NYSLRS benefits provide a lifetime monthly pension retirees can count on. And, in turn, NYSLRS retirees contribute to our local economies in both good times and bad.

Nearly 79 percent of NYSLRS retirees live right here in New York State, and they can be found in every region and county. That means, in every corner of the Empire State, NYSLRS retirees are there—patronizing local businesses and helping to create jobs. Retirees also pay a significant share of State, local and property taxes.

As of the State fiscal year ending, March 31, 2024, Suffolk County on Long Island is home to 39,837 retirees and beneficiaries—the most benefit recipients of the counties outside of New York City. They make up about 2.6 percent of the county’s residents, and they bring some $1.5 billion in pension payments to their region’s economy.

On the other hand, Hamilton County has the fewest NYSLRS benefit recipients—just 545. But, for this sparsely populated county in the heart of the Adirondacks, those retirees represent about 10 percent of the county’s population, and they inject more than $12.9 million of pension payments into their communities.

As the number of NYSLRS retirees in our State grows, you can count on their help in building a stronger New York for years to come. Visit our website to see more about how retirees contribute to every region in the State.

How Retirees Contribute to Economic Stability

A NYSLRS pension is a defined benefit plan, which provides guaranteed monthly pension payments to retirees for life. With a defined benefit plan, your pension will be calculated based on a preset formula. That means—unlike with 401(k)-style defined contribution plans, which are essentially retirement savings accounts—your contributions won’t affect the amount you receive in retirement. NYSLRS retirees don’t have to worry about their pension running out during retirement, and there’s no danger of a drop in monthly income based on the whims of the stock market.

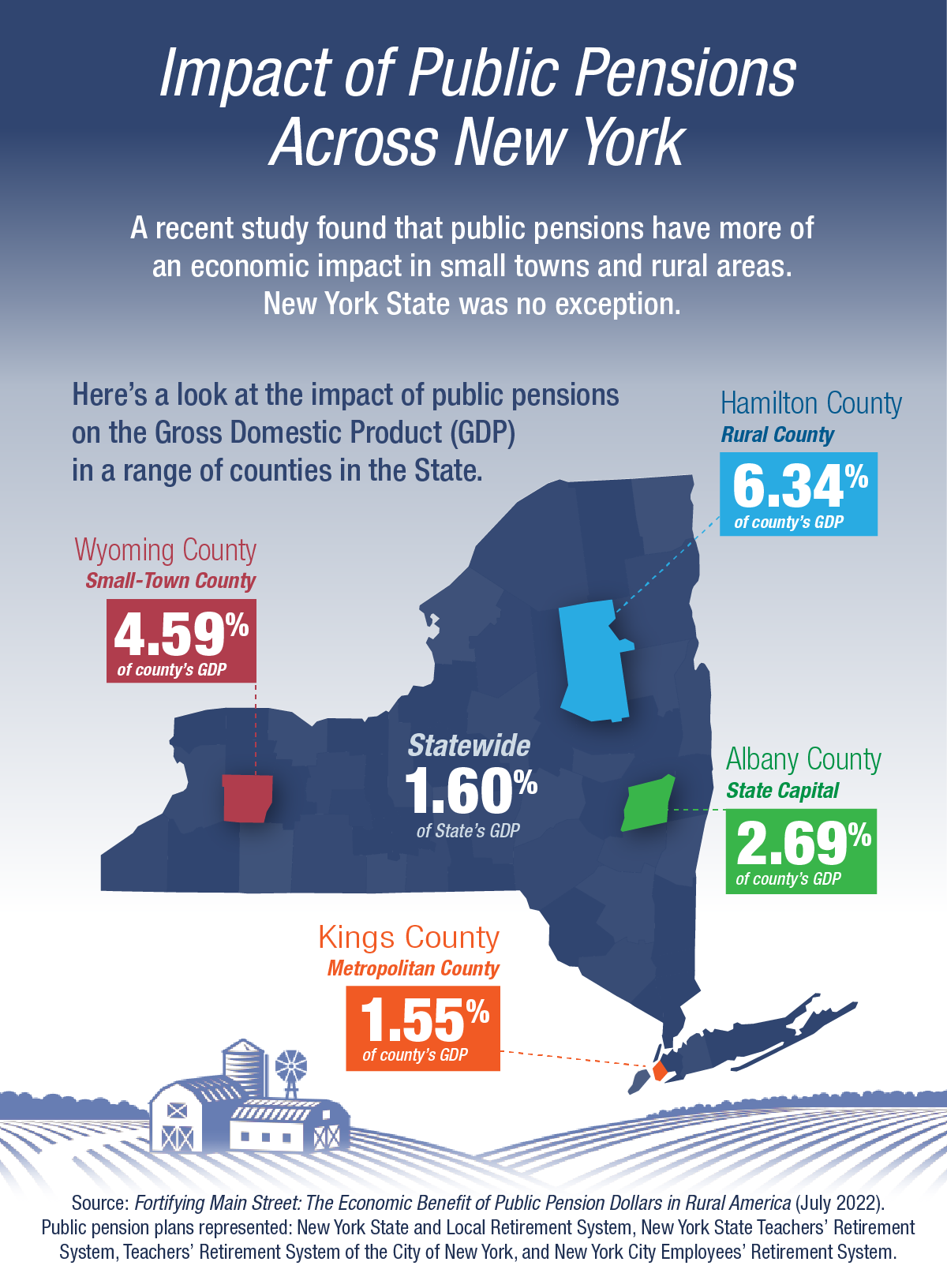

A study by the National Institute on Retirement Security (NIRS) suggests retirees with steady sources of income such as Social Security and monthly pensions are better able to maintain their spending during economic downturns, which may play a stabilizing role in local economies. That stability is particularly important in rural parts of the State. These areas often lack the economic diversity of more densely populated regions, which can make them more susceptible to downturns.

Defined benefit pension plans don’t just help New York State. Across the nation, pension benefits support millions of retirees who in turn contribute to their communities. In 2020, defined benefit pension plans paid $612.6 billion to 24.6 million retired Americans. According to the same NIRS study, their spending supported 6.8 million jobs and generated $1.3 trillion in economic activity.