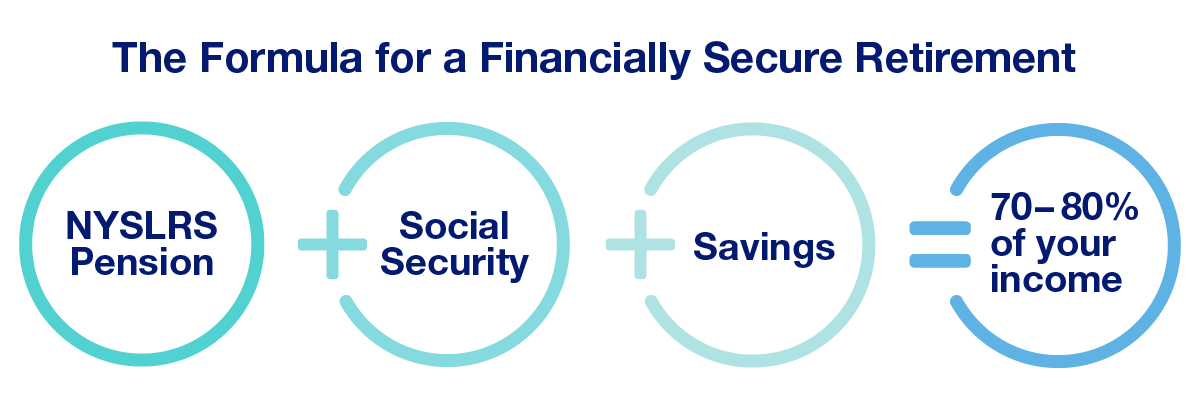

Financial advisers say you will need to replace between 70 and 80 percent of your salary to maintain your lifestyle after retirement. Your NYSLRS pension could go a long way in helping you reach that goal, especially when combined with your Social Security benefit and your own retirement savings. Here’s a look at how Employees’ Retirement System (ERS) members in Tier 6 (who are vested once they’ve earned five years of credited service), can reach that goal. Members who joined NYSLRS since April 1, 2012 are in Tier 6.

