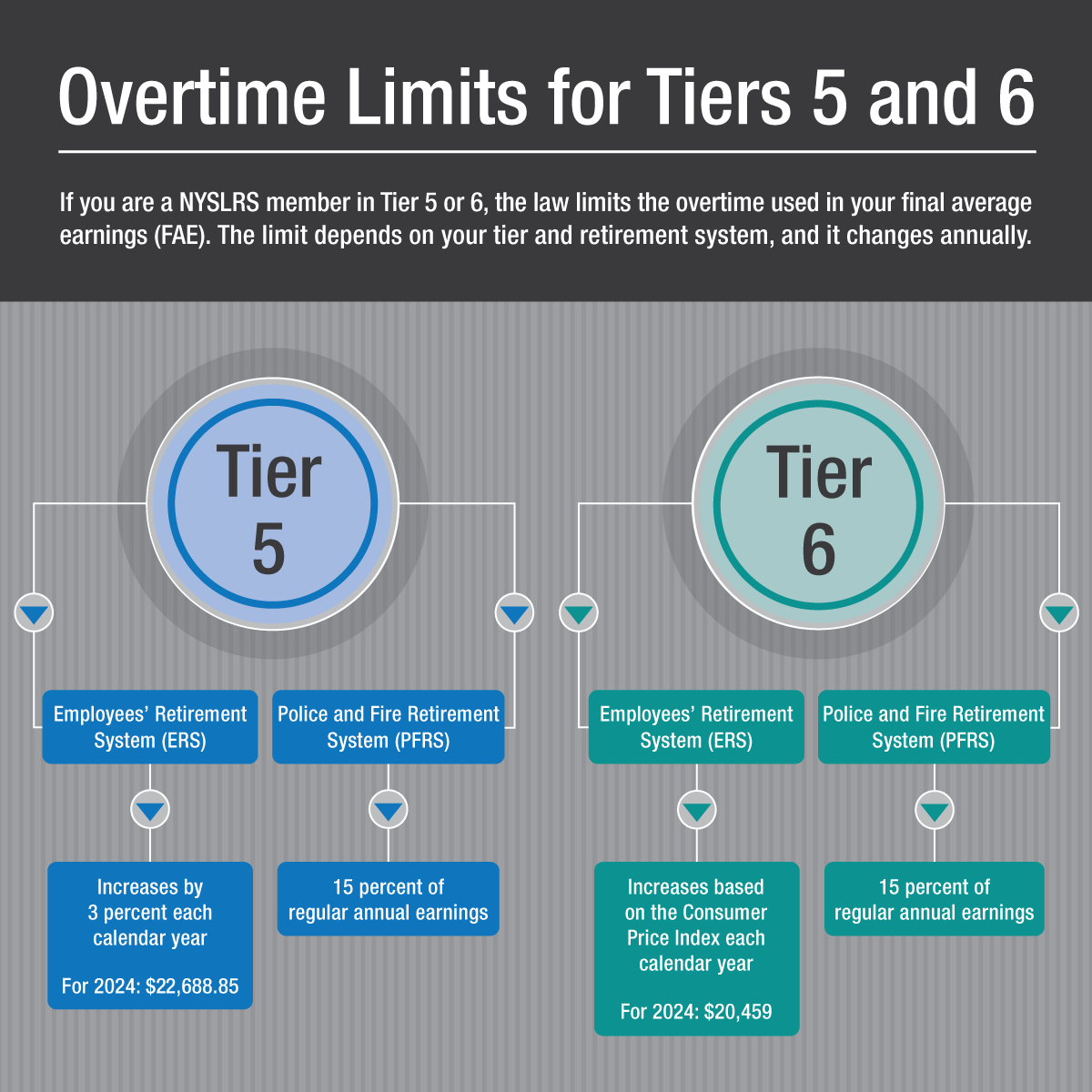

Tier 5 and 6 members are subject to limits on the amount of overtime that can be included in their pension. You can earn overtime pay beyond the overtime limit, but it won’t be factored into your pension calculation. And you don’t pay member contributions on overtime pay that is above the limit.

Tier 5 Overtime Limits

The overtime limit for Tier 5 Employees’ Retirement System (ERS) members increases each calendar year by 3 percent. In 2024, the limit for Tier 5 ERS members is $22,688.85.

For Tier 5 Police and Fire Retirement System (PFRS) members, the overtime limit is 15 percent of your regular earnings each calendar year.

For more information, visit our Overtime Limits for Tier 5 page.

Tier 6 Overtime Limits

The overtime limit for Tier 6 ERS members increases each calendar year based on the annual increase of the Consumer Price Index (CPI). In 2024, the limit for Tier 6 ERS members is $20,459.

For Tier 6 PFRS members, the overtime limit is 15 percent of your regular earnings each calendar year.

For more information, visit our Overtime and Earnings Limits for Tier 6 page.

Your Pension Benefit Calculation

Your NYSLRS pension will be based on your service credit and final average earnings (FAE). Your FAE is the average annual earnings you receive during the period when your earnings are highest (36 consecutive months for Tier 5 and 60 consecutive months for Tier 6). Your FAE will include overtime pay you earned up to each annual limit.

Your FAE may be limited in other ways. For example, for most members, if your earnings increase significantly in the years used for your FAE, some of those earnings might not count toward your pension. The specific limits depend on your tier. Visit our Final Average Earnings page for more information about this limit.

For Tier 6 members, the earnings that can be used toward your pension are also limited to the Governor’s salary.

Read Your Plan Publication

Your retirement plan publication provides specific information about the earnings that will be used to calculate your pension. Visit our website to Find Your NYSLRS Retirement Plan Publication.

Estimate Your Pension in Retirement Online

Most members can create their own pension estimate in minutes using Retirement Online. You can enter different retirement dates to see how those choices would affect your benefit. Sign in to Retirement Online and click the “Estimate my Pension Benefit” button to try it.