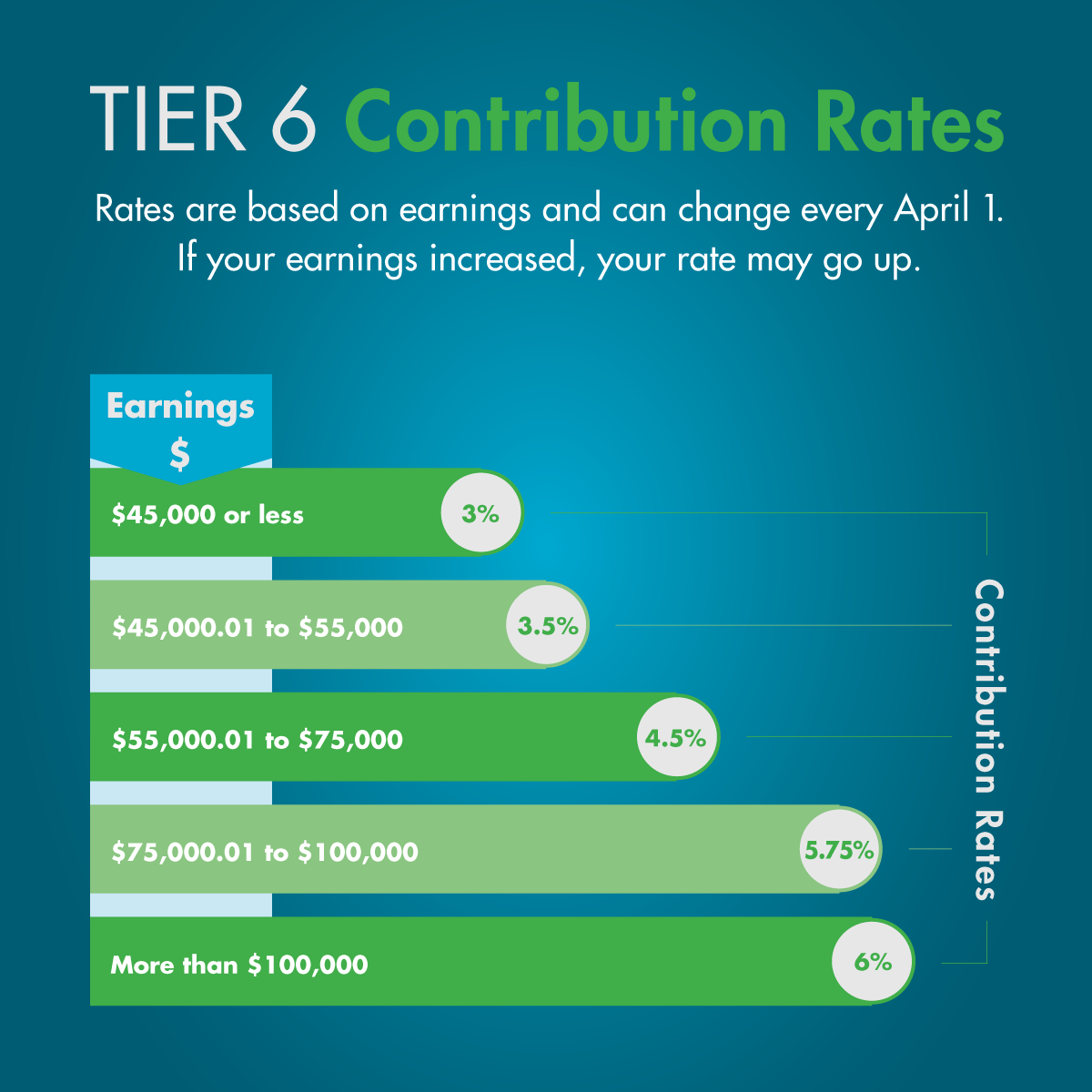

Most NYSLRS members contribute a percentage of their earnings toward their retirement. For Tier 6 members (those who joined NYSLRS on or after April 1, 2012), your contribution rate is based on your earnings and is subject to change each year on April 1.

The minimum contribution rate is 3 percent, and the maximum is 6 percent.

How Your Tier 6 Contribution Rate is Calculated

If you are a new Tier 6 member, your contribution rate is based on a projected annualized wage provided by your employer. For new part-time employees, your employer calculates a projected annualized wage by using your part-time rate to determine what your annual wage would be if you worked full-time.

Once you have been a member for more than two full state fiscal years, your contribution rate is calculated using actual earnings reported to us by your employer(s) from two state fiscal years prior. So, contribution rates for April 1, 2025 through March 31, 2026 are based on what you actually earned in all public employment from April 1, 2023 through March 31, 2024.

Earnings include:

- Regular pay;

- Holiday pay;

- Longevity pay; and

- Overtime pay (up to a certain limit).

Overtime Pay Temporarily Excluded from Tier 6 Contribution Rates

A new law temporarily excludes overtime pay earned from April 1, 2022 through March 31, 2024 from the calculation of Tier 6 contribution rates. This may lower contribution rates for some Tier 6 members from April 1, 2024 through March 31, 2026.

For more information, read our blog post, Overtime Pay Temporarily Excluded from Tier 6 Contribution Rates.

Contribution rates are set at the beginning of each fiscal year on April 1. If your contribution rate changes, we notify your employer in March so they can update their payroll system to withhold the proper amount.

For more information, visit our Member Contributions webpage.

Understanding Your NYSLRS Pension

NYSLRS pensions are defined benefit plans, also known as traditional pension plans. When you retire, you will receive a monthly pension payment for the rest of your life. Your pension will be calculated using a preset formula based on your earnings and years of service—it will not be based on the individual contributions you paid into the system. Member contributions support the benefits earned by current and future retirees and are an important asset of the Common Retirement Fund, which holds and invests the money used to pay NYSLRS benefits.

Find your NYSLRS retirement plan publication for comprehensive information about your retirement benefits and how your pension will be calculated.