Calculating an ERS Tier 6 Member’s Pension

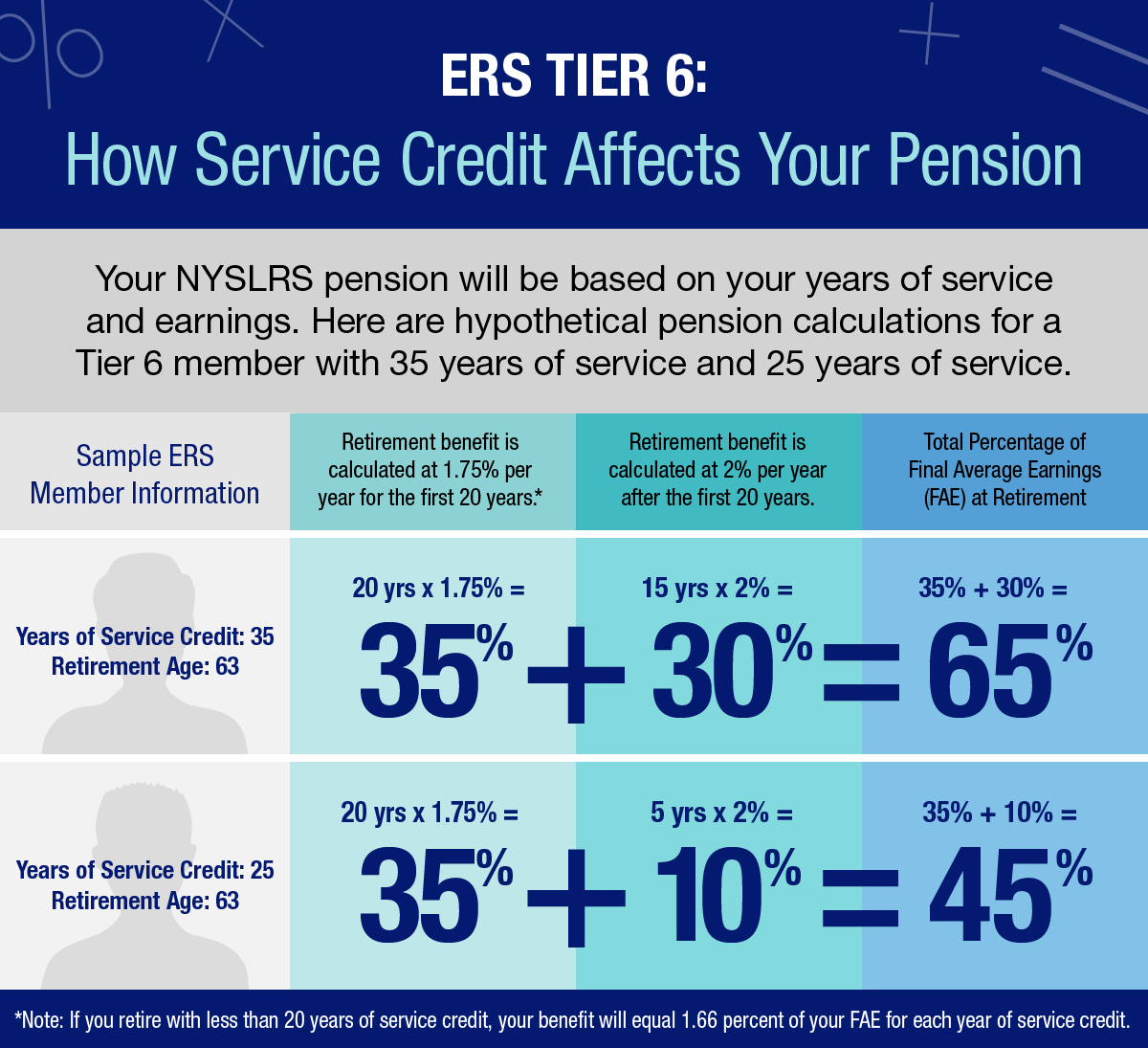

Your NYSLRS pension will be based on your Final Average Earnings (FAE) and the number of years you work in public service. FAE is the average of the five highest-paid consecutive years. Note: The law limits the FAE of all members who joined on or after June 17, 1971. For example, for most members, if your earnings increase significantly through the years used in your FAE, some of those earnings may not be used toward your pension.

Although ERS members can generally retire as early as age 55 with reduced benefits, the full retirement age for Tier 6 members is age 63.

For ERS Tier 6 members in regular plans (Article 15), the benefit is 1.66 percent of your FAE for each full year you work, up to 20 years. At 20 years, the benefit equals 1.75 percent per year for a total of 35 percent. After 20 years, the benefit grows to 2 percent per year for each additional year of service. (Benefit calculations for members of the Police and Fire Retirement System and ERS members in special plans vary based on plan.)

Say you begin your career at age 28 and work full-time until your full retirement age of 63. That’s 35 years of service credit. You’d get 35 percent of your FAE for the first 20 years, plus 30 percent for the last 15 years, for a total benefit that would replace 65 percent of your salary. If you didn’t start until age 38, you’d get 45 percent of your FAE at 63.

So, that’s how your NYSLRS pension can help you get started with your post-retirement income. Now, let’s look at what the addition of Social Security and your own savings can do to help you reach your retirement goal.

Other Sources of Post-Retirement Income

Social Security: According to the Social Security Administration, Social Security currently replaces about 40 percent of the wages of a typical worker who retires at full retirement age. In the future, these percentages may change, but you should still factor it in to your post-retirement income.

Your Savings: Retirement savings can also replace a portion of your income. How much, of course, depends on how much you save. The key is to start saving early so your money has time to grow. New York State employees and some municipal employees can participate in the New York State Deferred Compensation Plan. If you haven’t already looked into Deferred Compensation, you might consider doing so now.

Is geographic pay included in FAS? This answer doesn’t seem to be mentioned at all.

Yes, geographic (location) pay would generally be considered regular earnings.

For information specific to your retirement plan and tier, please message our customer service representatives using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

What happens to a tier 6 member who was retired under the Accidental Disability designation prior to the recent reform? Being that all tier 6 members are most likely to have around 12 years of service as of this writing; and nowhere near retirement, those people who have retired early from injury seem to have been given a raw deal. Can I assume that person will not have their pension recalculated to reflect the new 3 year FAS rather than the previous draconian tier 6 FAS calculation which involves the past 9 years salary?

The three-year final average earnings (FAE) calculation applies to Tier 6 ERS members who retire on or after April 1, 2024, and Tier 6 PFRS members who retire on or after April 20, 2024.

