Just like starting your first job, getting married or having kids, retirement will change your life. Some changes are small, like sleeping in or shopping during regular business hours. Others, however, are significant and worth examining ahead of time… like how much you’ll be spending in retirement each month or each year.

An Employee Benefit Research Institute (EBRI) study offers some good news for prospective retirees. Household spending generally drops at the beginning of retirement — by 5.5 percent in the first two years, and by 12.5 percent in the third and fourth years. (Although, nearly 46 percent of households actually spend more in the first two years of retirement.)

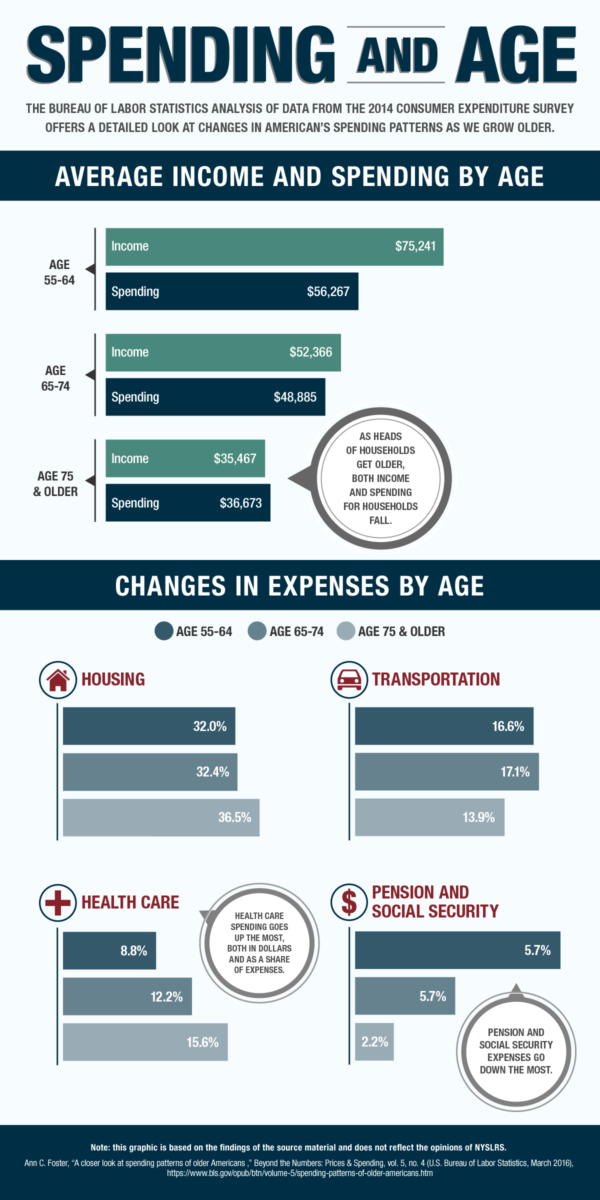

Analysis from the Bureau of Labor Statistics in the U.S. Department of Labor seems to support the research from EBRI. In “A closer look at spending patterns of older Americans,” the author analyzed data from the 2014 Consumer Expenditure Survey, and she also found a progressive drop in spending as age increases. (Income declines with age as well.)

While data supporting EBRI’s study is helpful, it turns out that the highlight of the Consumer Expenditure Survey results is a detailed look at how the things we spend our money on change as we grow older.

As interesting as that is, it’s just a general look at how older Americans are managing their money. What really matters is: How will you spend your money once you retire?

Prepare a Post-Retirement Budget

Like a fiduciary choir, financial advisors all sing the same refrain: Start young; save and invest regularly to meet your financial goals. If you do, the switch from saving to spending in retirement can be easy.

But, in order to make that transition, you need a budget.

The first step toward a post-retirement budget is a review of what you spend now. For a few months, track how you spend your money. Don’t forget to include periodic costs, like car insurance payments or property taxes. By looking at your current spending patterns, you can get an idea of how you’ll spend money come retirement.

Then, consider your current monthly income, and estimate your post-retirement income. If your post-retirement income is less than your current income, you might want to plan to adjust your expenses or even consider changing your retirement date.

We have monthly expense and income worksheets to help with this exercise. You can print them out and start planning ahead for post-retirement spending.

For those of you who carry smart phones, Forbes put together a list of popular apps for tracking your daily spending. All of them are free, though some do sell extra features. Many of them can automatically pull in information from your bank and credit card accounts, but if you’d rather avoid that exposure or if you use cash regularly, you may prefer an app that lets users enter transactions manually.