A recent survey gauged how important retirement benefits are to state and local government workers, and the crucial role that pensions and other benefits play in recruiting and retaining workers.

In 2015, more than 19 million Americans worked for state or local governments, according to U.S. Census Bureau data. Retirement benefits, including defined benefit and defined contribution plans, were available to most of those workers.

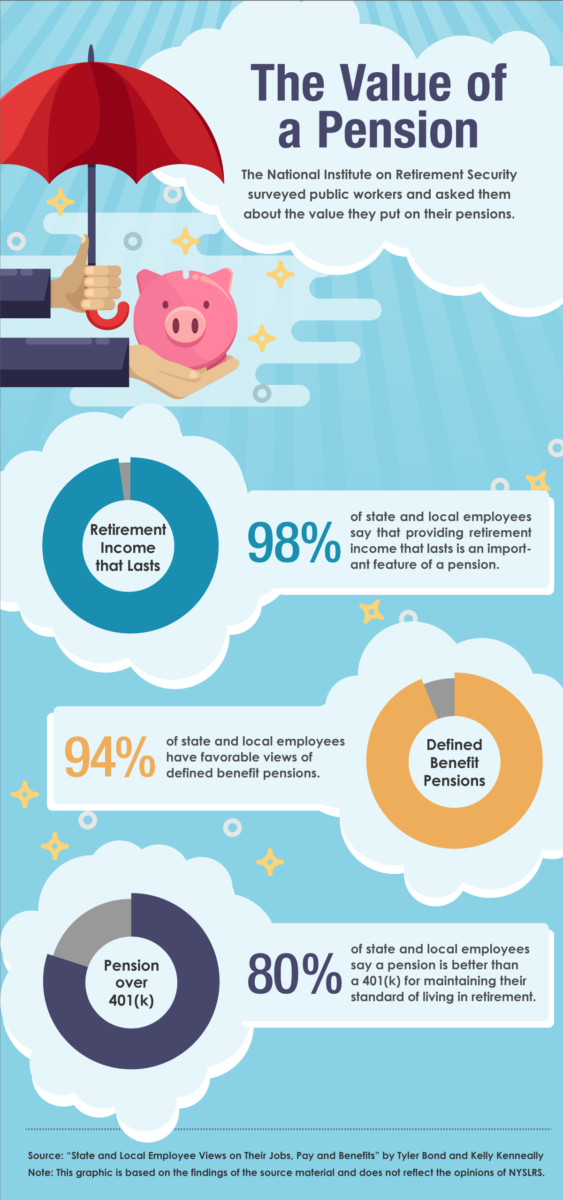

Last year, the National Institute on Retirement Security commissioned a survey of more than 1,100 public sector employees. Teachers, police officers, firefighters and other public workers were asked questions on a variety of work-related subjects, from job satisfaction to health care benefits. The majority of public workers surveyed (86 percent) cited retirement benefits as a major reason they stay in their jobs.

Defined Benefit vs. Defined Contribution

An overwhelming number (94 percent) of government employees surveyed said pensions help attract and retain workers. The same percentage had a favorable view of defined benefit pension plans.

As a NYSLRS member, you are part of a defined benefit plan, also known as a traditional pension plan. Your pension is a lifetime benefit based on years of service and earnings. It is not based on your individual contributions to the Retirement System.

With defined contributions plans, such as 401(k)-style retirement savings plans, the employer, employee or both make contributions to an individual retirement account. The money in the account is invested, and the amount the employee has at retirement is based on investment returns. A market downturn can affect the value of the benefit and employees risk outliving their money.

When Retirement Benefits Get Reduced

In an effort to cut costs, some state and local governments have replaced defined benefit plans with defined contribution plans. But these moves have had unexpected consequences.

The Institute’s study cites the experience of Palm Beach, Florida, which gutted its defined benefit plan. The town soon realized that it was spending large sums to recruit and train new police officers, only to see them move to nearby communities with better benefits. The town reconsidered and improved its pension plan.

Then there’s the case of West Virginia, where officials found that switching to a defined contribution plan for teachers actually cost more money. Because the traditional pension plan stopped receiving contributions from new teachers and their employers, it became harder for the state to meet its pension obligations. After 14 years, the state went back to offering a defined benefit plan to all new teachers. Teachers already in the 401(k)-style plan were allowed to switch to the traditional plan, and 79 percent made the switch. State officials project that the return to a defined benefit system will save them $1.2 billion in the first 30 years.

Meanwhile, Alaska is still struggling with its decision to drop its defined benefit plan. A report by the Alaska Department of Public Safety cited “the inability to provide a defined benefits retirement system” as a factor in the “critically low staffing levels” for Alaska state troopers.