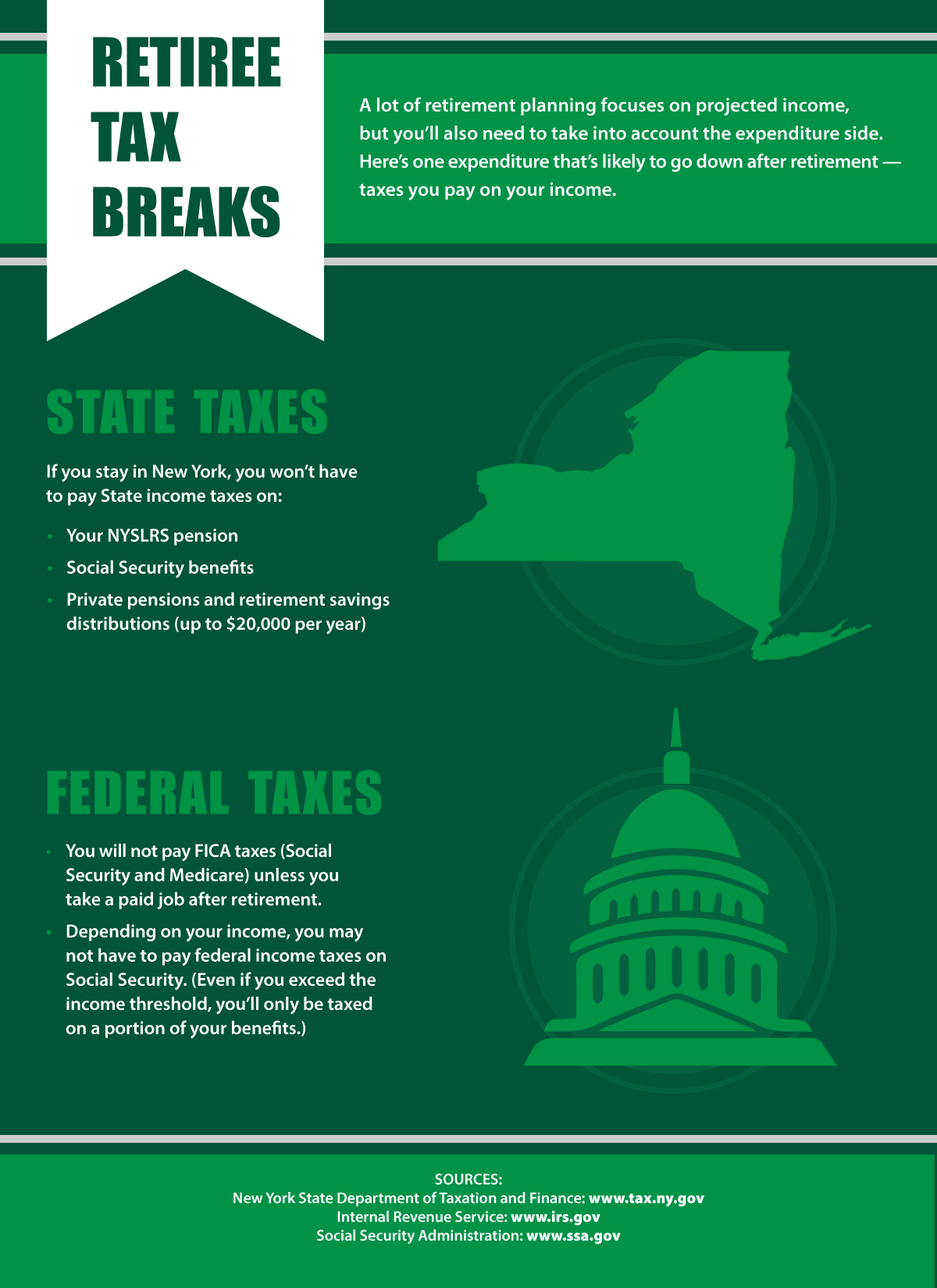

Estimating your post-retirement expenses is crucial to effective retirement planning, and it’s important to remember that taxes are also part of that equation. Most retirees pay less in taxes than when they were working, partly because their incomes are lower. But there are other reasons why your tax burden may be lighter after you stop working.

New York State Taxes

As a NYSLRS retiree, your pension will not be subject to New York State or local income tax. New York doesn’t tax Social Security benefits, either.

