Defined benefit pension plans, including NYSLRS, provide retirement security for millions of Americans. Here in New York, NYSLRS pays out more than $10 billion in benefits each year to nearly 400,000 New York State residents. Much of that money is spent at home, contributing to local economies and supporting jobs.

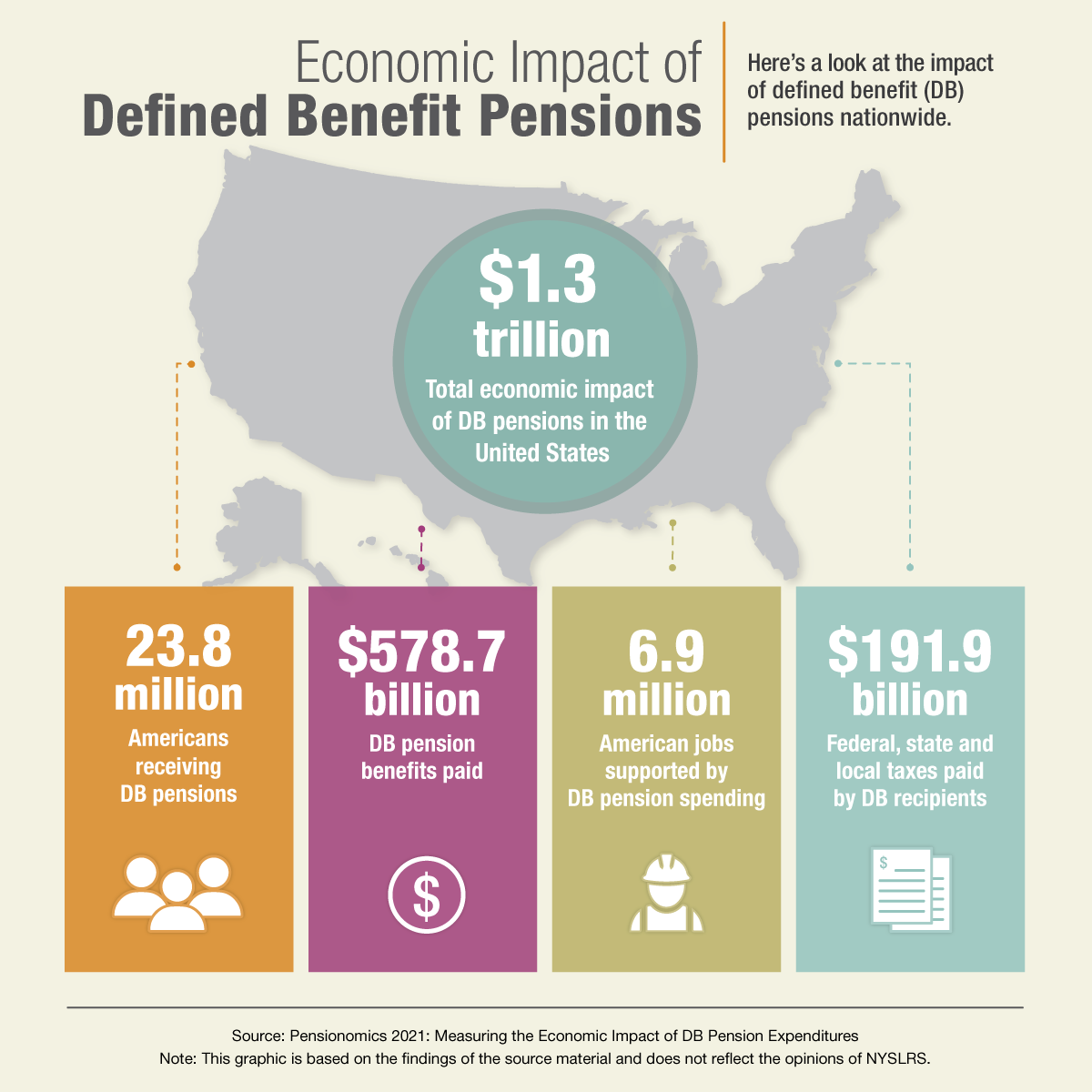

What’s happening here is mirrored across the country. According to a study released by the National Institute on Retirement Security (NIRS) in 2021, defined benefit pension plans paid $578.7 billion to 23.8 million retired Americans, and those payments had a significant impact on the nation’s economy.

What Is a Defined Benefit Pension Plan?

A defined benefit pension plan provides a pension that is based on a preset formula that takes into account salary and years of service. Unlike a 401(k)-style retirement plan (also known as defined contribution plan), it is not based on how much you or your employer contribute to your retirement account. A defined benefit plan provides a fixed monthly payment at retirement and is usually a lifetime benefit.

With a defined contribution plan, the amount of money the employee has accumulated at retirement depends on the investment returns of their individual account. A market downturn, especially near retirement, can affect the value of their benefit. With a defined benefit plan, market risk is shared, so a downturn doesn’t affect the benefit.

Most importantly, defined benefit pension recipients don’t have to worry about their money running out during their retirement years.

Who Gets Defined Benefits?

Defined benefit pension plans were once much more common in the United States. Today, defined benefit plans are more commonly offered by public employers, though about 16 percent of full-time private sector employees had access to a define benefit plan in 2018.

Who received these benefits? According to the NIRS study:

- $308.7 billion was paid to 11 million state and local government retirees and beneficiaries;

- $105.9 billion was paid to 2.6 million federal retirees and beneficiaries; and

- $164.1 billion was paid to 10.1 million private sector retirees and beneficiaries.

Employers Benefit from Defined Benefit Plans

Not surprisingly, the financial security provided by defined benefit plans has proved popular among workers. In 2019, the NIRS surveyed 1,100 public employees about their benefits. Most said retirement benefits are good tools for recruiting and retaining workers, and 86 percent said their retirement benefits are a major reason they stick with their jobs.

National Economic Benefits of Defined Benefit Plans

The $578.7 billion in pension payments generated spending that supported 6.9 million American jobs with paychecks totaling $394.2 billion, the study estimated. But the economic benefit didn’t stop there. This is because of what economists call the multiplier effect, the measure of the true impact of each dollar spent as it works its way through the economy.

The study found that each pension dollar paid had a $2.19 multiplier effect, which resulted in nearly $1.3 trillion in economic output. Real estate, food service, healthcare, and wholesale and retail trade were the sectors most impacted.

The study also noted that defined benefit pension payments have a stabilizing effect on local economies. Because they have a steady source of income, retirees with a defined benefit plan are less likely than retirees with defined contributions to curtail spending during economic downturns.

“These plans are a cost effective way to provide secure lifetime income for retired Americans and their beneficiaries after a lifetime of work. Moreover,” the study concluded, “DB pension plans generate economic benefits that reach well beyond those who earned benefits during their working years.”