We’ve written about how divorce may affect your pension. However, as a NYSLRS member, you have other benefits divorce may affect.

We’ve written about how divorce may affect your pension. However, as a NYSLRS member, you have other benefits divorce may affect.

If your ex-spouse will receive a share of your retirement benefits, domestic relations order (DRO) must be filed with NYSLRS. A DRO is a court order specifying how your pension should be divided as well as the distribution of other benefits discussed below.

Death Benefits and Your Beneficiaries

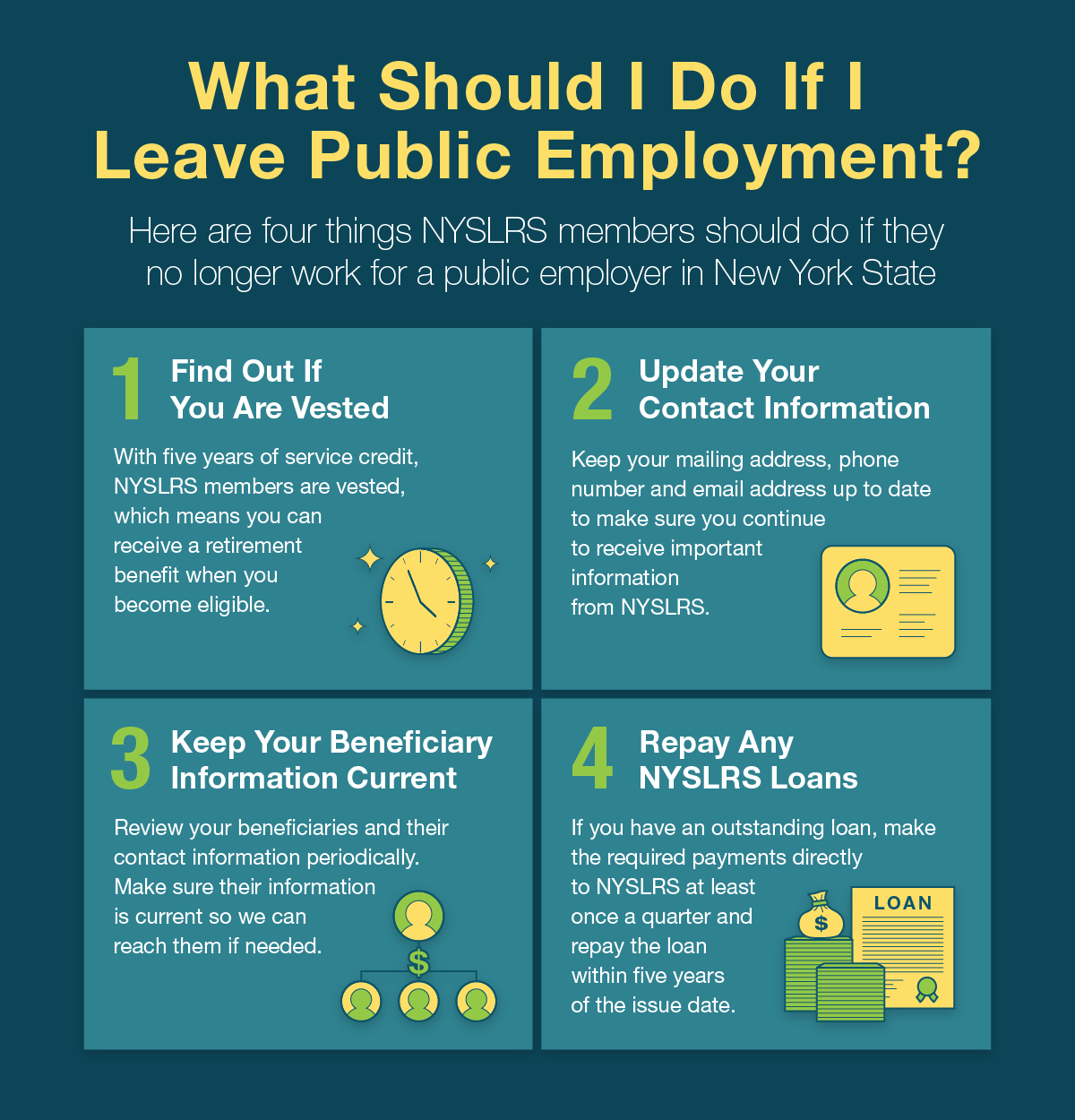

As of July 7, 2008, beneficiary designations for certain death benefits are automatically revoked when a divorce, annulment or judicial separation becomes final. If you are divorced, it is especially important to review your beneficiary designations to ensure your benefits will be distributed according to your wishes and your divorce agreement.

