Tax season is here. While your NYSLRS pension is not subject to New York State or local income tax, most NYSLRS pensions are subject to federal income tax. Each year, we provide a 1099-R tax form with the information you need to file your taxes.

Tax season is here. While your NYSLRS pension is not subject to New York State or local income tax, most NYSLRS pensions are subject to federal income tax. Each year, we provide a 1099-R tax form with the information you need to file your taxes.

We mail printed 1099-Rs by January 31. However, we make 1099-Rs available in Retirement Online sooner than printed copies are mailed—and you can sign in to your account now to access yours.

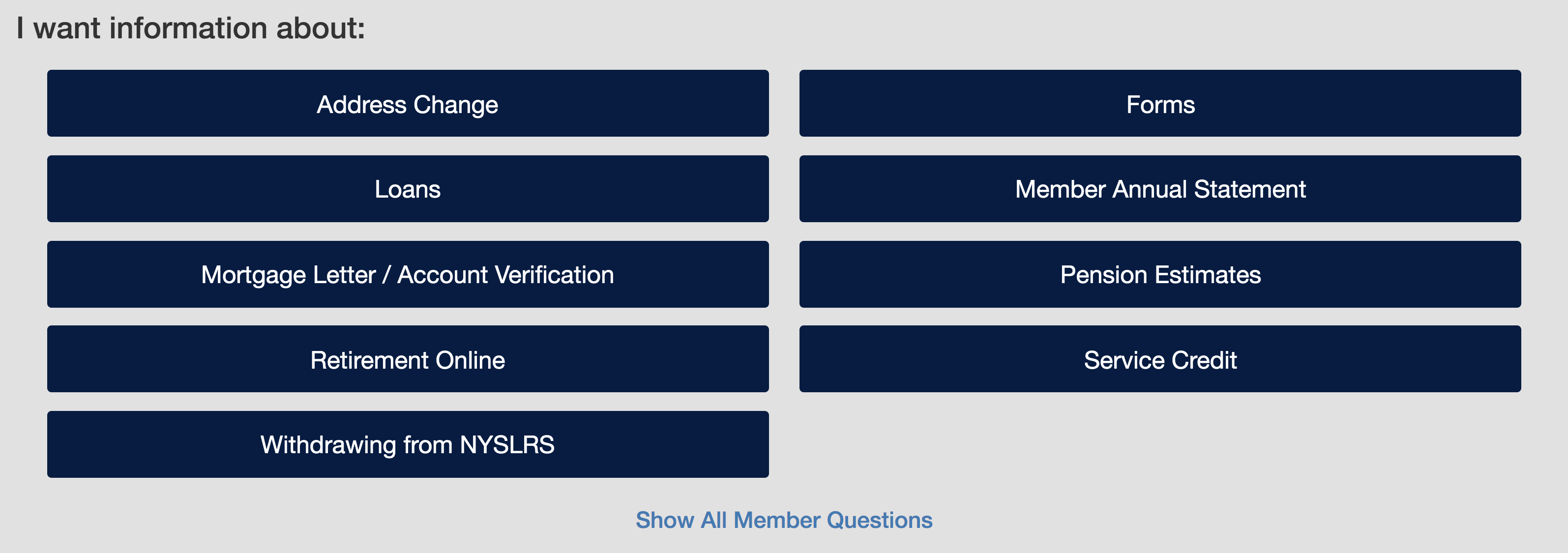

Get Your 1099-R Online Now

To view, save or print your tax form:

- Sign in to Retirement Online.

- Look under My Account Summary.

- Click Manage My 1099-R Tax Forms button.

- Select 2024 from Year dropdown. (Note: 2024 and 2023 are currently available online.)

- Click Generate button.

If you have one tax form, the document will open in a new browser tab. If you have more than one tax form, the documents will download to your computer.

