If you expect to leave public employment before retirement age, or if you’ve already left, take note of this important information about your NYSLRS pension.

Once you become a vested NYSLRS member, you’re eligible for a NYSLRS pension even if you leave public employment before retirement age. Vesting is automatic but receiving retirement benefits is not. You’ll need to apply for your pension. But when should you apply?

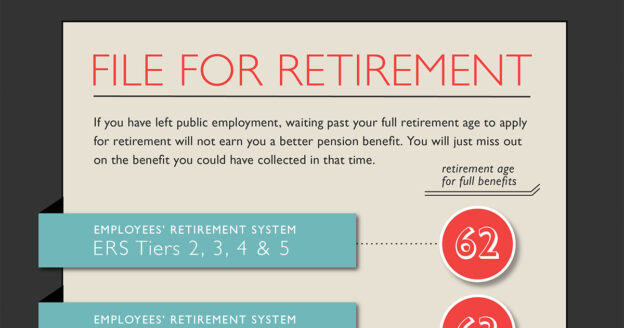

Filing for Retirement If You Have Left Public Employment

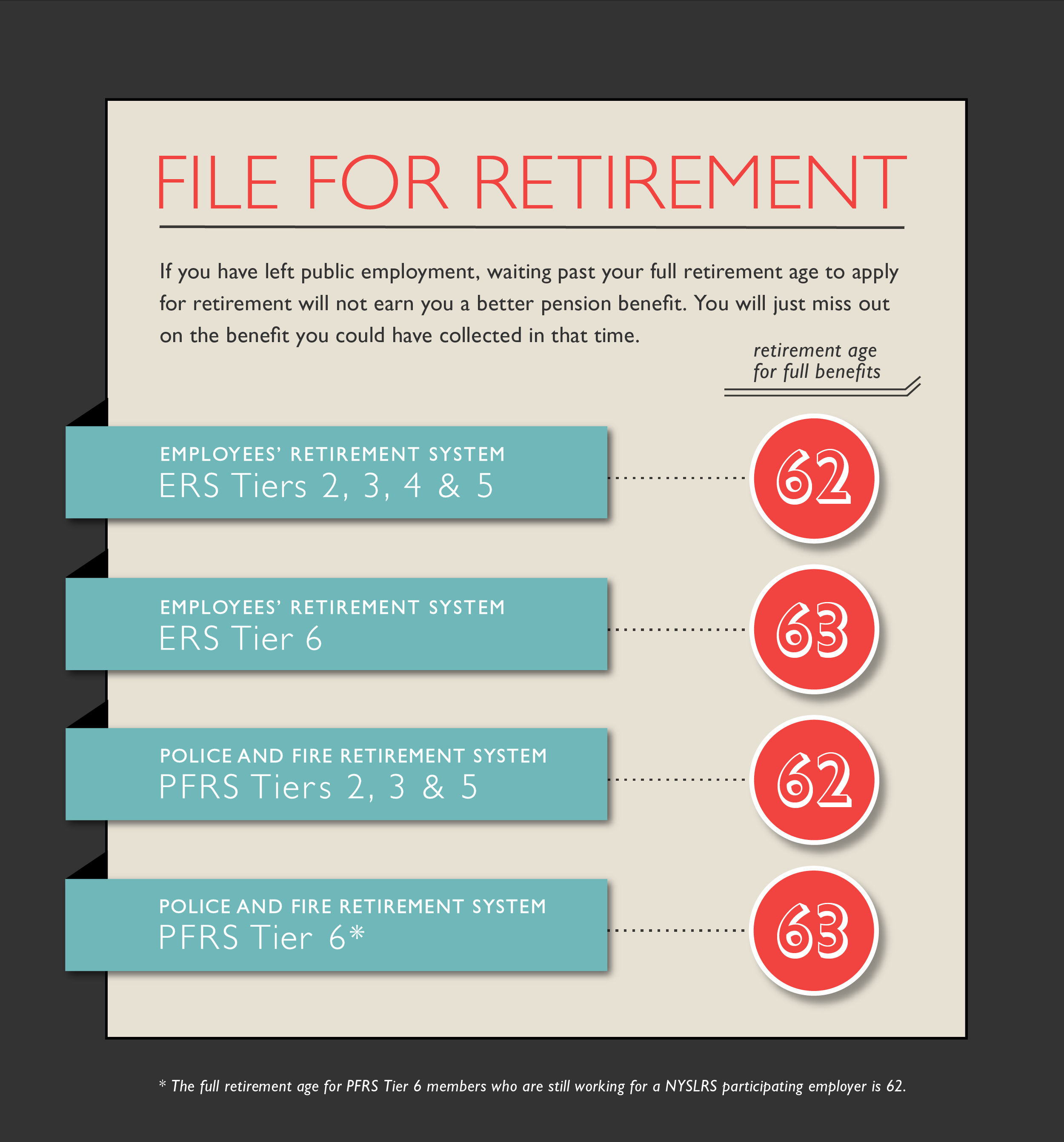

Most NYSLRS members can begin collecting their pension as early as age 55. If you file for your retirement benefit between age 55 and your full NYSLRS retirement age, you may face a permanent benefit reduction. Full retirement age for a NYSLRS pension is 62 or 63, depending on your plan and tier.

Waiting longer than your full retirement age, however, could cost you a lot of money.

If you aren’t working for a NYSLRS participating employer, your NYSLRS pension will not increase after your full retirement age. Pension benefits are not retroactive, and you will not be able to recover the monthly pension payments that you would have received if you retired at full retirement age.

How Social Security and NYSLRS Rules Differ

NYSLRS and Social Security are different systems with different milestones. You can collect Social Security retirement benefits as early as age 62. If you delay taking Social Security, your benefit amount will continue to increase 8 percent per year until you reach age 70 (for those born in 1943 or later).

But if you wait until you’re 70 to apply for your NYSLRS pension, you’ll miss out on years of NYSLRS benefit payments.

The information above applies only to members who leave public employment before their full retirement age.

(In most cases, if you are still working for a participating public employer in New York State, your pension amount will continue to increase, even if you work past your retirement age.)

Steps You Can Take

Your retirement may be years or even decades in the future. Here are a few steps you can take to help you keep track of your NYSLRS pension if you leave public employment:

- Estimate your NYSLRS pension at different ages using the benefit calculator in Retirement Online.

- Create a plan for retirement, taking into account the milestones above.

- Review your plan periodically and update it as necessary.

- Keep your contact information up to date using Retirement Online.

- Contact NYSLRS if you have questions about your benefits.