In 1921, NYSLRS’ pension fund held several million dollars and provided benefits to just a few dozen State employees. Today, the Common Retirement Fund (Fund) provides more than a billion dollars per month to hundreds of thousands of retirees and beneficiaries.

The System’s founders showed foresight in establishing the framework for a sustainable retirement system capable of providing long-term pension security for its members and retirees. Today, one hundred years later, we are considered one of the strongest public pension funds in the country, thanks in large part to the stewardship of Comptroller DiNapoli, trustee of the Common Retirement Fund and administrator of NYSLRS for the past 14 years.

Comptroller DiNapoli’s diligent efforts to maintain the financial well-being of the Fund, the fact that NYSLRS’ participating employers contribute their share into the Fund, and New York’s constitutional requirement that lifetime pension benefits be guaranteed to all NYSLRS retirees — all these elements combine to ensure that NYSLRS retirees will enjoy secure benefits for generations to come.

Investments

The Common Retirement Fund has been widely recognized as one the best-funded and best-managed public pension fund’s in the nation. (In June 2020, the Pew Charitable Trusts ranked NYSLRS as the second-best-funded public retirement system in the nation, based on 2018 data.) The cornerstone of the Fund’s reputation is its sound investment policies. At the direction of Comptroller DiNapoli, Fund managers use a long-term investment strategy designed to take advantage of growth opportunities during good economic times, while helping the Fund weather economic downturns.

The Comptroller seeks the input of a wide range of internal and external advisors, consultants and legal counsel who help to determine the best investment choices and allocation of assets for the Fund. These advisors provide independent advice and oversight of all investment decisions, serve as part of the chain of approval on all investment decisions before they reach the Comptroller for final approval and participate on advisory committees that meet periodically throughout the year.

Fund assets are invested in a diversified portfolio. About 55 percent of the assets are invested in publicly traded stocks. Other investments include bonds, mortgages, real estate and private equity.

The Fund is also strengthened by a forward-looking approach to addressing climate change-related investment risks and capitalizing on the opportunities created by the transition to a low-carbon economy. Comptroller DiNapoli recognizes that climate change poses an enormous threat to the global economy and to the Fund’s investment portfolio. Recently, he announced plans to transition the Fund’s portfolio to net zero greenhouse gas emissions by 2040. This process will include a review of investments in energy companies and, where consistent with his fiduciary responsibility to maintain the long-term financial health of the Fund for NYSLRS members, divestment of companies that don’t meet minimum standards. This policy will help ensure that the Fund adapts to a changing global economy and maintains its growth in coming decades.

The Common Retirement Fund’s Impact on New York Businesses

The Common Retirement Fund’s In-State Private Equity Program invests in new and expanding New York companies and makes capital available to qualifying small businesses. As of March 31, 2020, the Fund’s private equity portfolio included investments in over 330 New York businesses with a total value of $1.9 billion. These investments boost the State’s economy while at the same time generating significant returns for the Fund.

