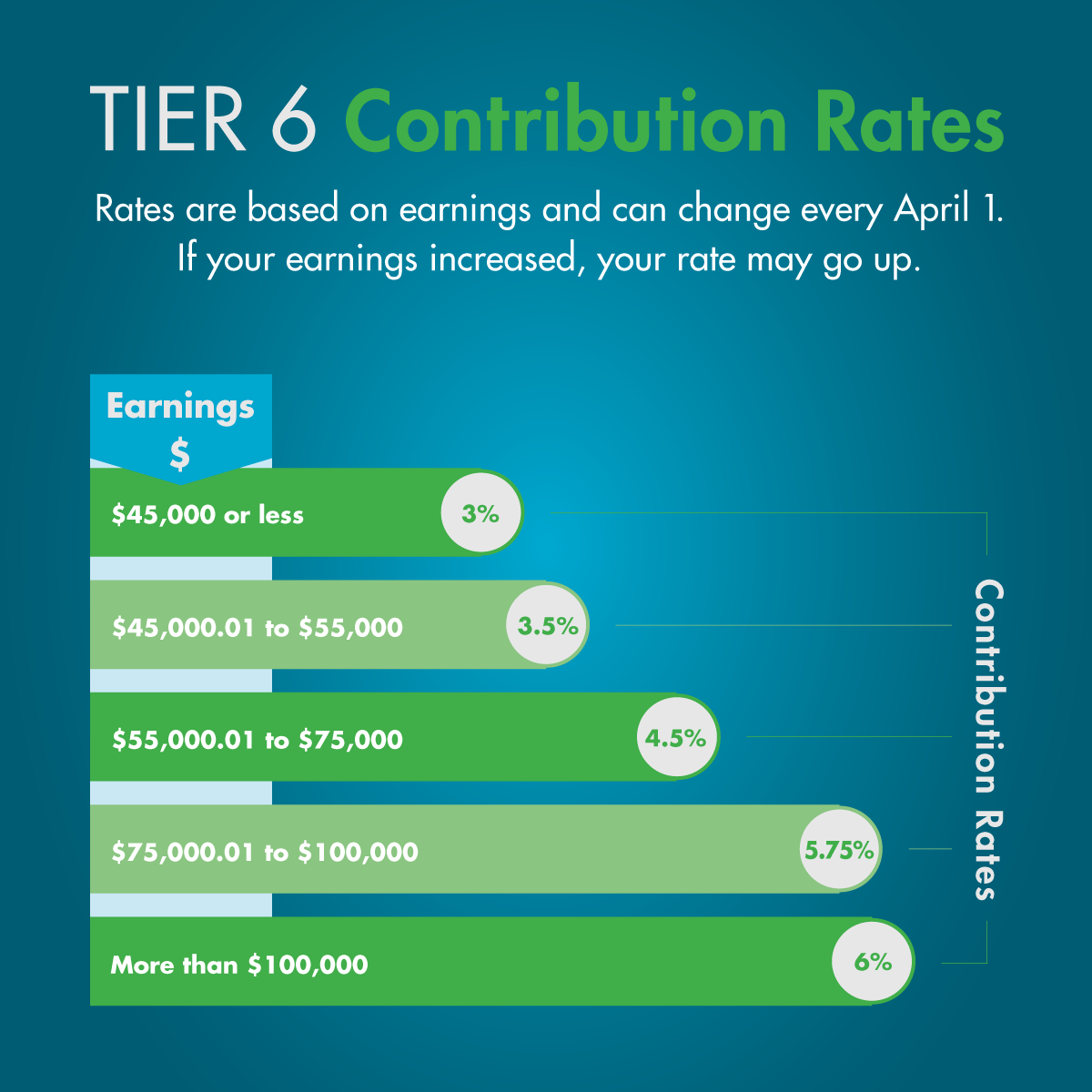

Most NYSLRS members contribute a percentage of their earnings to help fund pension benefits. For Tier 6 members (those who joined NYSLRS on or after April 1, 2012), that percentage, or contribution rate, can change from year to year based on your earnings. The minimum rate is 3 percent of your earnings, and the maximum is 6 percent.

When Tier 6 Contribution Rates are Determined

A Tier 6 member’s contribution rate is calculated annually. New rates become effective on April 1, the beginning of the state’s fiscal year. Once your rate is determined for a given fiscal year, it doesn’t change for the rest of that fiscal year. We provide rates to your employer in March, a few weeks before they need to apply any rate changes.

How Your Tier 6 Contribution Rate is Calculated

If you are a new NYSLRS member, during your first three years of membership your contribution rate is based on an estimated annual wage that your employer provided when you were enrolled as a new member.

If you have been a member for three or more years, NYSLRS calculates your rate using the earnings reported to us by your employer from the last completed fiscal year, April 1, 2022 through March 31, 2023.

Rates are calculated using your base pay, which includes:

- Regular earnings

- Holiday pay

- Longevity pay

- Overtime pay (up to a certain limit)

Update for 2024: Overtime is no longer excluded from the Tier 6 contribution rate calculation.

Legislation enacted during the COVID-19 emergency temporarily removed overtime from the Tier 6 contribution rate calculation. For some Tier 6 members, this meant lower contribution rates for up to two years, from April 1, 2022 through March 31, 2024.

Beginning April 1, 2024, overtime will be included in the calculation of contribution rates.

This video will help explain how your contribution rate is determined:

How Your NYSLRS Pension Works

The amount you contribute to the Retirement System does not affect the amount of your pension. A NYSLRS pension is a defined-benefit plan. Under this type of plan, once you are eligible for a pension and apply for retirement, you will receive a monthly payment for the rest of your life. The amount of your pension will be calculated using a formula based on your retirement plan, years of service and final average earnings.

You can learn more about how your pension will be calculated by reading your retirement plan publication. Use our Find Your NYSLRS Retirement Plan Publication tool to find yours.

Does this apply to former tier 6 employees. I left city service but am not at the age to receive benefits. Will my pension increase even though I quick 10 months ago ?

Members earn service credit while they are working for a participating NYSLRS employer. Members who leave public employment no longer contribute to the Retirement System or earn service credit.

NYSLRS benefits are defined benefit plans, which means you will receive a lifetime pension based on your years of service and earnings. The pension you will receive from NYSLRS will not be based on the contributions you paid into the system.

For account-specific information about your situation, please message our customer service representatives using our secure contact form.

BTW: retirees could also get involved to Fix Tier 6 as I mentioned above.

-there are several web sites; here is one from the NYS AFLCIO:

https://nysaflcio.org/fixtier6

Another reason all currently employed workers in the NYS pension system should be mindful of the efforts to Fix Tier 6 in Albany by elected reps and union reps.

Learn and do some lobbying to Fix Tier 6.

Whining at work or here won’t do it; lobbying your NY state rep will do it. Learn who the elected reps are and work with your union reps who are working to Fix Tier 6.

Interesting, where can I find more information about this? Also, my job is not union but im definelty interested in where I can read more on Fix Tier 6. Thanks!

There is a website: fixtier6.org