You may also get a tax break on any distributions from retirement savings, such as deferred compensation, and benefits from a private-sector pension. Find out more on the Department of Taxation and Finance website.

Be aware that you could lose these tax breaks if you move out of New York. Many states tax pensions, and some tax Social Security. For information on tax laws in other states, visit the website of the Retired Public Employees Association.

Federal Taxes

Unfortunately, most of your retirement income will be subject to federal taxes, but there are some bright spots here.

Your Social Security benefits are likely to be taxed, but at most, you’ll only pay taxes on a portion of your benefits. You can find information about it on the Social Security Administration website. (If you’re already retired, use the Social Security Benefits Worksheet in the Form 1040 instructions to see if any of your benefits are taxable.)

Throughout your working years, you’ve paid payroll taxes for Social Security and Medicare. For most workers, that’s 6.2 percent (Social Security) and 1.45 percent (Medicare) of your gross earnings out of every paycheck. But Social Security and Medicare taxes are only withheld from earned income, such as wages. Pensions, Social Security benefits and retirement savings distributions are exempt from Social Security taxes. Of course, if you get a paying job after retirement, Social Security and Medicare taxes will be deducted from your paycheck.

Once you turn 65, you may be able to claim a larger standard deduction on your federal tax return.

To better understand how your retirement income will be taxed, it may be helpful to speak with a tax adviser.

I have been retired for over two years from nys courts and still am receiving estimate and STILL waiting for my final pension amount. This is absolutely rediculous. Who can I contact to find out when this will be completed. Totally unprofessional and unfair!!!

Virtually all initial pension payments are made timely by the end of the month following retirement. These payments are closer than ever to a retiree’s final calculation. NYSLRS often receives adjustments to earnings for retirees well after the date of retirement and is working hard to recalculate pension amounts and provide retroactive payments as quickly as possible. We apologize for the length of time this has taken for some retirees. Thank you for your patience.

My wife is planning to retire next year, She is a teacher in NYS. We have an appointment to talk to someone in mid April. That’s the soonest we could get. I am so curious though. I know she wont have to pay State tax, SS, Medicare and her dues. So far I have spoke to a couple friends that retired and they all said there take home pay is the same as when they were working. All retired with 60% pension. I understand she will have to pay less tax. Is there a good calculator I can use to get real close to figure this out? Just doesn’t make sense to me yet. Thank you

You have reached the New York State and Local Retirement System (NYSLRS), the retirement system for employees of New York State and municipalities outside New York City.

If your wife is a member of the New York State Teachers’ Retirement System (NYSTRS), you can find their contact information at http://www.nystrs.org/Contact.

Otherwise, if your wife is a NYSLRS member, she can message her questions through our secure contact form.

Can you answer this same question for someone who is a Tier 4 member of NYSTRS with 30 years of service and 59 years old?

This blog is for members and retirees of the New York State and Local Retirement System (NYSLRS), the retirement system for employees of New York State and municipalities outside of New York City.

If you have questions about how your pension will be taxed, you may wish to speak with a tax adviser.

If you are a member of NYSLRS, please message our customer service representatives using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

If you are a member of the New York State Teachers’ Retirement System (NYSTRS), you can contact their customer service representatives at https://www.nystrs.org/Contact for assistance.

I plan on retiring from my full time job in 01/2024. I work for 4 small towns with a total income of $38,000. Can I still work for the small towns after retirement?

It is possible but certain rules and protocols must be followed. Here is more information:

In order to retire, a member must have a bona fide termination and be removed from payroll before the effective date of retirement. This is required by Internal Revenue Service (IRS) rules and the Retirement and Social Security Law (RSSL). When you apply to retire, we will notify your employer that your last day on their payroll must be no later than the day before your date of retirement.

Whether a termination has occurred is based on whether facts indicate that the employer and employee reasonably anticipated that no further services would be performed after the retirement date. Where it is expected that the employee will return to employment after the date of retirement, or where a member is retained on the payroll and paid for services past the date of retirement, there is no termination and the service retirement will be voided. Any pension amounts paid in error due to the fact that a retirement was invalid will be recovered by the Retirement System.

For account-specific information about how this may apply in your situation, please email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

what is deferred comp and how do I enroll? how is it a benefit to my retirement and if I plan to retire in 3-5 years is it worth it for me or to late?

