Over the past century, NYSLRS has provided pension security for retired public workers, whose spending has contributed to the economic strength and stability of their communities.

In every corner of the Empire State, NYSLRS retirees shop at local stores and patronize local businesses, which in turn helps create jobs. NYSLRS retirees also pay a significant share of local taxes.

Economic Stability

Spending by NYSLRS retirees provides something else for their communities: economic stability.

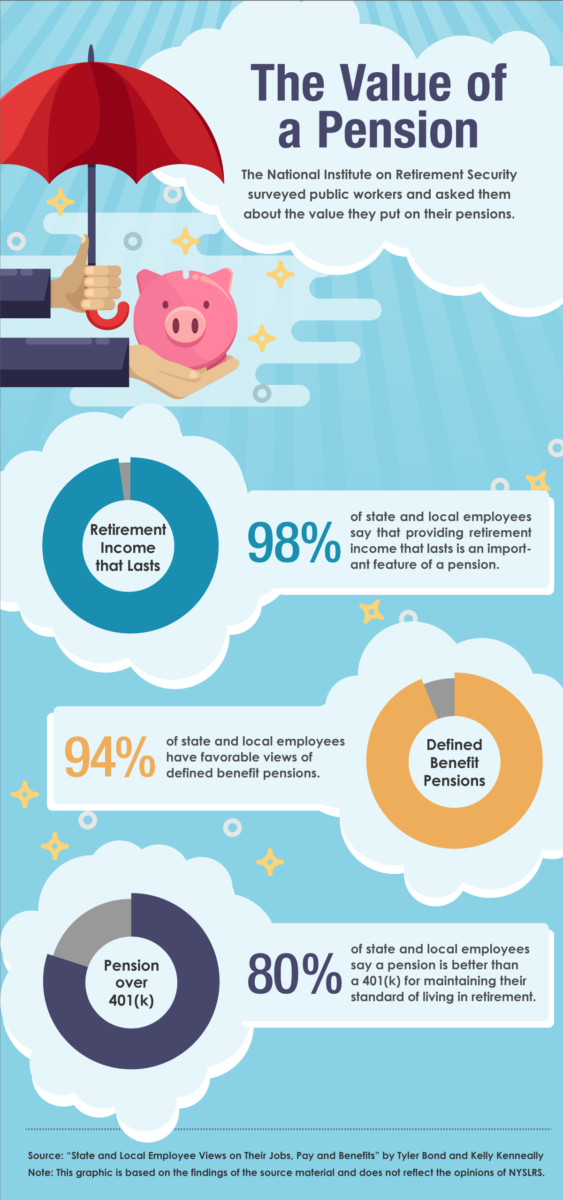

Because a NYSLRS pension is a defined-benefit retirement plan, retirees and beneficiaries receive a guaranteed monthly payment for life. Defined-benefit plans, which pay benefits based on a pre-set formula, differ from defined-contribution plans, such as a 401k, which are essentially retirement savings accounts.

Recipients of defined-benefit plans don’t have to worry about their money running out during retirement or a drop in their monthly income because of a dip in the stock market. They are better able to maintain their spending during economic downturns, which helps local businesses stay afloat during hard times.

That stability is particularly important in rural parts of the State, which are more susceptible to downturns because they lack the economic diversity of more-urban areas.

Defined-benefit pensions don’t just help New York State. Across the nation, these pensions are benefitting millions of pensioners and their communities. In 2018, defined-benefit pension plans paid $578.7 billion to 23.8 million retired Americans, and their spending supported 6.9 million jobs and generated $1.3 trillion in economic activity, according to a study by the National Institute on Retirement Security (NIRS).