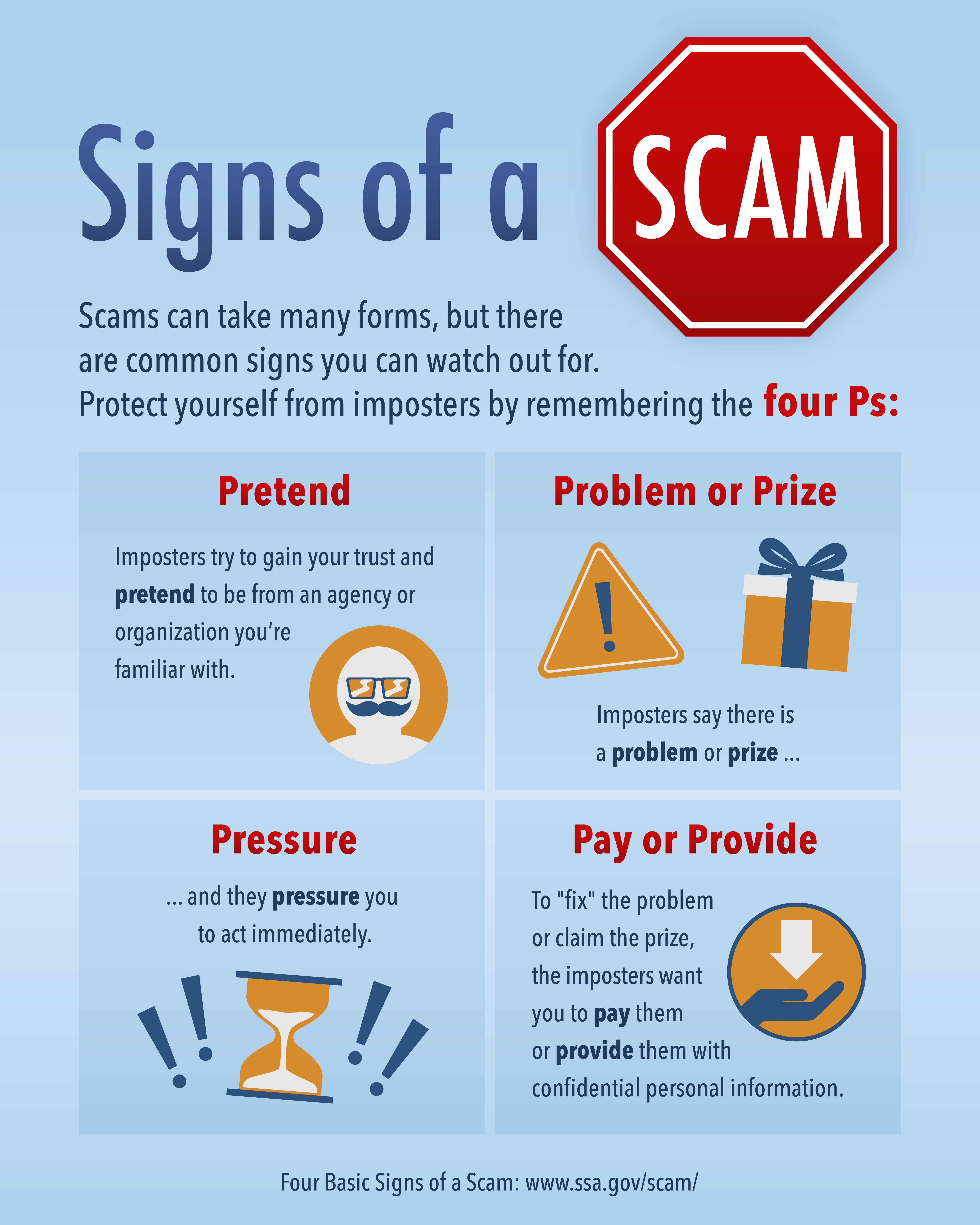

Your retirement account can be an attractive target for scammers, and imposters continue to find new ways to try to impersonate government agencies, such as NYSLRS or the Social Security Administration. Learn to distinguish fake messages from official NYSLRS communications and protect yourself from scams.

How Scams Work

Imposters pretend to be an agency or organization you already know to gain your trust. They use similar logos or imagery in correspondence. They may contact you from an email address that mimics — but isn’t identical to — those used by employees of the actual organization. Some can even make a real agency’s phone number appear on caller ID (known as spoofing).

Usually, once they contact you, they claim there is a problem (or prize or new benefit available) that requires your immediate attention. But here’s the catch: to fix the problem or receive the reward, the imposter needs you to pay them a fee or provide personal data, such as your Social Security number or bank account information. They may even threaten you with legal action, a suspension of your benefits or arrest if you fail to act in time.

If someone contacts you and you notice these signs of a scam, remain calm. Hang up the phone or delete the message if you feel like something is off. It’s the easiest way to avoid accidentally giving away personal information.

Artificial Intelligence Gives Scammers a New Tool

You should also be aware of an emerging threat — artificial intelligence (AI), which allows machines to mimic certain human behaviors, such as speech and writing. AI can personalize phishing emails, making it harder to recognize a fraudulent communication. It can impersonate the voice of a family member or friend, making you think they are in trouble or need money.

Here are some things you can do to protect yourself from AI-enhanced scams:

- Don’t share sensitive information through text or social media;

- Don’t send or transfer money to unknown locations;

- Consider designating a “safe word” for your family to use to identify themselves and share that word with family members and close contacts; and

- When in doubt, hang up and call your loved one back.

Doing Business With NYSLRS

Retirement Online, the convenient and secure way to do business with NYSLRS, is only available from the NYSLRS website. There is no mobile app available from NYSLRS. If you have a Retirement Online account, keep your username and password in a safe place and don’t share them with anyone.

Generally, NYSLRS will only call you if we are following up on a previous communication from you, such as a phone call, secure email message, Retirement Online request, form or letter. For security, you can use your NYSLRS ID to identify yourself instead of providing your Social Security number. To find your NYSLRS ID, sign in to Retirement Online, or check your annual statement or other correspondence from NYSLRS.

It’s important to review the communications you receive from NYSLRS. We send you letters or emails (depending on your delivery preference in Retirement Online) whenever you update your Retirement Online account or benefit information. However, if you receive a notification of an account change you did not make, contact us immediately.

Keep Your Password Current

Also, be sure to sign in to Retirement Online at least once a year and update your password so it doesn’t expire.