The New York State Deferred Compensation Plan (NYSDCP) is a voluntary retirement savings plan (457(b) plan) created for New York State employees and employees of other participating public employers in New York. Please check out our latest blog post to see how deferred compensation can help you save for retirement.

Is there a standard Federal tax rate for a public pension? Is it the same tax rate as regular income? Thanks.

For information about federal taxes, please visit the IRS website.

Can you explain how these income tax exemptions apply to the 401a and 403b retirement investment options?

For questions about New York State taxes, please visit the New York State Department of Taxation and Finance website (https://www.tax.ny.gov). For questions about federal taxes, please visit the Internal Revenue Service (IRS) website (https://www.irs.gov). You may also wish to speak to an accountant or tax preparer.

I work ed in NYstate hospital 32 years ago.I live in Maryland . I had 13.5 years with the NY state I was vested when I left 1992 years. I am not retire yet at 68 years old. When I could take my 401 k ? Can I take the lup sum money or I only allow take money monthy?

Based on the information you provided, you should be eligible to apply for a full retirement benefit from NYSLRS (for most members, full retirement age is 62). This benefit would provide you with a monthly lifetime benefit based on your salary and service when you were working. You can read our Are You Vested? And What It Means page for more information about how to apply for retirement as a vested member off the public payroll.

We also recommend you call our customer service representatives at 866-805-0990 or email them using the secure email form on our website. One of them will review your account and respond to your questions. Filling out the secure form allows them to safely contact you about your personal account information.

I got my butt kicked off n taxes. Long story short. My exemption were Married with 2 Depends. Huge Mistake… For the remainder of 2022 I changed to Single with 0 Dependents and reduced my Social Security to 12 percent. Talk to your tax people before you start drawing on your pensions.

Once I retire is there a vehicle ( flexible spending account) that offers me the opportunity to set aside pretax dollars for healthcare?

NYSLRS doesn’t administer health insurance programs for its retirees. If you are a New York State retiree, the New York State Department of Civil Service administers the New York State Health Insurance Program (NYSHIP). You can contact the Department of Civil Service (http://www.cs.ny.gov/home/contact.cfm) or visit their website at http://www.cs.ny.gov to learn more.

If you retired from a public employer other than New York State (a county, city, town, village or school district), your former employer’s benefits administrator should be able to answer your questions.

I have a quick questions out pension taxes in NY, my situation isn’t quite clear to me. My spouse is a retired NYS Teacher and will begin receiving pension payments this year. I retired from a private sector position and I am over 59 1/2 for the entire 2022. Will my withdrawals up to 20k be NY tax exempt although the Teacher pension payments will likely exceed $40,000?

We recommend you consult with a tax professional or the New York State Teachers’ Retirement System regarding your situation.

I do volunteer tax returns through the VITA program: based on our IRS training/certification we would treat the first 20k of your private pension as excluded from NYS tax and the entire amount of the NYS Teacher pension as excluded from NYS tax. Not tax advice, just based on training & how we would do the return. Both pensions would be subject to Federal tax.

Bill: I do volunteer taxes through the VITA program trained/certified via the IRS. We would treat your situation: entire NYS Teacher pension tax free from NYS taxes (owe Federal taxes, no state) & the first 20k of the private pension of spouse would be tax free from NYS taxes but owe Federal taxes. Not tax advice, just based on training & preparing tax returns on a volunteer basis. Hope this helps!

If I live in another state that taxes my pension, how do I have taxes withdrawn from my pension and directed to that state?

Unfortunately, NYSLRS cannot withhold state taxes from your pension benefit. We recommend you contact your tax advisor or your state tax department for information on how to pay your state taxes.

No where in this post, nor in anywhere on the main ERS site, is there any mention on PRE-TAX status for health insurance deductions. I retired in 2021 and my first 1099-R indicates my health insurance deductions were taken from “after tax” money. Do retirees have the option for pre-tax health insuance as we did as an active employee? If yes, then how do I enroll for the pre-tax option? Note: I am not a public safety employee, so I cannot claim the $3000 deduction on my federal tax return. Thanks

NYSLRS does not administer health insurance programs.

