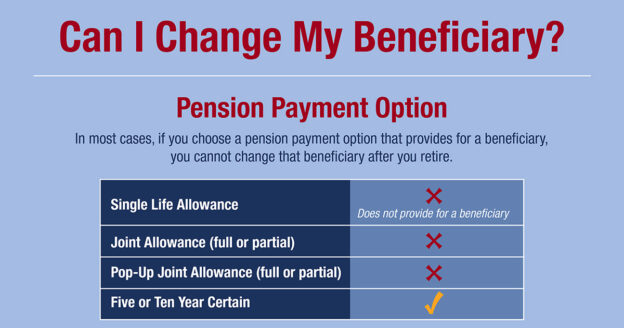

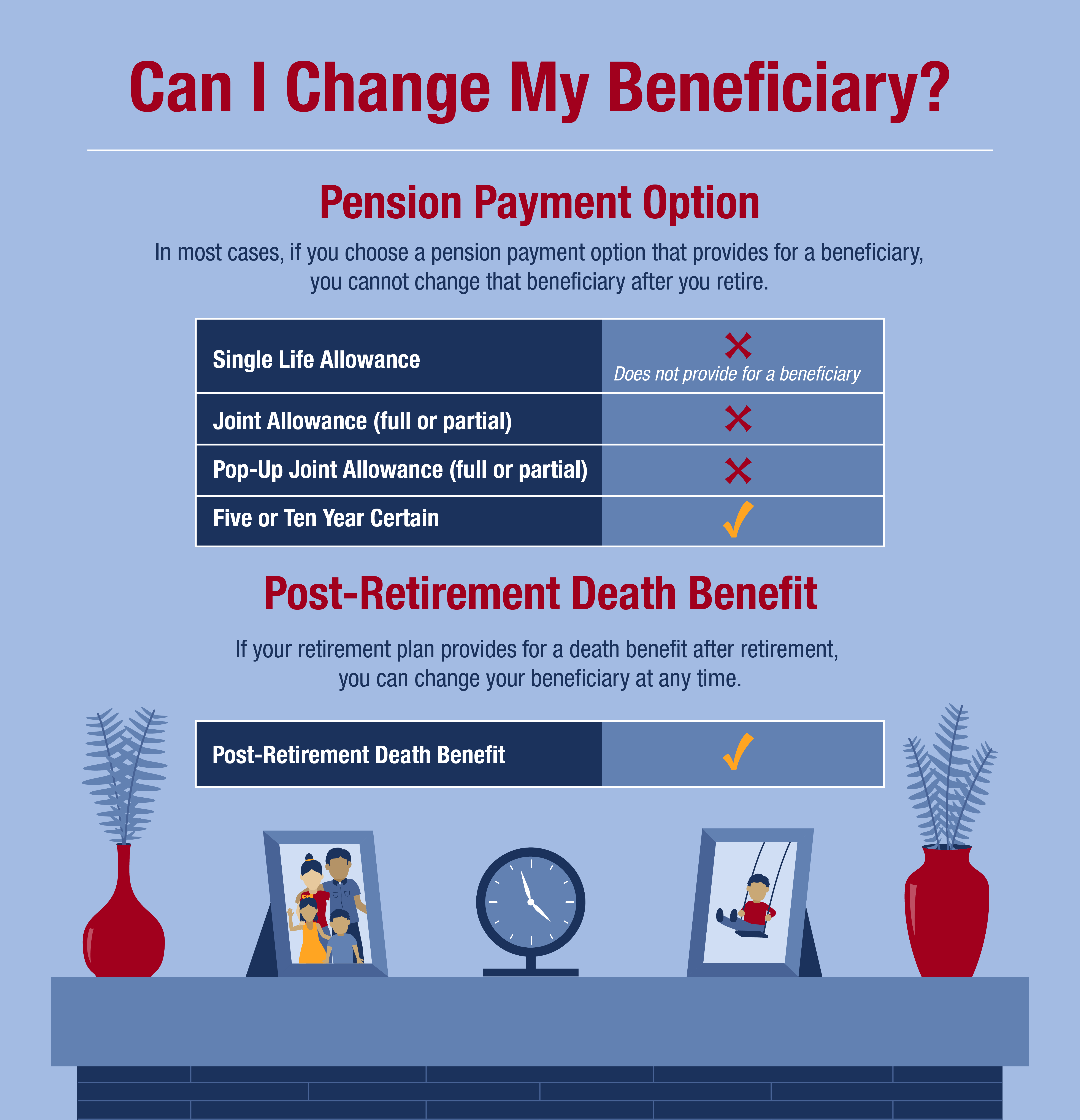

Can you change your beneficiary after you retire? That depends. If it’s the beneficiary for your pension, in most cases the answer is no. If you choose a pension payment option that provides a lifetime benefit for a surviving beneficiary, you cannot change that beneficiary, even if they die before you do. If your retirement plan provides a one-time, lump sum death benefit after you retire, you can change your beneficiary (or beneficiaries) for that benefit.

Available Pension Payment Options

At retirement, you will choose from a variety of pension payment options. After your pension becomes payable, you have up to 30 days to change your option. After that, you cannot change your pension payment option for any reason.

- If you don’t want to leave a lifetime benefit to someone else, the Single Life Allowance option may be right for you, but you won’t be able to change your option and add a beneficiary later. For example, if you’re single when you retire and marry during retirement, you cannot change your option to one that provides a continuing benefit for your spouse.

- If you want to leave a lifetime benefit to someone, there are several Joint Allowance options you can choose. After your death, if your beneficiary survives you, they will continue to receive all or part of your pension (depending on the specific option you choose) for the rest of their life. For these options, you can only name one beneficiary, and you cannot change that beneficiary after the 30-day window.

- There are payment options that allow you to change your beneficiary. For example, with the Five Year Certain or Ten Year Certain options, you can change your beneficiary at any time, but these options only provide a short-term benefit for a survivor.

The Post-Retirement Death Benefit

Your pension is not your only NYSLRS retirement benefit. Most NYSLRS retirees are eligible for a death benefit if they retired directly from payroll or within one year of leaving covered employment. This post-retirement death benefit is a one-time, lump-sum payment. You can change your beneficiary for this benefit at any time, and your beneficiaries for this benefit do not have to be the same as your pension payment option beneficiary.

Visit our Death Benefits page for retirees for information about how your post-retirement death benefit is calculated and how to update your beneficiaries if you are retired.

If you have questions about beneficiaries, death benefits or pension payment options, please contact us.