This Public Service Recognition Week, we proudly celebrate more than 695,000 members and 470,000 retirees of the New York State and Local Retirement System (NYSLRS) for their service to the people of New York State.

A Brief History of Public Service Recognition Week

This week was created in 1985 to honor those who serve our nation as federal, state, county and local government employees.

Congress officially designated the first full week of May as Public Service Recognition Week. This year, it is being celebrated May 5 through 11.

NYSLRS Members Deliver Critical Services

From the smallest village to our biggest cities, New York public employees like you provide the essential services that improve our quality of life. You work for employers such as:

- New York State

- Couties, Towns and Villages

- School Districts

- Correctional Facilities

- Public Libraries

- Fire and Water Districts

Whether they are protecting public health and safety, driving our children to school or clearing snow from the roads, NYSLRS members deliver the critical services New Yorkers depend on. Many NYSLRS members and retirees also give back to our state by volunteering in their communities or supporting charitable causes.

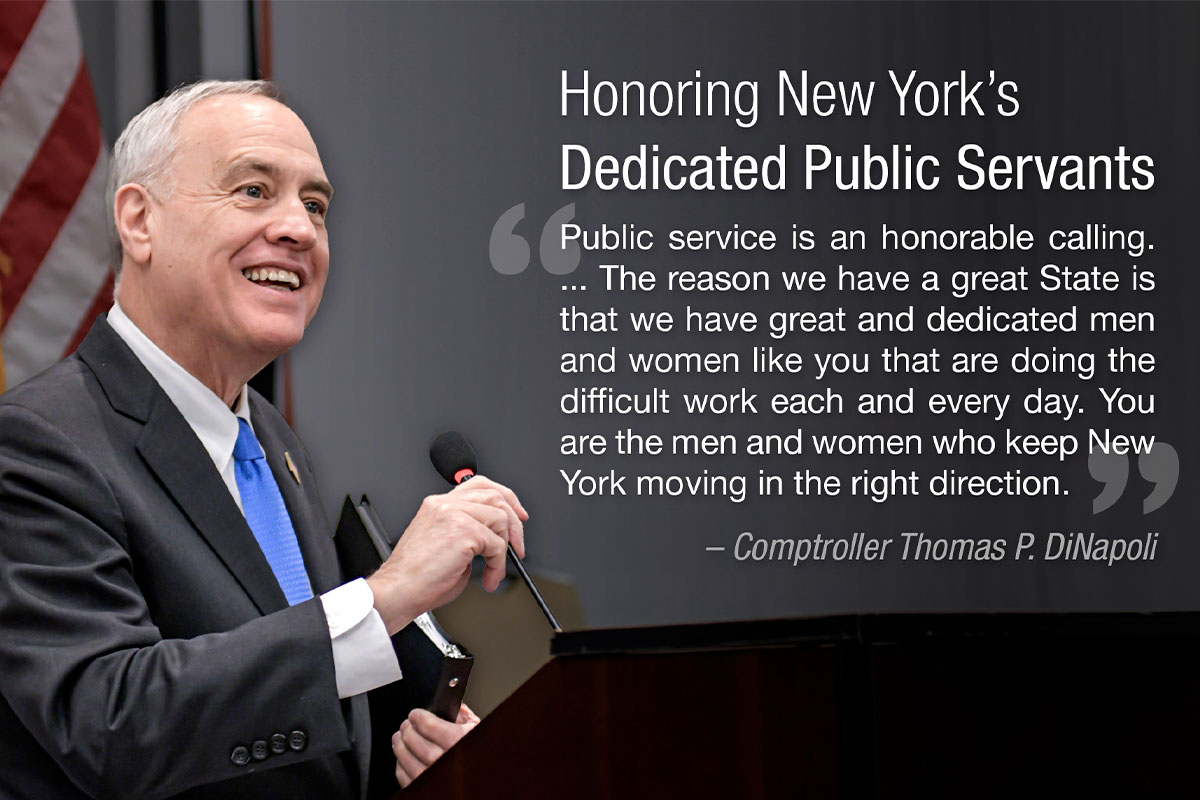

Comptroller DiNapoli’s Faith in Public Service

New York State Comptroller Thomas P. DiNapoli is the administrator of NYSLRS and trustee of the Common Retirement Fund. His public service career began at 18 years old, when he won his first election to become a trustee on the Mineola Board of Education. That made him the youngest person in New York State history to be elected to public office. He is also the second longest-serving comptroller in New York State history.

Comptroller DiNapoli is understandably proud about the career path he has chosen, and he often speaks about the contributions that New York’s public employees make to their communities and their State. He encourages young people to consider a career in public service. “It’s more than a job,” he says. “It’s a career with purpose.”