If I retire early (say in my 50’s) with over 20 years of service, can I wait until retirement age to begin receiving my pension without penalty?

For most members, the earliest you can collect a pension (retire) is age 55. There would be no penalty if you leave public employment and wait to retire until your full retirement age (63 for Tier 6 members). However, leaving public payroll before you are eligible to retire may affect your eligibility for certain death benefits and health benefits.

If you are considering leaving public payroll before you retire, we suggest you read our Life Changes: What If I Leave Public Employment? publication.

You may also wish to speak to your health benefits administrator to find out how going off payroll would affect any post-retirement health benefits you may be entitled to.

I am currently receiving a pension for working in a municipality. I am thinking of working at another municipality on a part time basis. My pay would be under $3,000. Does this affect my current pension in anyway or is there something else that has to be done? Please let me know. Thank you.

Most NYSLRS retirees can earn up to $35,000 per calendar year from public employment without a reduction in their pension. There generally is no earnings limit starting in the year the retiree turns 65.

For information specific to your situation, please message our customer service representatives using the secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

You may also find our publication What If I Work After Retirement? helpful.

For ERS Tier 6, If I have 20 years of service at age 55 and wanted to retire, my retirement benefit would be reduced, correct?

That’s correct. ERS Tier 6 members who are not enrolled in a special plan that allows for retirement with 20 or 25 years of service are able to retire with full benefits at age 63. If you choose to retire at 55, you will receive a reduction for early retirement. The amount of your benefit reduction is tied to your age and service credit. The closer you are to age 63 when you retire, the smaller the reduction in your benefit will be.

Most members can use our online pension calculator to estimate what your benefit would be at different retirement dates and ages. Sign in to your Retirement Online account and click the “Estimate my Pension” button to get started.

What happens if you start employment in your early 20s and have more than 30 years before age 63? Can you retire early or will that be reduced?

That depends on your tier and retirement plan. You can find information about Benefit Reduction for Early Retirement on our website and in your retirement plan publication.

For account-specific information about how this may apply in your situation, please email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

What happens if you started at the age 34 and have 30yrs of service at the age of 64, whats the percentage rate at retirement

Your pension benefit calculation depends on your tier and retirement plan. You can use this tool to help you find your retirement plan publication.

Most members can create their own pension estimate in minutes based on the most up-to-date account information we have on file for you. Sign in to Retirement Online, go to the ‘My Account Summary’ section of your Account Homepage, and click the ’Estimate my Pension Benefit’ button. You can enter different retirement dates to see how those choices would affect your benefit.

If you have other account-specific questions, please call our customer service representatives at 866-805-0990. Press 2, then follow the prompts. You can also message them using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

You need to speak to State Comptroller and your State Representatives to fix Tier 6. Also, Disability Retirement should not be 10 years. What happens if you have a true medical condition that stops you from working. No disability insurance? Sounds insane. Even for health benefits – it should be based on the years of tenure, not 10 years. Push these issues on your State Representative.

Is coaching considered overtime compensation earned in tier 6? I have heard it will not be calculated into the pension however I see there may be a $15,000 limit. Please clarify. I don’t believe I can support a family being a teacher in tier 6. So sad.

For questions about earning service credit from part-time employment, please email our customer service representatives using the secure email form on our website. One of them will review your account and respond to your questions. Filling out the secure form allows them to safely contact you about your personal account information.

I don’t believe that Tier 6 is suffering because of the benefits of previous tiers. It seems to me that everyone, no matter the field they’re in, is being negatively effected due to the economy in general.

All teachers must be compensated for this very difficult job which is only becoming more so as the years go on.

Tier 6 employees pay far more into the system with a far worse pension benefit. You would be better off working in the private sector with a 401k with employer match. Tier 6 needs to be fixed.

In addition, what is not mentioned is that you have to work 15 yrs to retire with full health benefits. With the other tier’s it’s 10 yrs, along with working until 63 for your full pension. it’s so unfair.

I left employment from ECMC in February but at that time was not vested in Tier 6. Just found out that I now am vested. So can I post date my retirement? Also, I only found out accidentally. Why was there no notification by mail? Seems like a pretty important piece of information to get out to members.

You can file for a NYSLRS retirement benefit using Retirement Online. You can also complete and mail us an Application for Service Retirement (RS6037). If you mail your application, we recommend you use certified mail, return receipt requested.

