Brush up on your Retirement System knowledge! Here are 10 things all NYSLRS members should know.

- Lifetime Retirement Benefit

You are part of a defined benefit pension plan, which provides a lifetime benefit at retirement based on your earnings and years of service. - Qualify for a Retirement Benefit by Becoming Vested

Becoming vested is a key milestone in every NYSLRS member’s career. Once you’re vested, you have earned enough service to qualify for a retirement benefit, once you meet the minimum age requirements established by your retirement plan. - Tier Determines Benefits

Your tier determines your eligibility for benefits under your plan and how those benefits are calculated. - Conduct NYSLRS Business Using Retirement Online

Retirement Online is the fastest and most convenient way to do business with NYSLRS. It only takes a few minutes to open your account. Use Retirement Online instead of calling or mailing for instant access to benefit information and convenient tools to make account changes. - Estimate Pension Using Retirement Online Calculator

Most members can use Retirement Online to create benefit estimates based on the most up-to-date information we have on file. You can enter different retirement dates and payment options to see how those choices would affect your benefit. - Use Plan Publication to Learn about Benefits

Your retirement plan publication is a comprehensive source for information about your benefits. - Pension Calculated Using Highest Earnings

Your final average earnings (FAE) is another major factor in calculating your NYSLRS pension. When we calculate your pension, we find the set of consecutive years (one, three or five, depending on your tier and retirement plan) when your earnings were highest. - Request Past Service Credit Before Retirement

Service credit is one of the major factors in calculating your NYSLRS pension. You earn a year of service credit for each year of full-time employment with a participating employer. In some cases, you may also be able to request additional credit for past service. - NYSLRS Membership Includes Death and Disability Benefits

NYSLRS membership provides more than just retirement benefits. If you become seriously ill or injured, you may be eligible for a disability benefit. And, you may also be eligible to leave a beneficiary a death benefit if you die while working for a public employer. - Best-Funded, Best-Managed

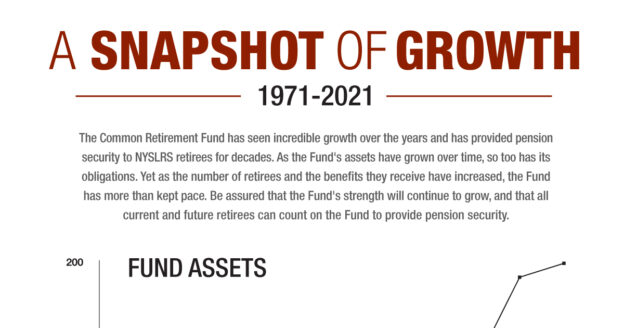

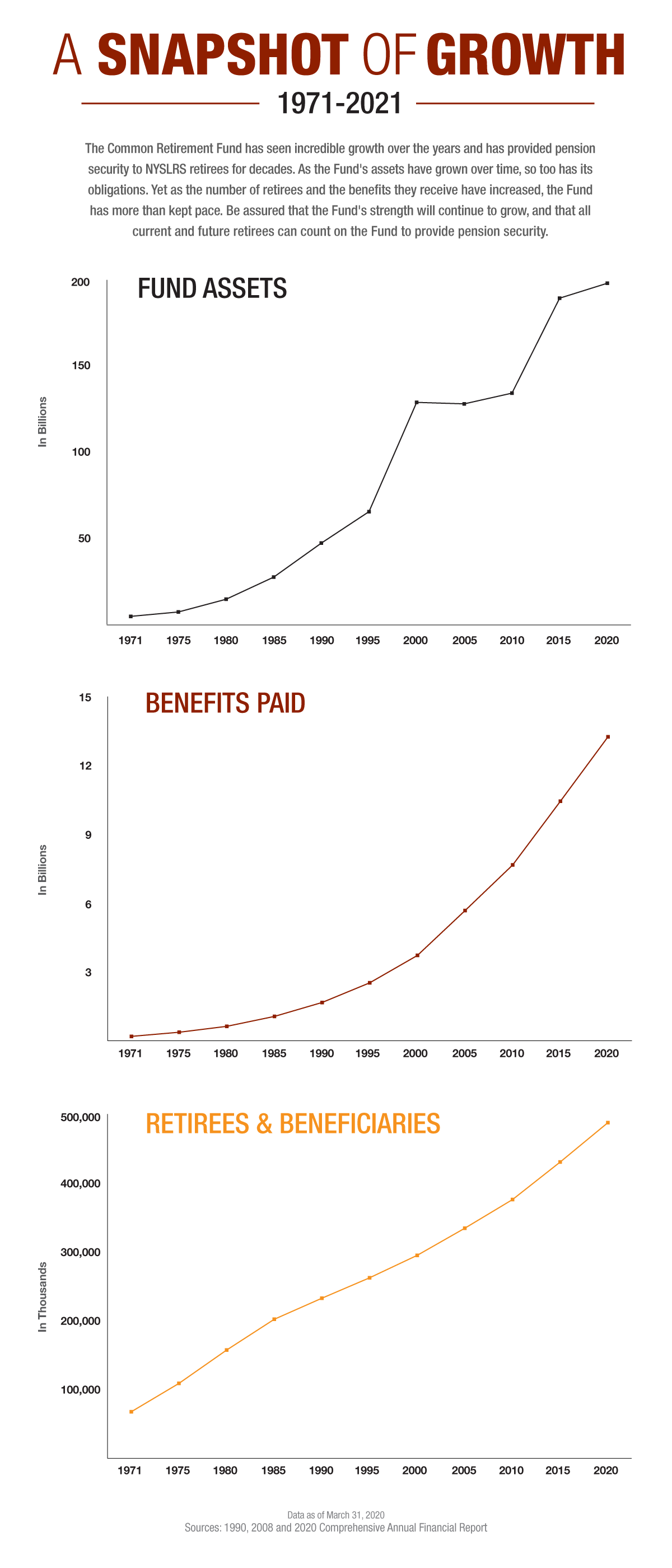

The New York State Common Retirement Fund holds and invests the assets of NYSLRS on behalf of members, retirees and their beneficiaries and continues to be one of the best-funded and best-managed public pension funds in the nation. Comptroller Thomas P. DiNapoli is the administrative head of NYSLRS and trustee of the Common Retirement Fund.

NYSLRS is one of the largest public retirement systems in America, serving more than 1.2 million members, retirees and beneficiaries. Read A Look Inside NYSLRS to learn more about your retirement system.