The New York State Department of Civil Service administers the New York State

Insurance Program (NYSHIP) for New York State retirees and some municipal retirees. You can call them at 1-800-833-4344 or 518-457-5754 or email them at pio@cs.ny.gov.

If you retired from a public employer that did not participate in NYSHIP, your former employer’s benefits administrator should be able to help you.

You can have that done through deferred comp if you have an account with them. There’s a form you fill out telling them how much to pay your health monthly

Thank you for the info !!

I have a unique situation. I work in NYS as a teacher and live in NJ. I file joint tax returns and NYS taxes my husband’s salary, even though he works in NJ. My question is this…do I have to file a return with the state of NY if I am no longer working there, but are getting a pension from the state?? If so, they will continue to tax my husband’s income.

NYSLRS pensions are not subject to New York State income taxes.

For questions about New York State tax law, please contact the NYS Department of Taxation and Finance at the link below.

http://www.tax.ny.gov/help/contact

NJ will tax your pension and your husband’s earnings. You will no longer need to file NYS tax returns after you retire because neither you or your husband live in NYS,

Can you add to site an icon that will allow for printing of the articles.

Thank you for your suggestion. We will take this under consideration.

What does the mandatory contribution balance mean? Do I still owe money before I can collect?

The NYSLRS social media team doesn’t have access to your personal account information. We suggest that you email your question to our customer service representatives using our secure email form (http://www.emailNYSLRS.com), and let them know what you are looking at that shows a mandatory contribution balance. One of our representatives will review your account and respond to your questions. Filling out the secure form allows us to safely contact you about your personal account information.

I have the same question. Doesn’t seem anyone needs access to an account to define that term.

In Retirement Online, your Mandatory Contribution Balance is the total of your contributions to NYSLRS, plus interest. Most NYSLRS members contribute a percentage of their earnings to the Retirement System. Unlike a 401k or IRA, these contributions don’t determine the amount of your pension. Your NYSLRS retirement benefit will be based on your service credit and final average salary.

May I change the number of my Federal withholding allowances in the future, if I find that the initial selection isn’t appropriate?

Certainly. You can change your tax withholding status at any time by filing a W-4P form. You can mail it to the address on the form, or fax it to 518-486-3252.

For help completing a W-4P form, visit our Understanding your W-4P Form interactive tutorial.

Our Withholding Tax Calculator can tell you how much will be withheld based on your marital status and the number of exemptions you choose (for example, married with 1 exemption or single with 0 exemptions).

The link in the above post to the Understanding you W-4P Form interactive tutorial goes to the fillable form PDF, not a tutorial. Please provide the link to the tutorial. Thanks

The W-4P tutorial is not available at this time. For more information about filling out the W-4P form, please read our Federal Withholding and Your Pension blog post.

Why does it say “if you stay in NYS you won’t have to pay NYS taxes”? I plan to leave NYS so why would I pay NYS taxes if I no longer live in NYS?

New York State does not tax your NYSLRS pension as income, so you wouldn’t pay State tax no matter where you live. However, many other states do tax pensions. As you plan for your retirement, you may want to take a look at the Retired Public Employees Association website. They track which states tax pensions, Social Security and 457 plan distributions.

Search for “Pension tax by state” to find a list. You’ll need to do more specific research with the state you plan to relocate to. The link mentioned in NYSLRS’s reply is a good place to start.

How can we lobby to get the Federal government to stop tax NYS Pensions?

We’re sorry; we don’t have any specific advice about lobbying the federal government. However a good place to start may be finding the legislators who represent you in the House of Representatives and in the Senate.

Better yet, lobby for the Federal govt to NOT tax Social Security!

You received a tax deduction on money you contributed like other retirement plans so it’s taxed upon withdrawl

What are the taxes on IRA withdrawals after retirement at age 64 and living in NYS?

We’re sorry; NYSLRS can’t offer specific tax information or advice. You may want to consult a tax adviser or visit the New York State Department of Taxation and Finance website.

In particular, Publication 36 | General Information for Senior Citizens and Retired Persons may be helpful.

I am on the cusp of retirement. My supervisor recommended I sign up for these info emails. There are at least two sentences in each of the past emails, that have addressed information that I have been searching for. You folks have certainly taken the edge off of the retirement question anxiety. Many thanks and … keep ’em comin’.

Thank you. We’re glad you’ve found them helpful.