Most members can apply for their pension as early as age 55, but they may face a pension reduction if they retire before their full retirement age.

You can sign up for E-News to get NYSLRS benefit information and updates emailed to you every month. Visit our website to review past editions, including our blog post about the vesting change.

If you have questions, please email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

I left state service for a federal job because the Tier 6 is so broken. I would have preferred to stay because I loved the work and helping the public, but I couldn’t bear the burden.

Public employees have born the brunt of conservative groups like the empire center. Andrew Como rewarded these groups by slashing the pension system and Tier 6 employees have suffered as a result. It is truly not worth working for the state of New York under Tier 6.

We need a massive overhaul of tier 6. It’s a joke! Why do you think younger generations are not going into education anymore?? It’s not worth it!! I’m struggling to pay my mortgage and taxes and childcare and kids and bills and yet I see my tier 4 colleagues done with paying their pension dues. It’s disgusting and an embarrassment to nys. Thinking of leaving the profession just to have a livelihood. Maybe things need to get worse in order to make things better. Can someone organize a protest or rally? We have to do something for us and future educators! It’s a civic duty.

We in Tier 6 need to rally, but how? Who would organize it? And we need to get NYSUT behind us (but the younger leadership because OBVIOUSLY it was the older NYSUT leaders that sold us down the river!).

I am organizing it.

Count me in, more than 50 percent of all employees are in teir 6 all unions should get involved

I totally agree with “Concerned Citizen”, those of us who are in Tier 6 are being forced to bare the brunt of the cost of the awesome benefits that the prior tier are getting/will get. When I get to retire, I will have paid into ERS at least 30 year, yet I will still have no security that I’ll be able to live on that benefit even with my own separate retirement savings. Younger generations shouldn’t be punished for lack of foresight with what was promised to elder generations. The state and local governments are in their best financial condition in years, why isn’t that being reflected in the wages and benefits provided to it’s employees?

Agree as well. Not only does 6 need to pay into this the WHOLE TIME we work, the % we pay goes up as our salary does. Where as 4 gets a simple 10 years at a locked 3%. That’s not right. Tier 6 (and 5 as it’s small and usually lumped in) is the largest Tier… What good is a UNION if it doesn’t represent the majority? Shorter vesting isn’t what we need. We need a small tweak on Tier 4. We need some tweaks on anyone still working on the 1-3 tiers too. They are more than set, I’m sure. Lastly, we need to make Tier 6 more friendly. Too many people retired and put a LARGE amount of work on the Tier 6 shoulders. It’s not worth it to stay like it used to be. Fix Tier 6, and then END it. Make a Tier 7 now to help spread out that burden.

I absolutely agree. I’ve been a state worker for two years and unfortunately I started working for state (DOCCS ) at an o ok der age so I will have only 15 years retirement and that’s counting military time that I’m buying back. I rely on my overtime and usually almost double my base pay and I recently found out that my overtime will not count for my pension. How disappointing and now I have to be worried about my retirement .they need to offer tier 6 alit more benefits than they do.

Your NYSLRS pension will be based primarily on your years of service and final average earnings (FAE). For Tier 6 members, FAE can include overtime pay if it was earned during FAE period and does not exceed the annual overtime limit.

For account-specific information about how your retirement benefits, please email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

Still not good enough, tier 6 is paying for past NYS mistake. So tier 6 pays retirement benefits for all of there career, receives a lesser benefit than previous tiers and has to work longer. Why punish tier 6 for past mistakes. Just make a total overhaul from tier 4 on. 1.75 pension multiplier coupled with low pay and career payments into the pension is not good. Tier 4 and below should change. No wonder NYS is going broke, another California. Although the pension is well funded, we are taxed to oblivion. One of the highest state taxes, highest property taxes, highest county and city taxes. Move out of NYS before it’s to late!

i totally agree with you we are punished for past mistakes. Please fix tier 6

Can anyone please ballpark me a pension for tier six doccs with 7 years of service. Approx how much per year or month would be fine.

Please call our customer service representatives at 1-866-805-0990 (or 518-474-7736 in the Albany, NY area), press 2, then follow the prompts. You can also email them using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

7 years ? You’re getting do-do just like I am going on 8 years , I have to work til I’m 83 years old !