The unfortunate reality of the COVID-19 emergency is that some NYSLRS members may become seriously ill and some may die from the disease. That is why it is vitally important that members understand how to apply for retirement benefits, if they need to take that step.

NYSLRS members who become seriously ill from COVID-19 may wish to file for a disability retirement benefit so their beneficiary may be eligible for a continuing pension, rather than a one-time in-service death benefit, if the member dies.

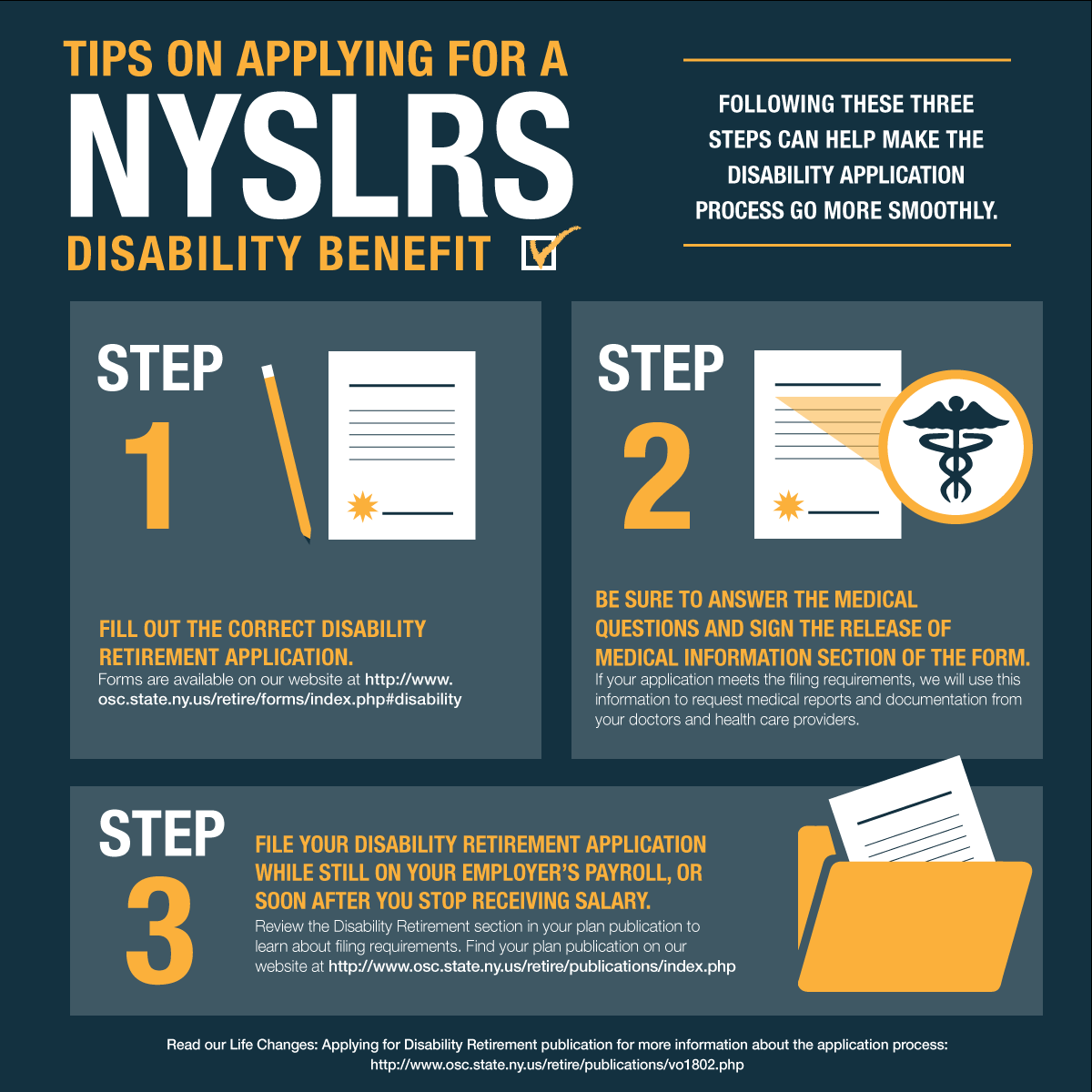

These members, or their employer on their behalf, need to file the disability retirement application that is appropriate for them according to their retirement plan.

Please visit our Disability Benefits page and select “Find Your Application” to help you find the right application. Additionally, the member, or the member’s spouse, should file a pension payment option election form to identify a beneficiary to receive the continuing benefit. An option election form cannot be filed by the employer. A continuing benefit cannot be paid to a beneficiary unless we receive an option election form.

Applications and option election forms can be emailed directly to NYSLRS’ Disability Processing Unit. If the member dies after applying, the disability retirement application would be effective upon death. If the member recovers, he or she would be allowed to withdraw the disability retirement application.

Eligible members may also file for a service retirement. However, a service retirement cannot be canceled if your retirement date has passed. You can file a disability and a service retirement application at the same time. Service retirements can be filed electronically using Retirement Online.

Please call our Contact Center at 866-805-0990 if you have questions.