunately, adding a small amount to your retirement savings won’t have a substantial impact on your paycheck. For example, if you’re making $60,000 a year, 1 percent is only $600. That’s just $50 a month or, if you are paid every other week, about $23 per payday.

The impact on your take-home pay would be even less if you save in a tax-deferred plan because you won’t have to pay income tax on those earnings until after you retire. The New York State Deferred Compensation Plan’s paycheck impact calculator can help you estimate how increased savings would affect your paycheck. (You don’t have to have a Deferred Compensation account to use their calculator. The New York State Deferred Compensation Plan is not affiliated with NYSLRS.)

When to Increase Retirement Savings?

The sooner you boost your savings, the better off you’ll be. But if you’re not ready to increase your savings right now, then try this: Schedule your increase to coincide with your next raise. That way, you may not even miss the money.

need to know

how to start recovering my retirement payments as i am retired since 3/2021

If you are no longer with your NYSLRS employer, you may be eligible to withdraw your membership and receive a refund of your contributions or apply to retire, depending on how much service credit you have.

You can view your current total estimated service credit by signing in to your Retirement Online account.

If you have less than ten years of service, here is information about withdrawing your membership.

If you are eligible to retire, you can find information about how to apply on our Preparing for Retirement webpage.

If you have questions, please write to our customer service representatives using our secure email form. Filling out the secure form allows NYSLRS to safely contact you about your personal account information.

How long does it take for a recalulation of benefits? I retired December 31, 2019 and I still haven’t heard anything

When you retire, your pension payment is based on the salary and service information we have on file for you at retirement. In some cases, slight adjustments are made to the initial amount after we receive and process final payroll information from your employer. These recalculations are processed in date order and are generally minimal compared to the overall benefit amount.

Once we have all the information we need and we finalize your benefit amount, if your payment increases, you will receive a retroactive payment for the amount you are owed back to your date of retirement.

Can I gett copy s of 1099 r on line for myself didn’t receive it

You can request a reprint of your 1099-R online. The reprint will be mailed to the address we have on file for you.

You may wish to sign in to Retirement Online to check your address and update it if necessary before you request a reprint. If you don’t have an account, go to the Sign In page and click the “Sign Up” link under the “Customer Sign In” button.

If you still need help, you can contact our customer service representatives using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information. You can also use the form to request that a 1099-R be mailed to your current address.

I requested a 1099-R reprint twice still haven’t received it and they have my correct address on file. Won’t answer the secure contact form except an auto reply

We’re sorry for the trouble you’re having. Your message is important to us and we have sent you a private message in response.

I was never made aware that I can boost my retirement account. I would like more information on this please.

The blog post is referring to personal retirement savings accounts such as an IRA, a 401(k) or the savings accounts offered by the New York State Deferred Compensation Plan. State employees and some municipal employees are eligible to participate in the Deferred Compensation Plan. You can ask your employer if you are eligible to participate in this plan.

Your NYSLRS pension is a defined benefit plan and not a retirement savings account, like a 401(k), so you cannot make additional contributions to increase your benefit. A NYSLRS pension is a lifetime benefit based on a member’s years of service and earnings.