If your ex-spouse is awarded a portion of your death benefits, a DRO will specify how much your ex-spouse will receive and direct you to name your ex-spouse as a beneficiary. You should file the DRO with NYSLRS as soon as it’s officially accepted by the court and choose additional beneficiaries for the remainder of any benefits. However, if your designations conflict with the terms of the DRO, the DRO will take precedence over any other beneficiary designations.

The best way to view and update your death benefit beneficiaries is by using Retirement Online. If you are already retired, visit our Death Benefit page for retirees for information about available death benefits and how to update your beneficiaries and their contact information.

Ordinary Death Benefit

Your ordinary death benefit would be payable to your beneficiaries if you die in active service (before retiring).

Post-Retirement Death Benefit

Most members of the Employees’ Retirement System (ERS) are covered by a post-retirement death benefit, which provides a one-time, lump sum payment to your beneficiaries if you die after retiring.

Accidental Death Benefit

Your accidental death benefit may be payable to certain beneficiaries if you die as a result of an on-the-job accident. The beneficiaries of this benefit are designated by law, and only those beneficiaries may receive this benefit — even if there is a DRO.

Loans

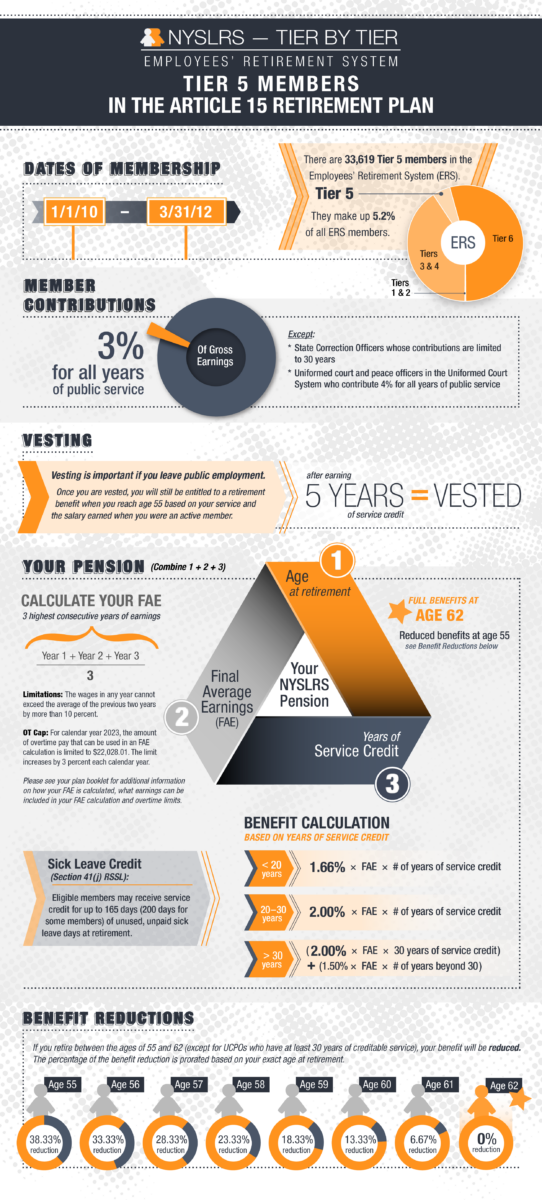

NYSLRS members who meet eligibility requirements can take out a NYLSRS loan by borrowing a percentage of their contribution balance. Even if you are eligible, a DRO may be written to prohibit you from taking future loans.

If you retire with an outstanding loan balance, your pension will be reduced. The ex-spouse’s share of the pension will also be reduced unless the DRO specifically states the ex-spouse’s share should be calculated without reference to outstanding loans.

Contribution Refunds

Occasionally, NYSLRS may refund a member’s contributions because of a tier reinstatement, membership withdrawal or membership transfer. Some members are eligible to make voluntary contributions and withdraw them as excess contributions. Generally, if a DRO doesn’t mention a contribution refund, the member will receive the full amount.

For More Divorce Information

Visit our Divorce and Your Benefits page for more information, including how divorce can affect service credit, disability benefits or cost-of-living adjustments.