Looking Forward

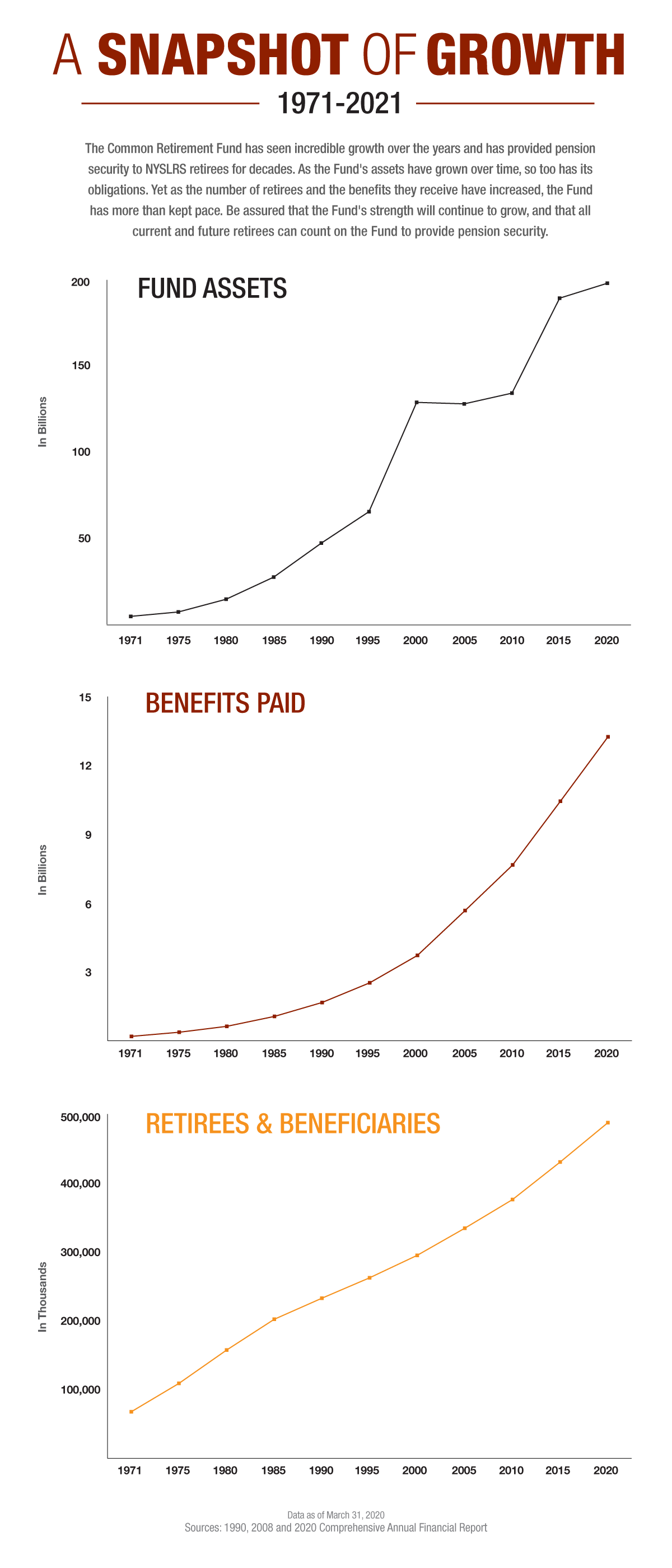

As the Common Retirement Fund’s assets have grown over the years, so have its obligations. As of March 31, 2020, there were 487,407 NYSLRS retirees and beneficiaries, who were paid $13.4 billion in benefits over the previous year. That’s up from 67,689 retirees and beneficiaries, who were paid $194 million in benefits in 1971. Roughly a third of NYSLRS members are expected to retire over the coming decade.

Comptroller DiNapoli’s focus on continuing the Fund’s record of strong growth ensures that the Retirement System will be ready to meet the challenges of the future. The New York State Common Retirement Fund’s estimated overall investment return was 33.55 percent for the State fiscal year that ended March 31, 2021, reflecting the financial markets’ dramatic rebound from lows reached during the COVID-19 pandemic. The return on investments increased the Fund’s value to an estimated $254.8 billion. More than 1.1 million NYSLRS members, retirees and beneficiaries can continue to rely on the Retirement System for their retirement security.

I thank Suffolk County & the NYS Pension system for our pensions I don’t know where Id be without them Keep up the good work Dave H

Thank you

Thank you Mr. DiNapoli. I am one of those old pensioners but I am happy to get a small boost occasionally. I just turned 90 and I hope my pension will continue until I pass. Again thank you and your staff for your continued watch over the pension fund. God Bless

On behalf of Comptroller DiNapoli, thank you for your kind words. They are greatly appreciated.

Rest assured, your NYSLRS pension is a guaranteed lifetime benefit.

will there be an early retirement incentive this year 2021 for 4 Tier members?

At this time, we are not aware of any retirement incentive that was approved for NYSLRS members. If a State retirement incentive program is approved by both houses of the Legislature and signed into law by the Governor, NYSLRS will notify your employer and provide details for our members on our website and on social media.