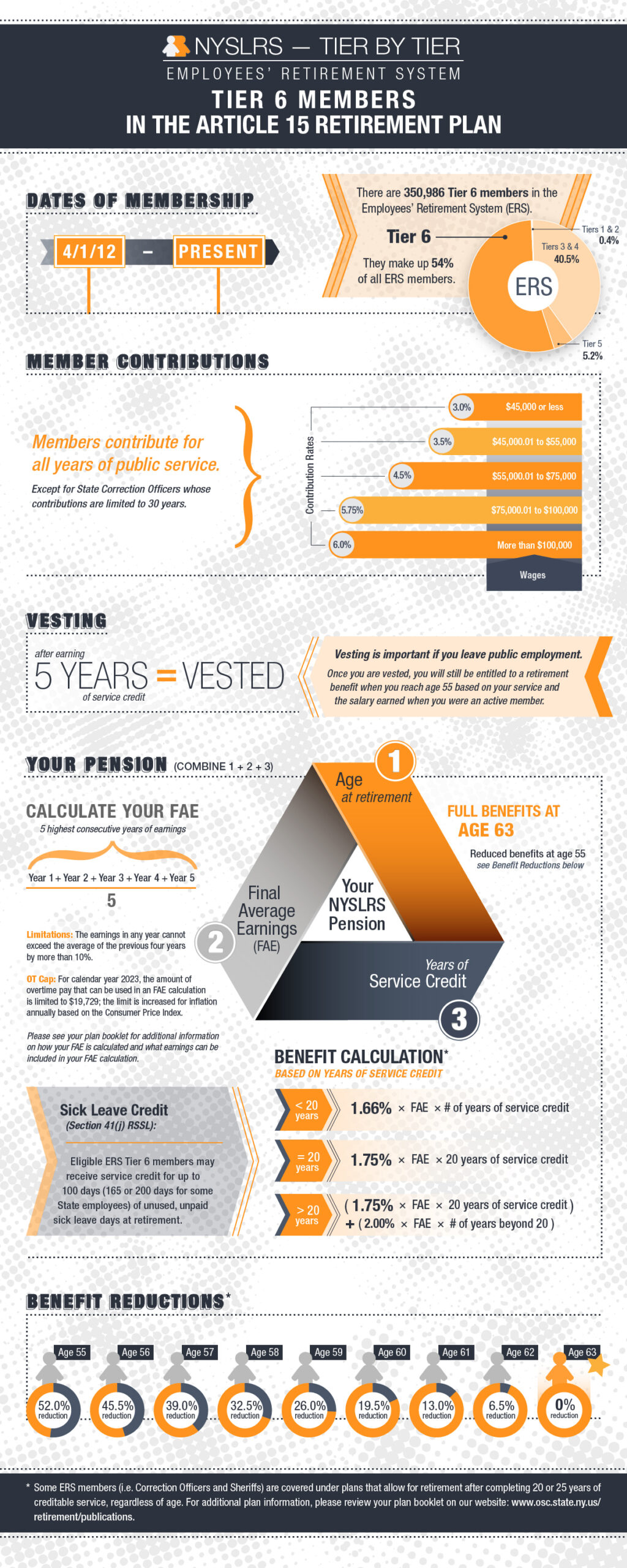

When you join the New York State and Local Retirement System (NYSLRS), you’re assigned a tier based on the date of your membership. This post looks at Tier 6 members of the Employees’ Retirement System (ERS).

Your tier determines such things as your eligibility for benefits, the calculation of those benefits, death benefit coverage and whether you need to contribute toward your benefits.

ERS has six tiers. Anyone who joined ERS on or after April 1, 2012 is in Tier 6. There were 350,986 ERS Tier 6 members as of March 31, 2022. At 54 percent of membership, Tier 6 is the largest ERS tier.

Most ERS Tier 6 members (unless they are in special retirement plans) retire under the Article 15 retirement plan. Check out the graphic below for the basic retirement information for Tier 6 members in this plan.

Membership Milestones

As of April 9, 2022, Tier 6 members only need five years of service credit to become vested. If you are a vested member in the Article 15 retirement plan, you are eligible for a lifetime pension benefit as early as age 55, but if you retire before the full retirement age of 63, your benefit will be reduced.

If you retire with fewer than 20 years, the benefit is 1.66 percent of your final average earnings (FAE) for each year of service. If you retire with exactly 20 years of service, the benefit is 1.75 percent of your FAE for each year of service (35 percent of your FAE).

If you retire with more than 20 years of service, you’ll receive 35 percent for the first 20 years, plus 2 percent for each additional year. For example, with 35 years of service you can retire at age 63 with 65 percent of your FAE.

Where to Find More ERS Tier 6 Information

For more information about ERS Tier 6 membership, find your NYSLRS retirement plan publication. It’s a comprehensive description of the benefits provided by your specific plan.

You can check your service credit total and estimate your pension using Retirement Online. Most members can use our online pension calculator to create an estimate based on the salary and service information NYSLRS has on file for them. You can enter different retirement dates to see how your choices would affect your potential benefit.

