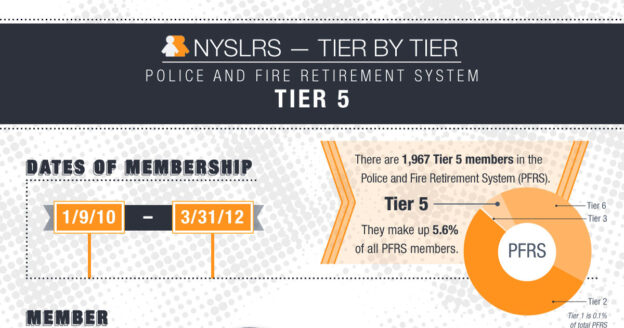

The Police and Fire Retirement System (PFRS) covers more than 35,000 police officers and firefighters across New York State. Let’s look at the PFRS milestones you will reach over the course of your public service career and how they will affect your benefits.

Why Milestones Matter

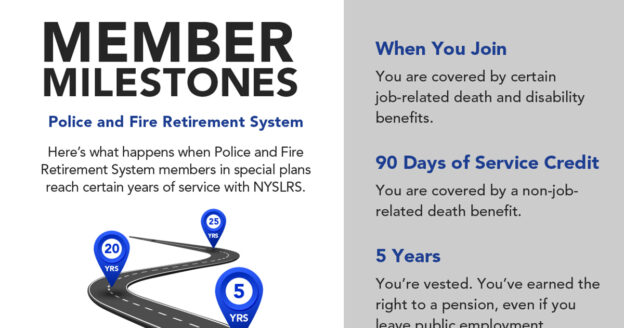

As a NYSLRS member, you earn service credit for your paid public employment. Generally, one year of full-time work equals one year of service credit. As you earn service credit, you’ll reach career milestones that will make you eligible for certain benefits or for increases to your existing benefits.

Some milestones are common to most PFRS members; others are shared by members in a particular tier or retirement plan. For example, your plan determines when you would be eligible to apply for a non-job-related disability benefit. Understanding these milestones will help you plan for retirement.

Important PFRS Milestones

Special Retirement Plans

Most PFRS members are in special retirement plans, which allow you to retire after 20 or 25 years of service regardless of age.

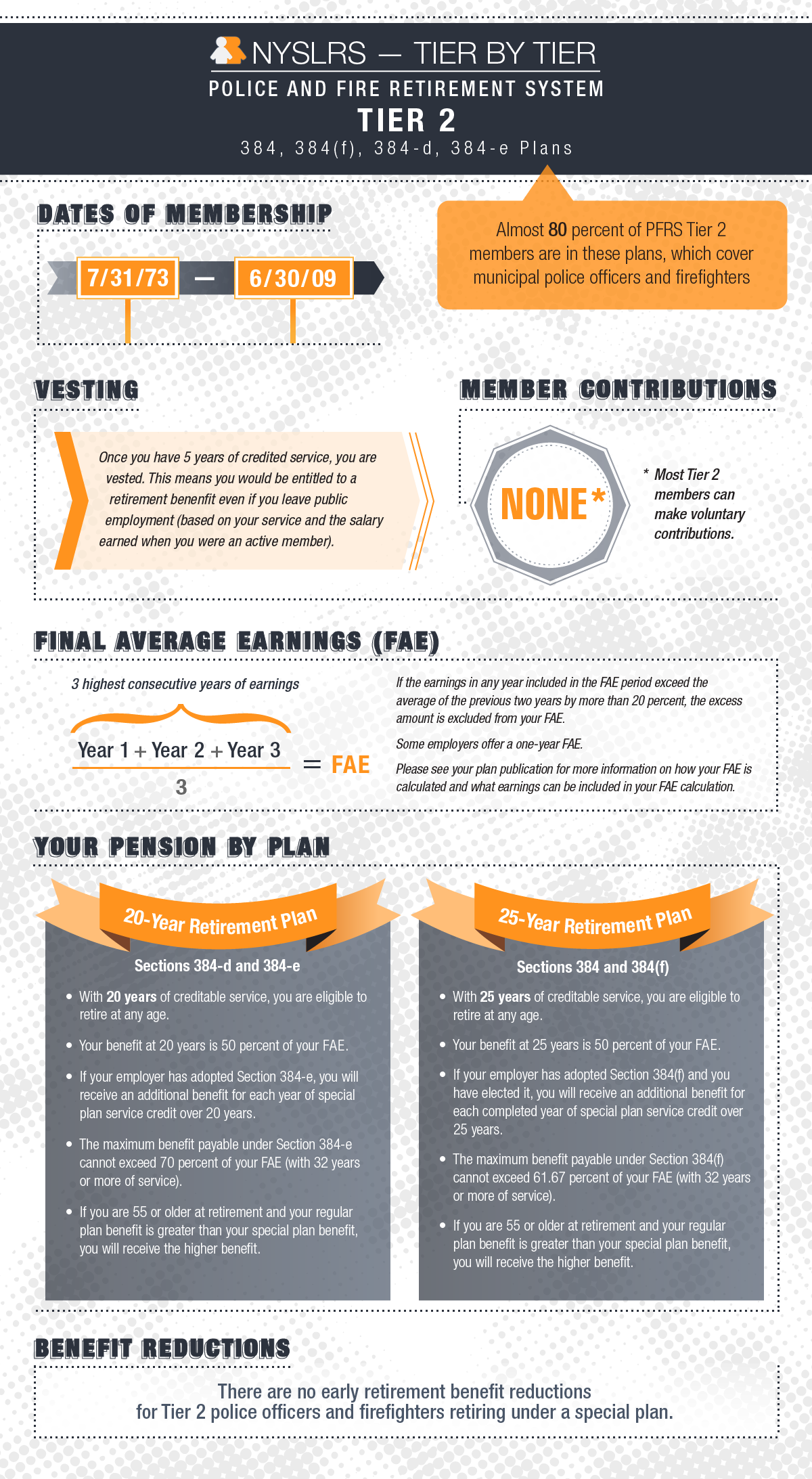

If you retire at your 20- or 25-year milestone, your pension will be 50 percent of your final average earnings (FAE). Depending on your retirement plan, you may earn 1.66 percent of your FAE for each year you work beyond the 20 or 25 years, however for most PFRS members, a maximum of 32 years of service can be used in your pension calculation.

Final Average Earnings

A new law improves your pension benefits. When you retire, your FAE will be based on the average of your three highest consecutive years of earnings, the same as members in other tiers. Read our blog post, Calculating Your Final Average Earnings, for more information, including how your FAE will be calculated and limitations.

Eligible Service

PFRS members in special plans should be aware that not all public employment counts towards reaching the 20- or 25-year milestone. Service usually must be in specific job titles to be creditable toward your pension benefit. For example, if you are in the New York State Police Plan, service with a city police department would be creditable, but service as a sheriff’s deputy or corrections officer would not be. PFRS members may be eligible to purchase credit for military service to reach 20 or 25 years.

More Information About Your Benefits

Most members can estimate their pension in Retirement Online. You can fine tune your estimate by entering your annual earnings and expected pay increases. You can also include any service credit you plan to purchase.

Your specific PFRS milestones, along with your eligible service and pension calculation, are determined by your retirement plan, so it is important to familiarize yourself with the details of your plan. You can visit our website to Find Your NYSLRS Retirement Plan Publication.