On January 3, 1921, NYSLRS began helping New York’s public employees achieve financial security in retirement. Now – 100 years later – we continue to fulfill that promise.

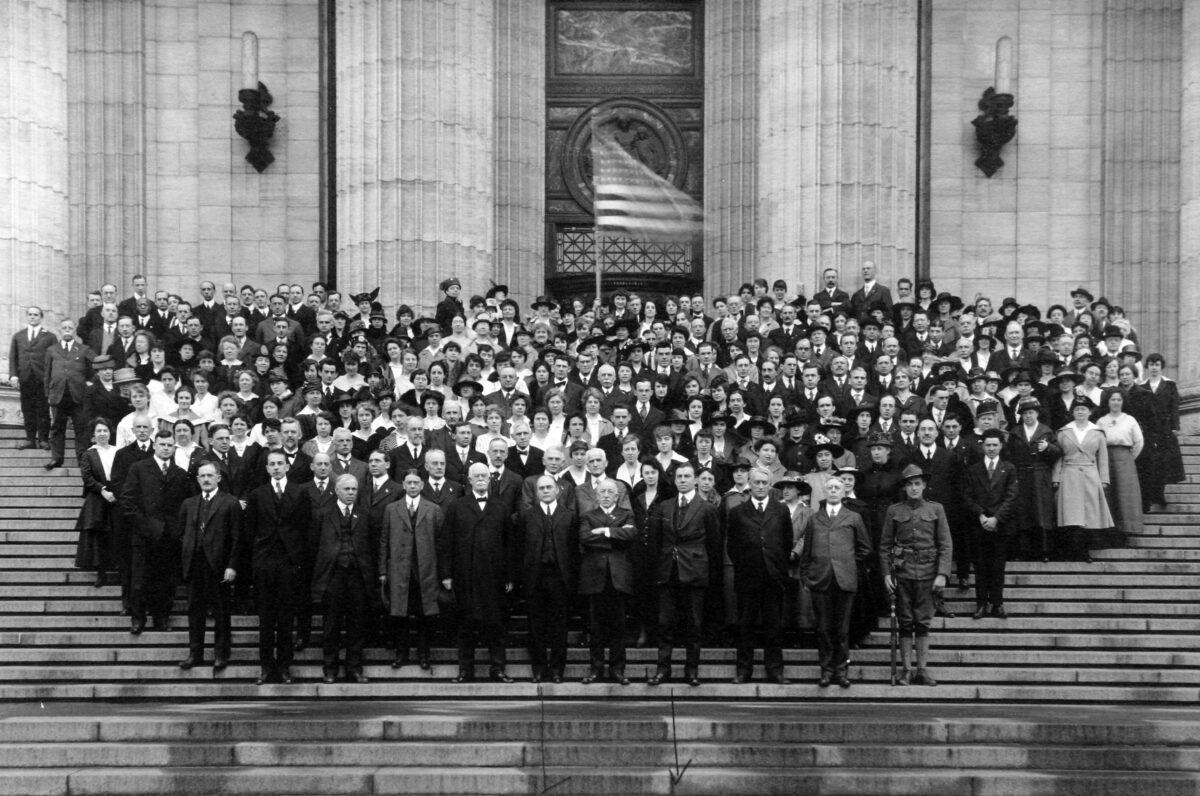

NYSLRS’ Origins

In 1920, the State Commission on Pensions presented Governor Al Smith a report they’d been working on for two years. The report showed that though there were already pension plans covering 8,300 banking department employees, teachers, State hospital workers, Supreme Court and other certain judiciary employees and prison employees, 10,175 State employees were not covered. To help ensure the financial security of public employees during their retirement years, the Commission recommended that a system be established to pay benefits to State employees – and the Commission wanted a system that would always have enough money on hand to pay benefits.

On May 11, 1920, Governor Smith signed legislation creating the New York State Employees’ Retirement System. By June 30 1921, 43 retirees were drawing pensions. The total amount of their annual pensions was $17,420.16. The first disability pension benefit of $256 per year was also paid.

Still Fulfilling Our Promise After 100 Years

Today, there are more than one million members, retirees and beneficiaries in our system, and NYSLRS is one of the strongest and best funded retirement systems in the country. Last fiscal year, NYSLRS paid out $13.25 billion in retirement and death benefits.

Our core mission for the last 100 years has been to provide our retirees with a secure pension through prudent asset management. This has been our promise since 1921 and will continue far into the future.

Sources: Report of the New York State Commission on Pensions, March 30, 1920; Chapter 741 of the Laws of 1920; and Report of the Actuary on the First Valuation of the Assets and Liabilities of the New York State Retirement System as of June 30, 1921.