Members may not be able to use the Retirement Online calculator in certain circumstances, for example, if they have recently transferred a membership to NYSLRS, or if they are a Tier 6 member with between five and ten years of service. These members can contact us to request an estimate or use the “Quick Calculator” on our website. The Quick Calculator generates estimates based on information you provide.

Can you retire at 63 in a tier 6 with 10 years of service? What percentage of your salary will you be able to retire with? I am 55 just came back to State service two years ago I was previously in a tier 4 with 12 years of service I had stopped paying into my pension way before I left State service, in 2004. However, I did withdraw pension. I was told I could buy it all back and get reinstated to my original tier but I am wondering if its even worth it?

We recommend that you contact our customer service representatives for account-specific information about your situation. To speak to them, or schedule an appointment for a phone consultation, call 866-805-0990, press 2, then follow the prompts.

You can also message our customer service representatives using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

If I have 24 years in tier 4 and am now in tier 6 with 10 years at 55 years old can I retire and combine the two tiers?

We recommend that you send your question to our customer service representatives so they can provide you with account-specific information.

Please message them using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

I just started working for the state and am contributing to the pension. Are there any residency requirements to contribute and receive a pension? If I move to a different state but still work for NYS, can I still contribute to the pension and receive a benefit or am I bound to live in NYS as well?

The New York State and Local Retirement System (NYSLRS) is the retirement system for employees of New York State and municipalities outside New York City.

If you continue working for an employer who participates in NYSLRS, your membership will remain active.

If you have account-specific questions about your NYSLRS benefits, please message our customer service representatives using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

Ok thank you, so it does not seem to be like NYC where residency is required. Thought it might have been. Thank you.

I plan on leaving with 17 of service at the age of 49. What benefits can I expect?

Most vested members in regular plans can apply for retirement as early as age 55, but their pensions may be reduced if they retire before full retirement age (62 or 63, depending on tier). You can find more information on our Benefit Reductions page.

Most members can use the benefit calculator in Retirement Online to estimate their pensions based on information we have on file for them. If you don’t have an account, you can find a step-by-step guide to registering in the Tools & Tips section of the Retirement Online page.

I have been told by others that NYSLRS might send me an offer to retire before full benefit age to get me out of the system. As a Tier 6 member who will have 36 years of service by age 55, should I expect said letter?

At this time, we’re not aware of any statewide retirement incentives. The New York State Legislature (not NYSLRS) occasionally enacts these retirement incentive programs, which are approved by both houses and signed into law by the Governor. NYSLRS administers programs that are signed into law.

Individual employers may choose to offer incentives to their employees, however, these individual employer incentives would not affect a member’s NYSLRS pension benefits.

Has there been any discussion about how employers will be able to sustain higher employee wages for those individuals that will be working from age 55 until age 63? Seems like this will be a burden for local governments and school districts that have marginal revenue increases each year and rely on replacing those high salaries with younger individuals.

For reports and information on New York State local governments, please visit the Office of the State Comptroller website at http://www.osc.state.ny.us/local-government.

I have worked permeant since November of 2012, but have work for the school district since September of 2011. I joined the retirement plan in 2019. I would like to know if I can buy back the years that I was not enrolled in the retirement plan? If so, how much would this cost? Could I do it a year at a time or do I have to do it all at once?

Yes, if you worked for a participating employer before joining NYSLRS you can request to purchase credit for that service.

You can apply in Retirement Online. Sign in to your account, scroll down to the ‘My Account Summary’ section of your Account Homepage and click the “Manage My Service Purchases” button, then click “Request Additional Service Credit.”

We will notify you if you are eligible to receive credit for your past service. Our letter will provide payment information.

For more information, read our publication, Service Credit for Tiers 2 through 6.

Only had about two and a half years of service and had to resign because of cancer. Do I have any money for the two and a half years of service in tier 6?

Most Tier 6 members make membership contributions. If you have membership contributions on file and have less than ten years of service, you can withdraw them beginning 15 or more days after leaving public employment. However, withdrawing your contributions terminates your membership and you will not be eligible for any Retirement System benefits.

To withdraw your membership, sign in to your Retirement Online account, go to the ‘My Account Summary’ area of your Account Homepage and click “Withdraw My Membership.” You can also apply by mail by submitting a Withdrawal Application (RS5014).

If you have questions or need help with Retirement Online, please call our customer service representatives at 866-805-0990, press 2, then follow the prompts.

Can I retire at 55 years old with 30 years of service with out a reduction?

It depends on your Tier and retirement plan. However, ERS Tier 6 members in regular retirement plans who retire before the full retirement age of 63 will receive a benefit reduction for early retirement. You can find more information, including information for other tiers, on our Benefit Reduction for Early Retirement page.

For questions about your specific account, you can contact our Call Center at 866-805-0990. You may also send a message using our secure contact form. Filling out the secure form allows our customer service representatives to safely contact you about your personal account information.

No, the article says if you are tier 6, you can retire at 55, but with a reduction.

I am tier 6. If I am vested, does this make me eligible for health benefits?

NYSLRS does not administer health insurance programs. Please contact your employer’s health benefits administrator for questions about coverage.