Retirement Online will be unavailable for a few days while we complete routine year-end maintenance. Retirement Online will be offline from 3:00 pm on Tuesday, December 29 until 7:00 am on Friday, January 1.

Using the NYSLRS Automated Phone System During the Maintenance Period

Another way you can get information about your NYSLRS benefits is through our automated phone system, which allows you to get personal account information, order forms and conduct other retirement transactions without having to speak with a customer service representative. The automated phone system is generally available 24 hours a day, seven days a week, so you can conduct business with NYSLRS on your schedule.

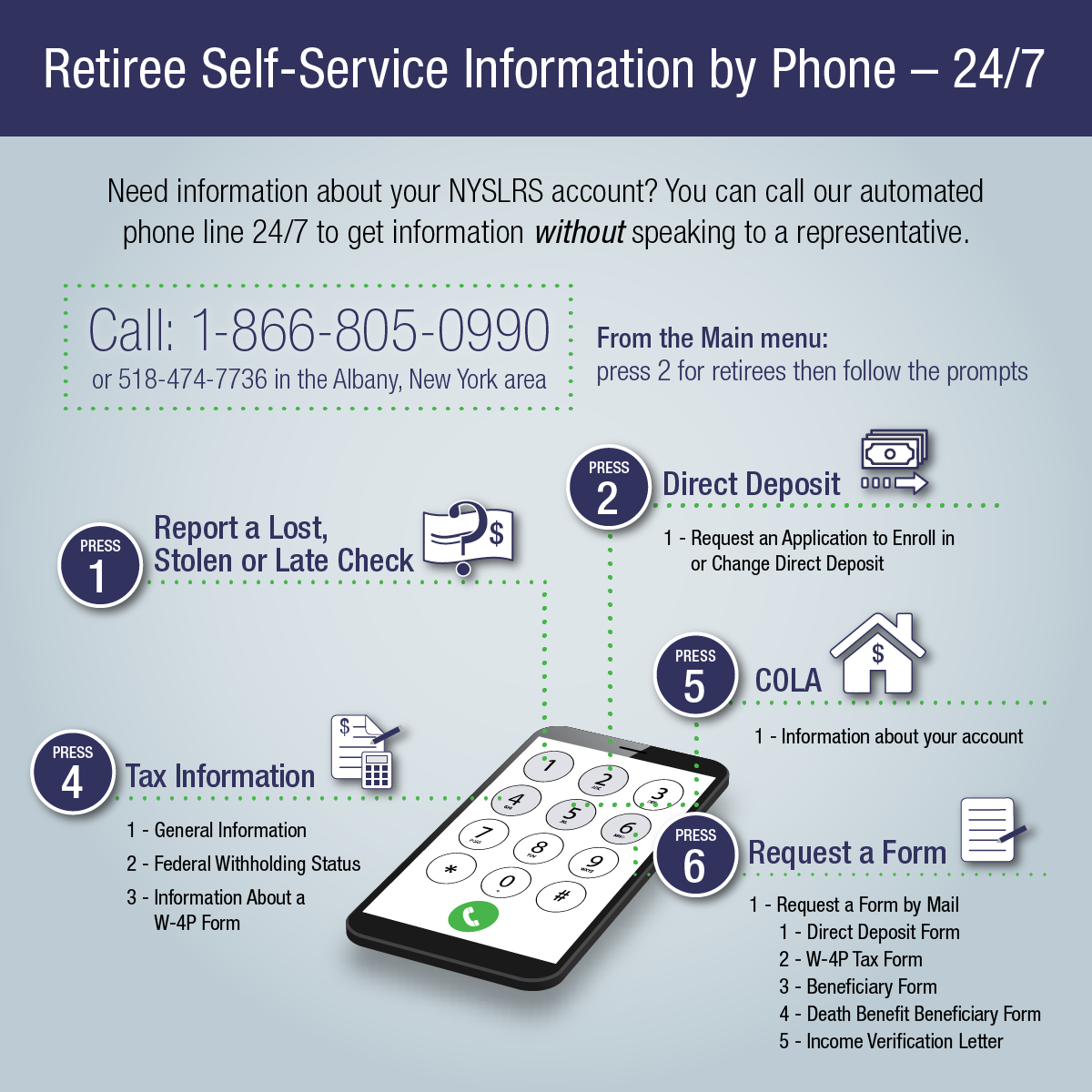

Retirees can use the automated phone system to:

- Request that NYSLRS forms be mailed to them,

- Report a lost, stolen or late pension check,

- Get tax information,

- Get information about cost-of-living adjustments (COLAs), and

- Request a direct deposit form.

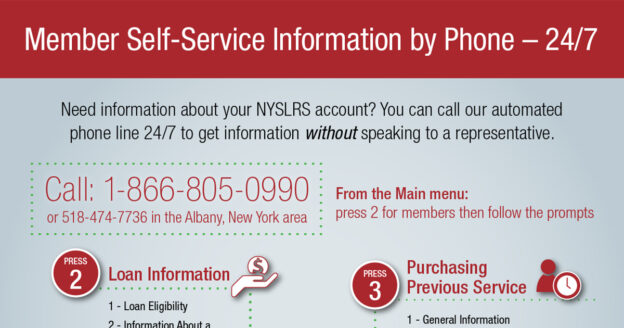

Members can use the automated phone system to:

- Request that NYSLRS forms be mailed to them,

- Find out if they are eligible for a loan or get their current loan balance,

- Request that a benefit projection be mailed to them, and

- Get personalized information about purchasing credit for previous service.

Here are the retiree menu options for the phone system:

Here are the member menu options for the phone system:

Other Ways to Get Information

If you are looking for general information about NYSLRS benefits, you can:

- Visit the Contact Us page. Click the “Member,” “Retiree” or “Beneficiary” button for answers to frequently asked questions about NYSLRS benefits.

- Visit the Retiree section and Member section of our website for access to information on a variety of topics.

- Email our customer service representatives using our secure email form for questions on account-specific information. Filling out the secure form allows them to safely contact you about your personal account information.