NYSLRS is actually two retirement systems: the Employees’ Retirement System (ERS) and the Police and Fire Retirement System (PFRS).

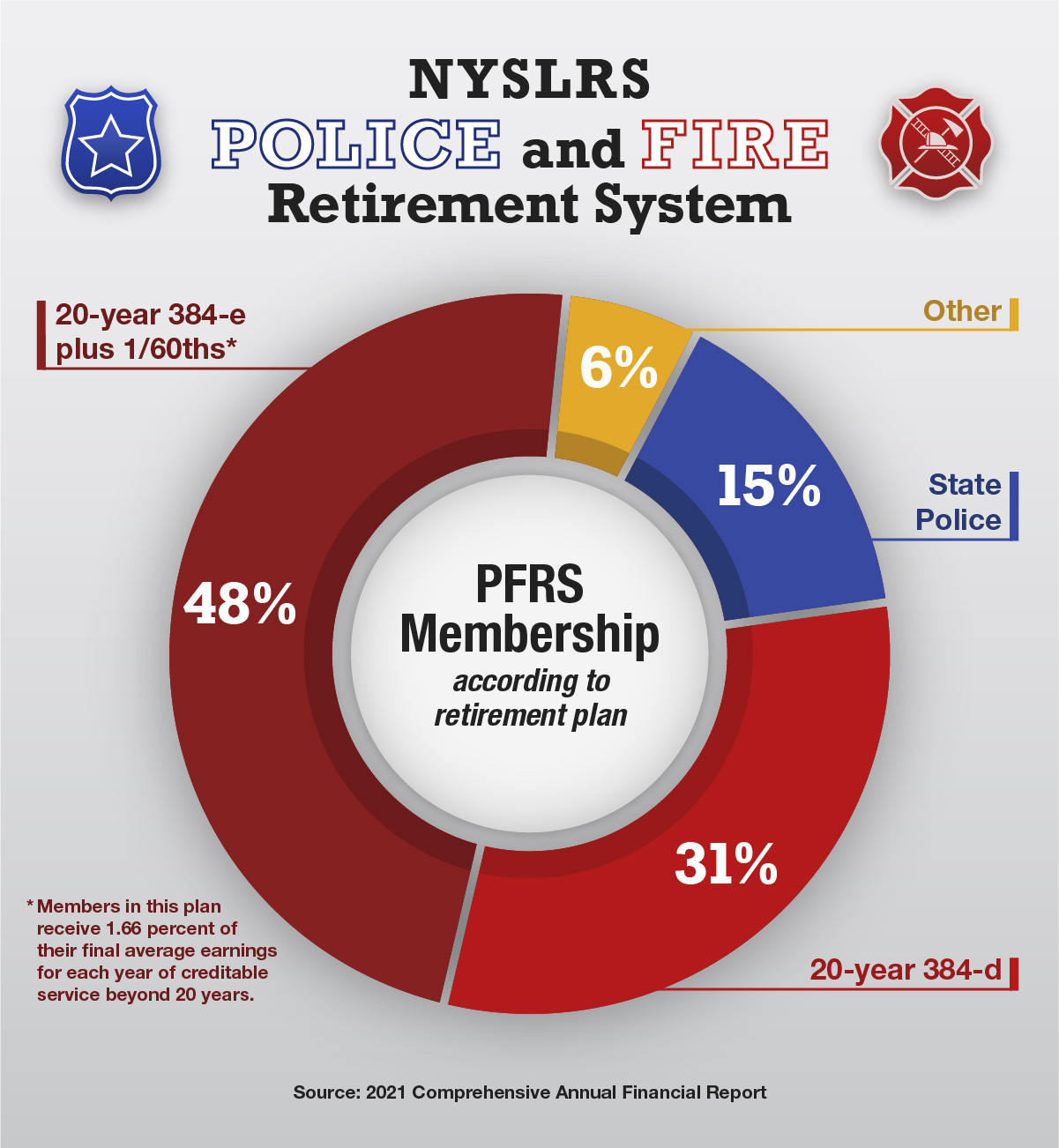

PFRS, which provides retirement benefits for police officers and paid firefighters, is the smaller of the two systems, with about 32,000 active members. A third of PFRS members work for cities, while almost 19 percent work for New York State. The remainder work for towns, counties and villages.

There are five tiers in PFRS, reflecting when the members joined the system: Tiers 1, 2, 3, 5 and 6 (there is no Tier 4 in PFRS). Tier 2, which includes PFRS members who joined the Retirement System from July 31, 1973 through June 30, 2009, is the largest tier, accounting for almost 55 percent of PFRS membership.

If you joined PFRS on or after April 1, 2012, you are in Tier 6.

Ninety-eight percent of PFRS members are in special retirement plans that allow for retirement after 20 or 25 years of creditable service. If you are in one of these plans, once you have the full amount of required service, you can retire at any age.

Some PFRS members are in regular retirement plans, which require a member to reach a certain age before they are eligible for a pension.

As a PFRS member, you’ll pass a series of important milestones throughout your career. Knowing and understanding these milestones will help you better plan for your financial future.

Service Credit

Service credit is a key in determining your eligibility for a pension and other benefits, including the amount of those benefits.

Under most 20- and 25-year plans, not all public employment is creditable. Usually, police and firefighting service can be counted as special-plan service. You may also be able to use military service to help you reach 20 or 25 years. If you have questions about the service that can be used to calculate your pension, please check your retirement plan booklet or contact us.

