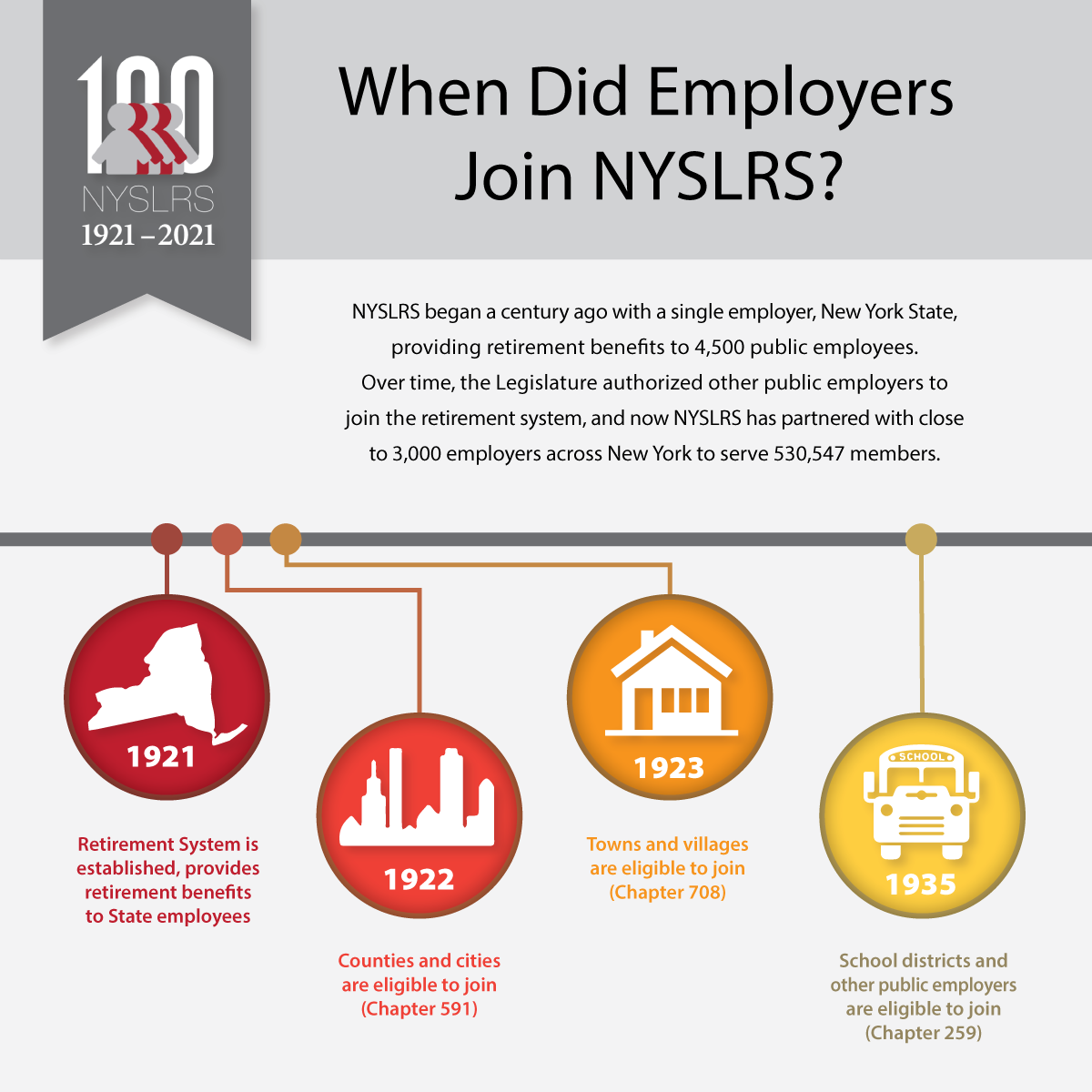

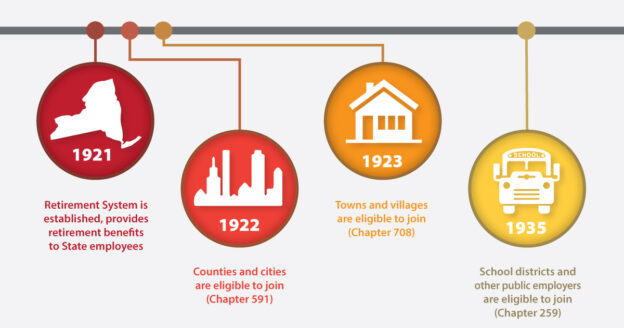

When the Retirement System was created in 1921, it served a single employer: New York State. But that would quickly change as a series of new laws allowed local governments and other public employers to join the system.

In May 1922, Steuben County was the first county to join, and Newburgh became the first city the following month. In 1923, Onondaga was the first town and Avon was the first village to sign on. The Roosevelt Public Library on Long Island became the first library to join in 1924. In 1935, the system was opened to school districts and other public employers.

The NYSLRS Partnership

Today, close to 3,000 public employers participate in NYSLRS, and they employ about two-thirds of the system’s roughly half million active members. These employers’ active involvement has helped make NYSLRS one of the largest public retirement systems in America, serving 1.1 million members, retirees and beneficiaries.

This partnership includes a shared commitment to providing secure pension benefits to New York’s public employees. Participating employers make annual contributions to help fund the future benefits of their employees. Each year NYSLRS’ actuary calculates the contribution rates required to ensure that adequate assets are being accumulated to pay benefits. These contributions along with member contributions and our investments are what fund promised benefits. As a result, NYSLRS is one of the best-funded public retirement system in the country, with an estimated Fund value of $254.8 billion as of March 31, 2021.

How NYSLRS Benefits Public Employers

Being part of NYSLRS allows municipal employers, regardless of their size, to offer prospective workers an attractive benefits package, including a defined benefit pension. With a defined benefit pension, those employees can be assured of a lifetime benefit during their retirement years.

In a recent survey, a majority of public employees said pensions are an important recruiting and retention tool. Eighty-six percent cited retirement benefits as a major reason they stay in their jobs. Another survey indicated that the general public agrees that pensions, particularly for public safety employees, are a good way to recruit and retain public workers.

How NYSLRS Benefits Communities

The benefits provided by NYSLRS help ensure that local governments can attract qualified and committed people to perform essential public services. Our members are police officers, firefighters, forest rangers and nurses. They plow roads, monitor water supplies, drive school buses, inspect restaurants, process unemployment claims and provide other vital services.

What’s more, after they retire and begin collecting their pensions, most NYSLRS members remain in New York, where they continue to contribute to their communities. In 2019, spending by NYSLRS retirees generated more than $15 billion in economic activity statewide and helped create an estimated 77,900 jobs.

Thank you for the updates. In a future edition, could you include an article to discuss final pension determination has been made and what factors into it, how long does it take to finalize and what occurs. Many individuals who works in 2020 worked overtime and figures were probably not included in final pension amount, therefore, just information on progress towards the final decision.

Thank you

Thank you for your feedback.

Overtime pay is included in final average earnings (FAE) if it is for work done during the FAE period. Depending on your tier, the amount of overtime used in calculating FAE may be limited. For more information, check your retirement plan booklet.

If we receive additional payroll information from your employer after you retire, we may need to adjust your pension payment. Finalizing your retirement benefit can take some time. The time this takes depends on the complexity of the circumstances.

For account-specific information, please email our customer service representatives using our secure email form. One of our account representatives will be able to answer your questions. Filling out the secure form allows them to safely contact you about your personal account information.