As a NYSLRS member, you are enrolled in a defined benefit plan, also known as a traditional pension plan.

How a Defined Benefit Plan Works

Defined benefit pension plans provide a specified payment amount at retirement. If you are vested and retire from NYSLRS, you will receive a monthly pension payment for the rest of your life. Your pension will be calculated using a preset formula based on your earnings and years of service. Your individual contributions to NYSLRS will not affect the pension you receive when you retire.

Defined benefit plans are supported by contributions from both members and employers. With defined benefit plans, retirement assets are pooled and the investment risk is shared. These plans are usually administered by professional managers, whose long-term investment strategies help to reduce the impact of market turmoil. NYSLRS employs an experienced group of investment managers.

The biggest contributor to your pension plan is the New York State Common Retirement Fund. Over the past 20 years, the Fund’s investment returns have covered 75 percent of the cost of pensions.

Defined Contribution Plans — And Their Risks

Defined benefit plans are often confused with 401(k)-style retirement savings plans, which are known as defined contribution plans.

With a defined contribution plan, the employee, the employer or both make contributions to an individual retirement account for the employee, and the money in the account is invested. In most cases, the employee decides how and where the money is invested (or the plan may offer pre-packaged investment options). At retirement, the employee will be able to draw from the accumulated value of contributions and investment returns, minus any fees.

The amount of money the employee has at retirement depends on the investment returns of the individual account. So, market downturns, especially near retirement, can negatively affect the value of the benefit. Employees depending on defined contribution plans run the risk of outliving their savings.

NYSLRS’ Defined Benefit Plans

NYSLRS administers more than 300 retirement plan combinations, but all of them are defined benefit plans and share certain features. NYSLRS plans:

- Provide a guaranteed benefit for life;

- Offer a pension based on final average earnings and years of service;

- Provide a right to pension benefits (vesting) with five years of service credit;

- Build a cost-of-living adjustment (COLA) into pensions to help offset the effect of inflation; and

- Include disability retirement and death benefits.

We strongly encourage you to review your retirement plan publication for a complete description of your benefits. To find your retirement plan publication, visit our Find Your NYSLRS Retirement Plan Publication page and follow the steps listed.

Advantages of Defined Benefit Plans

Defined benefit plans provide important advantages for state and local government employers. For one, offering these plans makes it easier to recruit and retain qualified employees, particularly police officers, fire fighters and teachers. Employers can also reduce the risk of employee turnover, which could help cut training costs and improve productivity.

