The laws governing your NYSLRS retirement benefit can be confusing. Sometimes a small misunderstanding can have a big impact on your finances. So base your financial decisions on retirement facts, not common myths.

Retirement Myths vs Facts

My NYSLRS pension is like a 401(k)-style retirement savings account and I will get my contributions back when I retire.

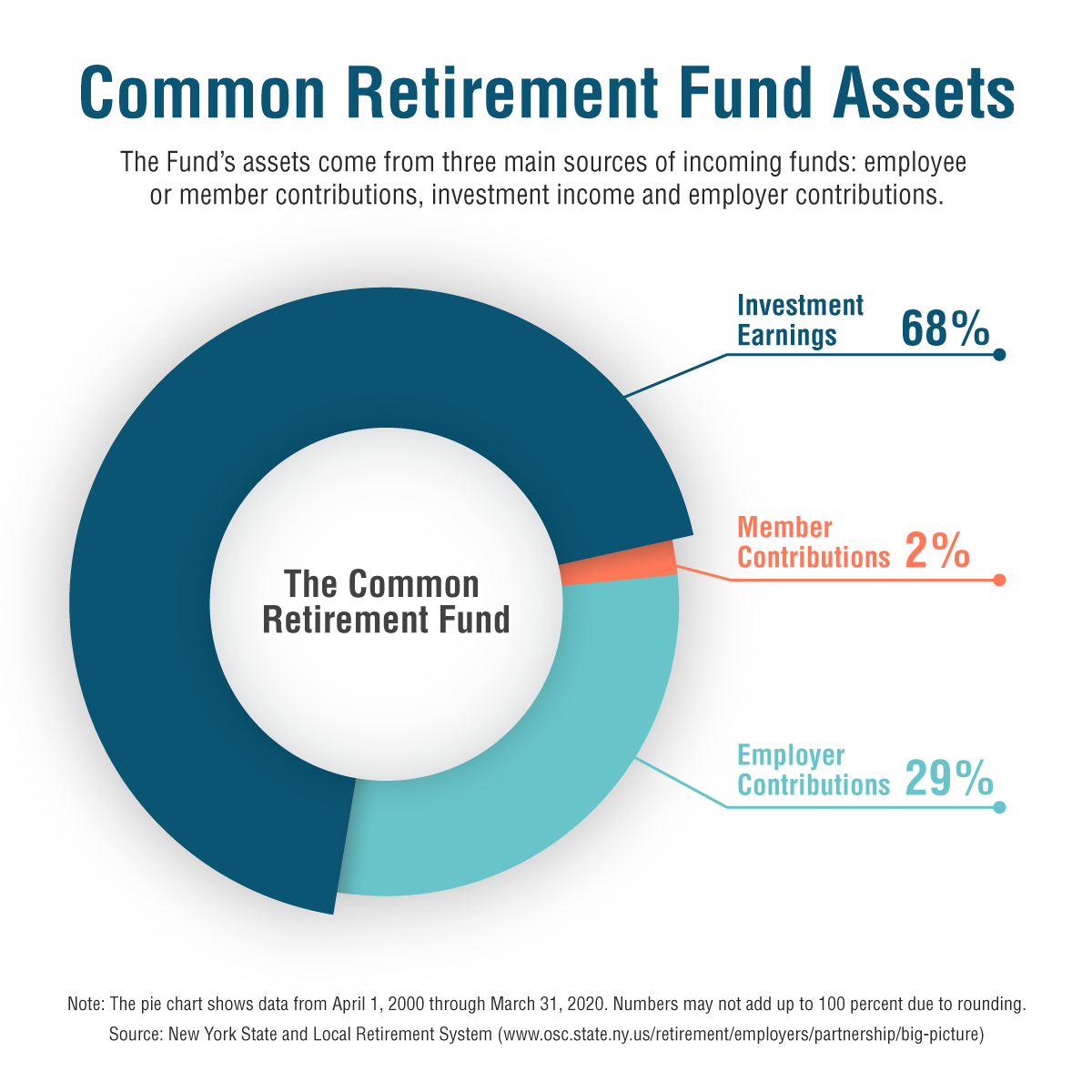

Your NYSLRS pension is a defined benefit plan. Your pension will be a lifetime benefit based on your earnings and years of service—it will not be based on your contributions. Member contributions support the benefits earned by current and future retirees and are an important asset of the Common Retirement Fund.

If I work for more than one NYSLRS participating employer, the service credit from both will count toward my pension benefit.

It depends. You can only earn one year of service credit in a 12-month period. If you work part-time for two participating employers, you would receive credit toward retirement from both, up to the maximum of one year. However, if you already work full-time for one NYSLRS employer, plus you work part-time for another employer, your part-time job won’t increase your retirement service credit. Also, if you are a full-time employee of a school district, you won’t earn extra service credit if you work during the summer.

NYSLRS administers health insurance coverage for its retirees.

NYSLRS does not administer health insurance programs. We may deduct premiums from a retiree’s monthly pension benefit to pay for health insurance coverage if their former employer instructs us to do so, but we can’t answer questions about coverage or changes in premium amounts.