PFRS Plan Booklets

You can find details about your NYSLRS benefits in your retirement plan booklet.

For the majority of PFRS members, that’s the Special 20- and 25-Year Plans booklet. This booklet is for PFRS Tier 2, 3, 5 and 6 members covered by Sections 384, 384-d and 384-e of the State Retirement and Social Security Law.

If you are a PFRS member who works for New York State, your booklet is based on your specific job. There are separate booklets for State Police, Forest Rangers, Regional State Park Police, State University Police and EnCon Police.

If you are not covered by one of the plan booklets listed above, you can find your booklet on our Publications page. If you’re not sure what retirement plan you’re in, you can find that information in the My Account Summary section of your Retirement Online account. You can also check your Member Annual Statement, ask your employer or email us using our secure contact form.

Is there legislation that permits or prohibits municipal emergency medical services workers (ie uniformed EMTs or Paramedics) from joining the PFS plan under a 20 or 25 year retirement plan? I work for a county EMS department currently in the ERS.

The Police and Fire Retirement System (PFRS) provides retirement benefits for public employees who serve as police officers and paid firefighters, while the Employees’ Retirement System (ERS) provides retirement benefits for public employees in other titles, such as emergency medical technicians (EMTs) or paramedics.

Some ERS employers can choose to adopt special 20- or 25-year retirement plans for certain ERS titles. For EMTs, the only 25-year retirement plan available is for those employed by Nassau County. If you are not employed by Nassau County, your county would need to request special legislation to provide this benefit for its emergency medical service workers.

Is there any benefit to filing earlier (i.e. 90 days out) vs filing closer to your anticipated retirement date? Thanks!

The date you file is up to you, though we must have your application on file at least 15 days, but no more than 90, before your retirement date.

Before you file, you may wish to sign in to Retirement Online to review the information we have on file for you. You can also file for your service retirement benefit, and upload retirement-related documents, using Retirement Online.

If you have account-specific questions, you can message our customer service representatives using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

What is the cost difference to a municipality for 384-d vs. 384-e?

The cost for a municipality to provide a plan can vary based on a number of factors. If you are an employer with questions about adopting a retirement plan, you can submit them through our Employer Help Desk Form. In the ‘Please select why you are contacting us’ field, choose “Cost or Adoption of Retirement Plans.”

Employers can find their annual contribution rates broken down by Tier and retirement plan in the About Employer Contribution Rates section of our What Every Employer Should Know web presentation.

On Turbo Tax, what do i check, where is says “Where is this Distribution from”

NYS & Local Police & Fire Retirement System ?

NYSLRS is unable to provide tax advice. You may also wish to speak to an accountant or visit the IRS website.

I am tier 4 NYS Retirment article 15 (what ever that means)as a general employee still working since 1989, we are confused, after a few 911 dispatchers have retired “SeethroughNY” says my fellow retired co workers in the NYS POLICE AND FIRE RETIREMENT, we have never been in the NYSP&F retirement..any help with this?

If you are in Tier 4 you are a member of the Employees’ Retirement System. There is no Tier 4 in the Police & Fire Retirement System.

Article 15 refers to your retirement plan, which is established by law (Article 15). Your system, tier and retirement plan determine your benefits.

You can check your retirement system, retirement plan and tier in your Retirement Online account or your Member Annual Statement, and then visit our website to find the publication that describes your plan. For account-specific information, please email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

Can I use my time as a nyc corrections officer (NYCERS tier 3) as credit towards the 20 years of service if I joint a village PD in westchester county.

To receive a 20-year retirement benefit, you must have 20 years of service credit in a 20-year plan. For account-specific information about how this may apply in your situation, please email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

I am looking for mu Form 1099 R for 2021. How would I go about getting the form

You can request a reprint of your 1099-R online. The reprint will be mailed to the address we have on file for you.

You may wish to sign in to Retirement Online to check your address and update it if necessary before you request a reprint. If you don’t have an account, go to the Sign In page and click the “Sign Up” link under the “Customer Sign In” button.

If you still need help, you can contact our customer service representatives using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information. You can also use the form to request that a 1099-R be mailed to your current address.

I am trying to be reinstated into tier 4 from tier 6 do to prior service. I have paperwork from ERS stating that they are looking into from 2017 to present, when I call the retirement system the recording tells me that it takes up to 24 months to verify my prior service, unless my math is wrong from 2017 to 2021 is well over the 24 month time frame can someone tell me what is going on plaese.

To check on the status of your reinstatement request, please email our customer service representatives using the secure email form on our website (http://www.emailNYSLRS.com). One of them will review your account and respond to your questions. Filling out the secure form allows them to safely contact you about your personal account information.

I retired in March, 1997 with almost 26 yrs of service. I spent 2 years active with the military. Am I still eligible to buy back my military time so it can be added to my pension.

Unfortunately, you cannot purchase credit for previous or military service after you retire.

I went to police academy and retired as a deputysheriff they said wr were tier 4 also confused

Deputy sheriffs are generally members of the Employees’ Retirement System (ERS), which has a Tier 4.

I have sent 4 change of bank forms in with check attached and again today the money went to the wrong bank !!! What’s wrong ???

We’re sorry you could not reach us. Your message is important to us and we have sent you a private message in response.

I’m confused because I started out in Tier 3 & they changed my tier to 4. Why did you say there is no tier 4?

If you are in Tier 4, you are a member of the Employees’ Retirement System. There is no Tier 4 in the Police & Fire Retirement System.