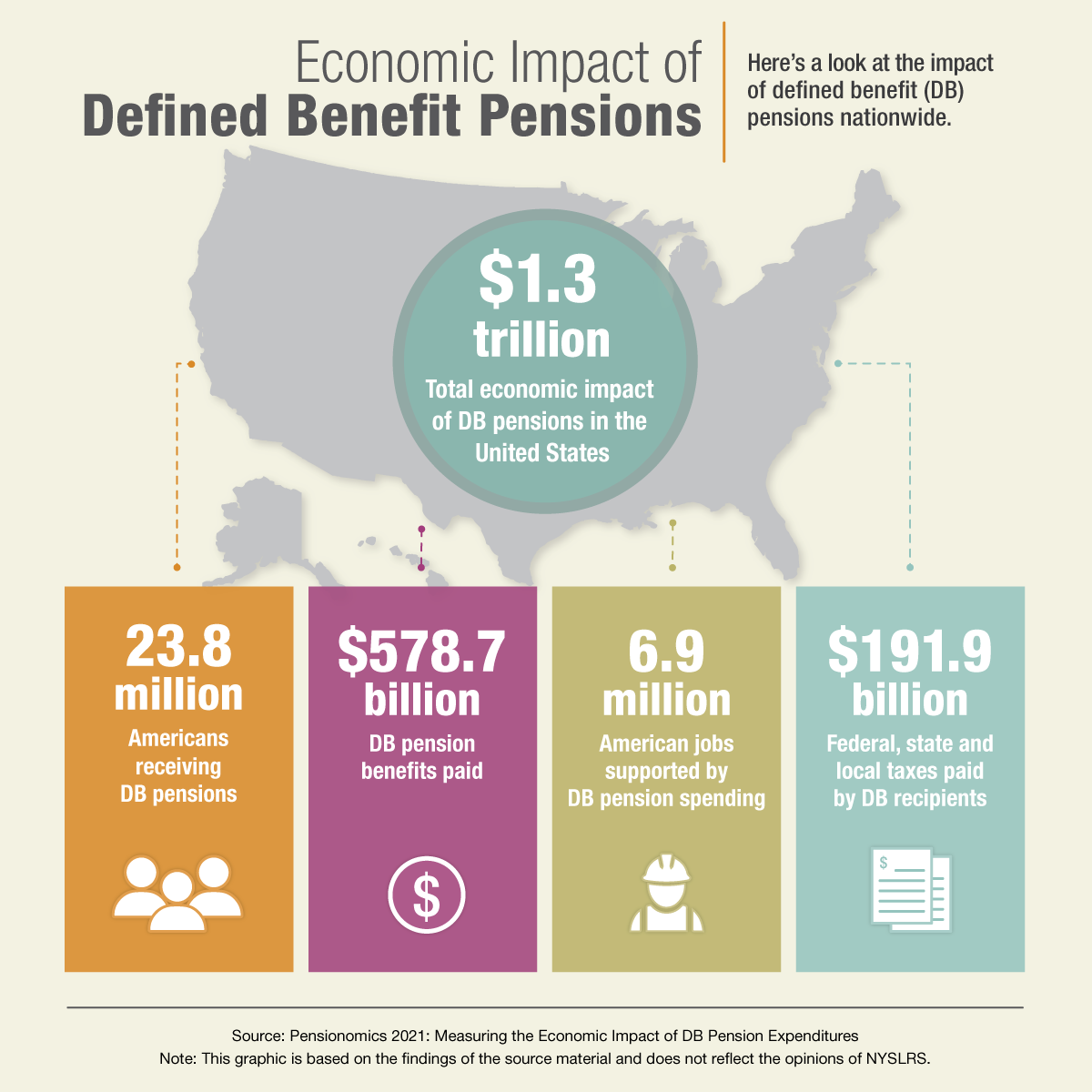

Defined benefit plans also help support state and local economies, because they provide a steady, reliable stream of retirement income for many retirees across New York and the nation.

Read more about the advantages of defined benefit plans.

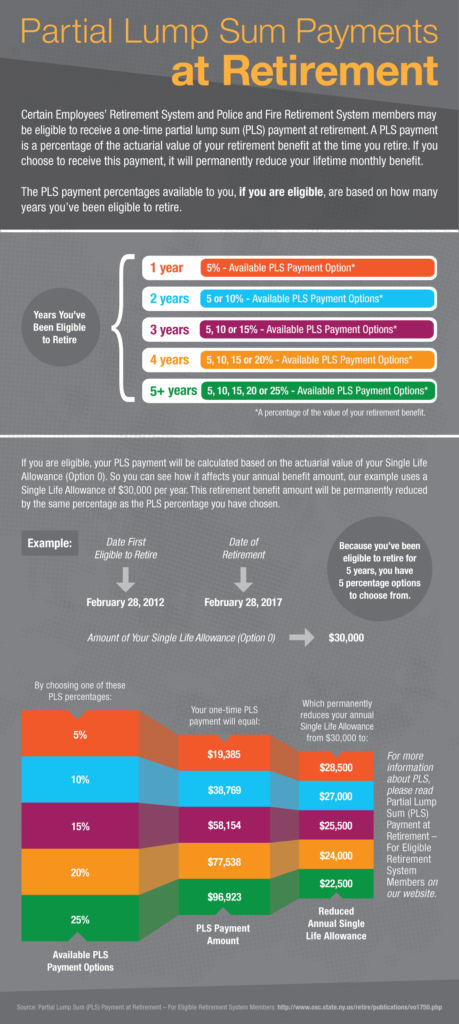

How the Partial Lump Sum Payment Works

How the Partial Lump Sum Payment Works