Please check your browser settings and disable pop-up blockers to ensure your tax form is generated. By default, your browser may block pop-ups, which could prevent a new tab from opening or the file from downloading.

If you don’t have a Retirement Online account, check out our Retirement Online Tools and Tips blog post, where you’ll find a link to step-by-step instructions to help you register.

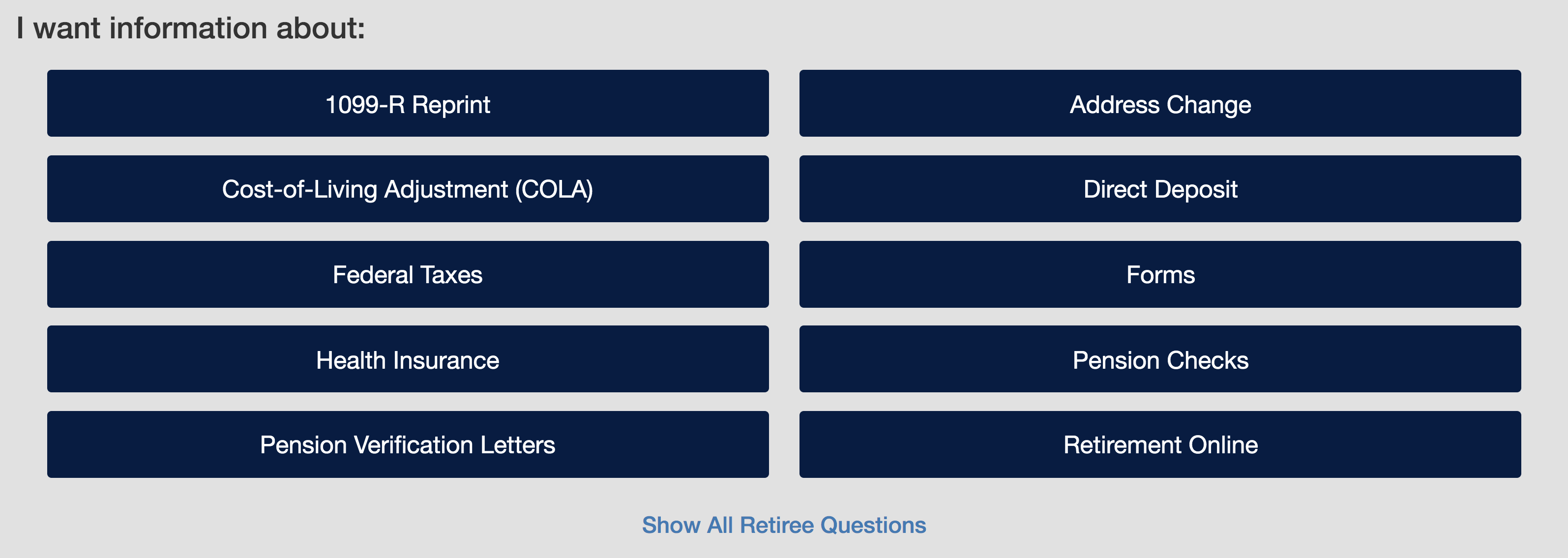

Understanding Your 1099-R

Your tax form includes:

- The total benefit paid to you in a calendar year.

- The taxable amount of your benefit.

- The amount of taxes withheld from your benefit.

If you have questions about the information on your tax form, check our interactive 1099-R tutorial. It walks you through a sample and offers a short explanation of each box on the form.

Get an Email Notification for Your 1099-R

Next year, you can get access to your tax form sooner by updating your delivery preference to email. When your 1099-R is available, we’ll send an email notifying you to sign in to Retirement Online.

- Sign in to Retirement Online.

- Look under My Profile Information.

- Click update next to ‘1099-R Tax Form Delivery by.’

- Choose Email from dropdown.

Be sure the email address listed in your Retirement Online profile is current.

Note: If you choose email as your delivery preference, you will not receive a printed copy in the mail.