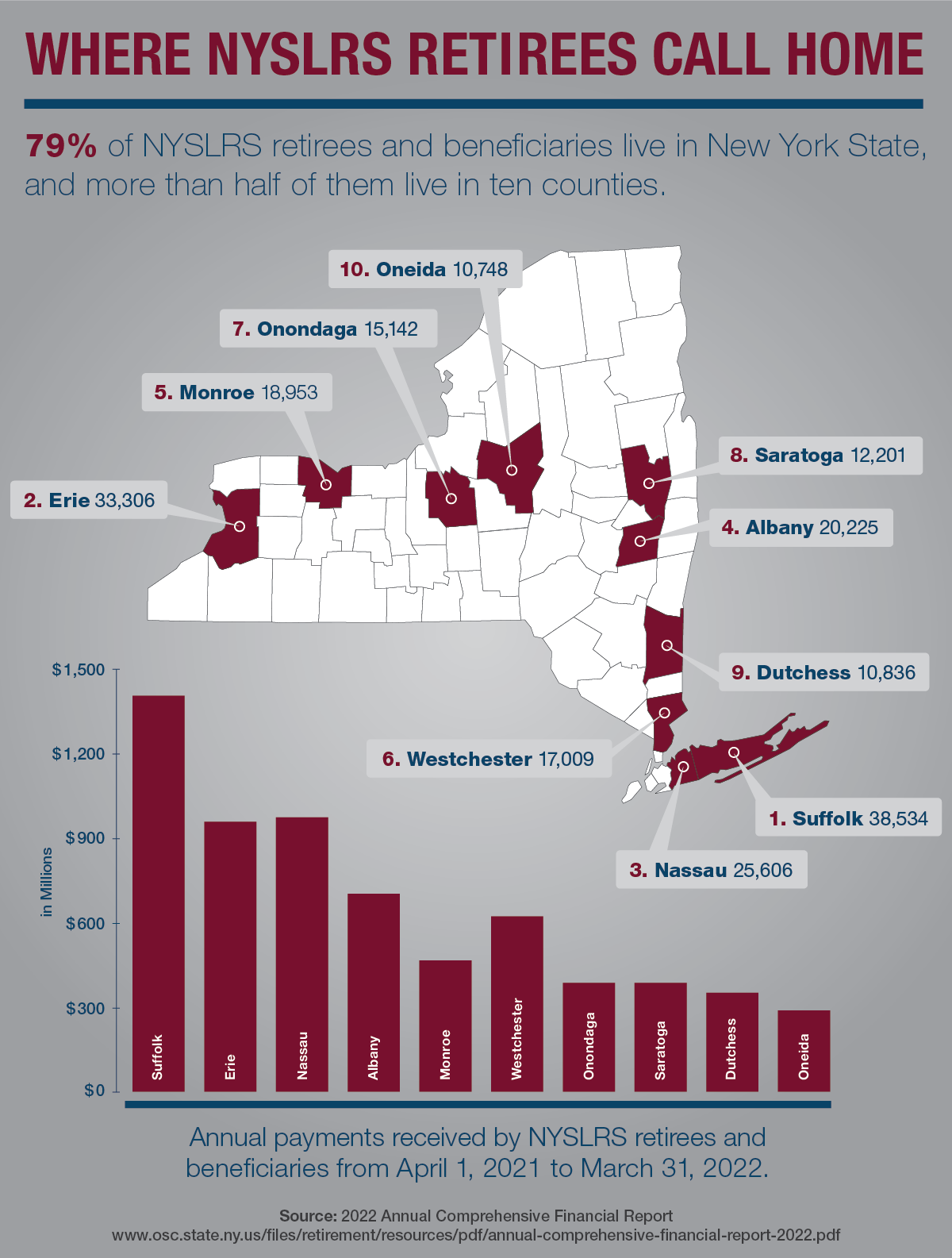

NYSLRS retirees tend to stay in New York, where their pensions are exempt from State and local income taxes. In fact, 79 percent of NYSLRS’ 507,923 retirees and beneficiaries lived in the State as of March 31, 2022. And more than half of them lived in just ten of New York’s 62 counties.

So where in New York do these retirees call home? Well, there are a lot of NYSLRS retirees and beneficiaries on Long Island. Suffolk and Nassau counties are home to more than 64,000 recipients of NYSLRS retirement benefits, with annual pension payments of nearly $2.4 billion. But that shouldn’t be surprising. Suffolk and Nassau counties have the largest and third largest number of pension benefit recipients, respectively, of all the counties in the State outside of New York City by population. (The City, which has its own retirement systems for municipal employees, police and firefighters, had 24,061 residents who were NYSLRS retirees and beneficiaries.)

Erie County, which includes Buffalo, ranked number two among counties in the number of NYSLRS retirees, with more than 33,000. Albany County, home to the State capital, ranked fourth with more than 20,000. Monroe, Westchester, Onondaga, Saratoga, Dutchess and Oneida counties round out the top ten.

All told, retirees and beneficiaries in the top ten counties received $6.5 billion in NYSLRS retirement benefits in 2021-2022.

Hamilton County had the fewest NYSLRS benefit recipients. But in this sparsely populated county in the heart of the Adirondacks, those 505 retirees represent about 10 percent of the county’s population. During fiscal year 2021-2022, $11.5 million in NYSLRS retirement benefits was paid to Hamilton County residents.

NYSLRS Retirees Across the United States and Around the Globe

Outside of New York, Florida remained the top choice for NYSLRS retirees, with 39,885 benefit recipients. North Carolina (10,011), New Jersey (8,302) and South Carolina (7,285) were also popular.

There were 646 NYSLRS benefit recipients living outside the United States as of March 31, 2022. These retirees and beneficiaries live throughout the world, with the most common countries being:

- Canada: 164

- Israel: 56

- United Kingdom: 36

- Italy: 31

- Jamaica: 31

Whether you retire close to home or move away, you’ll always be a part of NYSLRS.