The New York State Department of Civil Service administers the New York State Health Insurance Program (NYSHIP) for New York State retirees and some municipal retirees. If you are still working, your employer’s Human Resources (Personnel) office should be able to answer your questions about post-retirement coverage.

I can take out a NYSLRS loan after I retire.

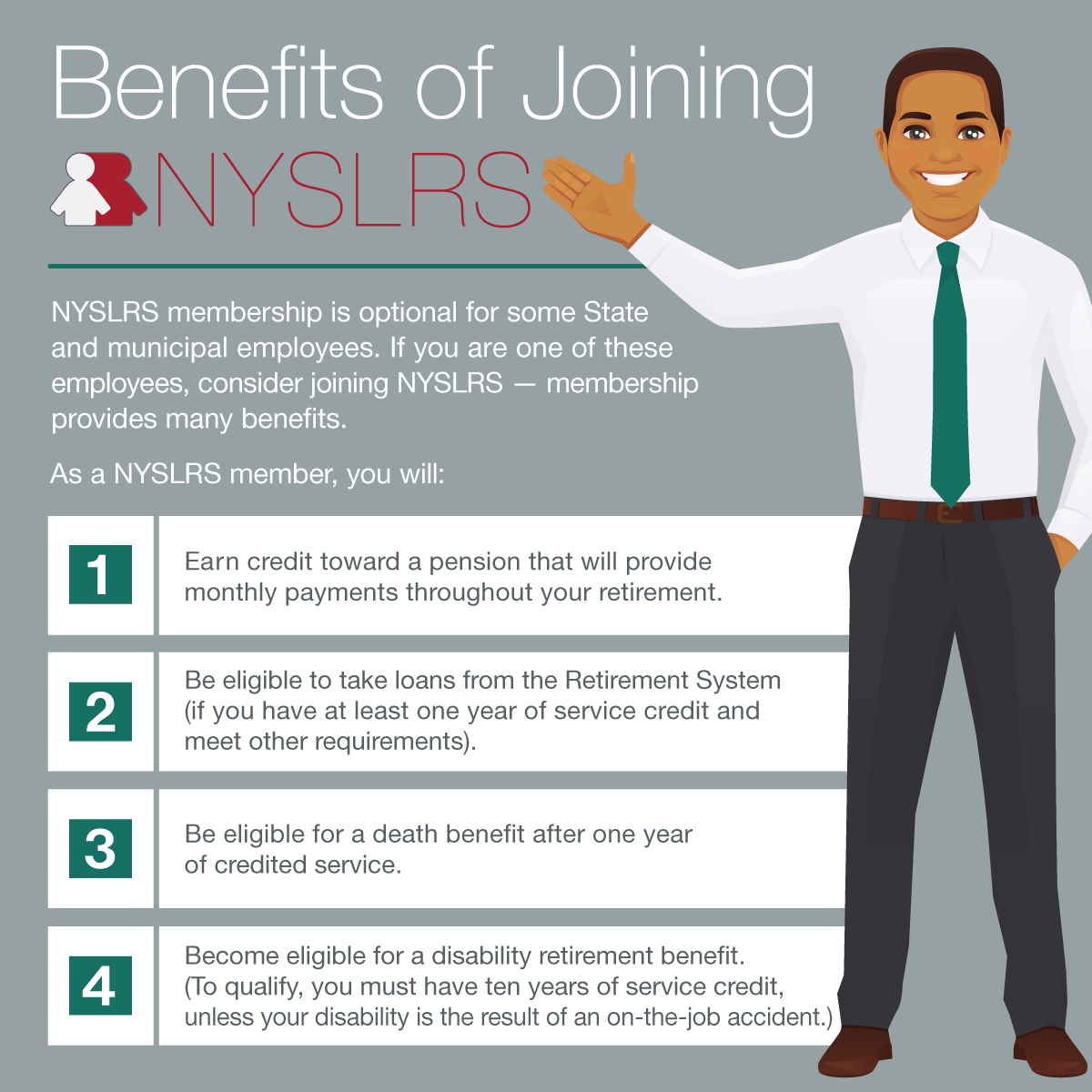

You need to actively work for New York State or a participating employer to take a NYSLRS loan. They are not available to retirees.

If I’m vested and no longer working for a public employer, NYSLRS will automatically start paying my pension as soon as I’m eligible.

Your pension is not automatic. You must apply for retirement 15 to 90 days before your retirement date. Your retirement date is up to you. In order to retire, a NYSLRS member must terminate employment and be removed from the payroll of their employer(s) before the effective date of retirement.

Most NYSLRS members can begin collecting their pension as early as age 55. If you retire between age 55 and your full retirement age (62 or 63, depending on your tier and plan), you may face a permanent benefit reduction. If you have left public employment though, your benefit won’t increase after you reach full retirement age so don’t delay filing for retirement beyond that point.

You can find more answers about your NYSLRS benefits in your retirement plan publication. If you have account-specific questions, please message our customer service representatives using our secure contact form.

Check out Common Retirement Myths—Part 2 where we debunk five other retirement myths.