When you joined the New York State and Local Retirement System (NYSLRS), you were assigned a tier based on the date of your membership. This post looks at Tier 5 members of the Employees’ Retirement System (ERS).

Your tier determines such things as your eligibility for benefits, the calculation of those benefits, death benefit coverage and whether you need to contribute toward your benefits.

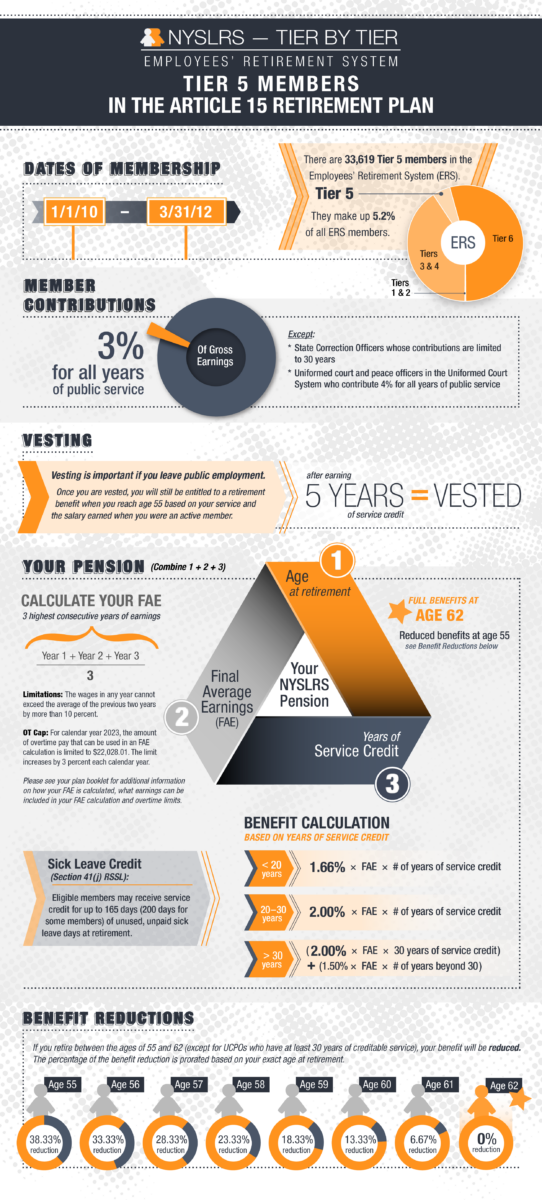

ERS has six tiers. Anyone who joined from January 1, 2010 through March 31, 2012 is in Tier 5. There were 33,619 ERS Tier 5 members as of March 31, 2022, representing 5.2 percent of ERS membership.

Most ERS Tier 5 members (unless they are in special retirement plans) retire under the Article 15 retirement plan. Check out the graphic below for the basic retirement information for Tier 5 members in this plan.

Membership Milestones

As of April 9, 2022, Tier 5 members only need five years of service credit to become vested. If you are a vested member in the Article 15 retirement plan, you are eligible for a lifetime pension benefit as early as age 55. However, if you retire before the full retirement age of 62, your benefit will be reduced.*

If you retire with less than 20 years, the benefit is 1.66 percent of your final average earnings (FAE) for each year of service. If you retire with 20 to 30 years, the benefit is 2 percent of your FAE for each year of service. For each year of service beyond 30 years, you will receive 1.5 percent of your FAE. For example, with 35 years of service, you can retire at 62 with 67.5 percent of your FAE.

Where to Find More ERS Tier 5 Information

For more information about ERS Tier 5 membership, find your NYSLRS retirement plan publication. It’s a comprehensive description of the benefits provided by your specific plan.

You can check your service credit total and estimate your pension using Retirement Online. Most members can use our online pension calculator to create an estimate based on the salary and service information NYSLRS has on file for them. You can enter different retirement dates to see how your choices would affect your potential benefit.

Members may not be able to use the Retirement Online calculator in certain circumstances, for example, if they have recently transferred a membership to NYSLRS. These members can contact us to request an estimate or use the “Quick Calculator” on our website. The Quick Calculator generates estimates based on information you provide.

For information about other tiers, our series NYSLRS – One Tier at a Time gives you a quick look at the benefits for other tiers in both ERS and the Police and Fire Retirement System.

*Uniformed court officers or peace officers employed by the Unified Court System that have at least 30 years of credit may retire with a full benefit as early as age 55.

If the agency that hired a group of us, and we were hired without a contract in place due to expiration of the previous agreed upon contract, do we fall under the previous tier, when the contract was in place. For example, hired without a contract in place, given Tier 6 but essentially should be given Tier 5 when the last contract was in place and not expired with the agency? Thanks for your time and consideration in responding to this comment

Your tier is determined by your date of membership with the Retirement System.

If you joined the Retirement System on or after April 1, 2012, you are in Tier 6.

When I was 16 years old I worked for my local school district as a lifeguard. When I was filling out paperwork for the job the person at the school administration building say “sign here to decline this they are just going to take money out of your paycheck you don’t want that.” I found out years later that was paperwork to join the retirement system. That would have put me in tier 4, I took a job in a state hospital at 24 years old and that put me into tier 5. My question is how can someone who is underage sign away something as important as whether or not to join a retirement system without a guardian?

NYSLRS cannot retroactively enroll an individual for a period in which membership was optional, regardless of the reason the individual failed to join. Action contrary to this would be in violation of the Retirement and Social Security Law.

If you buy back time can you change tiers?

Purchasing credit for previous service may improve your pension, but it does not change your membership date or tier. For more information on requesting credit for previous service, read our publication Service Credit for Tiers 2 through 6.

You may be eligible for a change in your date of NYSLRS membership, and perhaps a change in your tier, if you withdrew your membership in NYSLRS or another public retirement system in New York State before your current membership. For more information on tier reinstatements, visit our Transferring or Terminating Your Membership page.

The FAE listed above says “5 highest consecutive years of salary” then 3 underneath it. Is this an error? Shouldn’t it read 3?

Thank you for your comment. For ERS Tier 5, the Final Average Earnings (FAE) is based on the three highest consecutive years of earnings – we’ve updated the infographic to reflect this.

As a reminder, earnings in any 12-month period cannot exceed the average of the previous two years by more than 10 percent. Any amount over the 10 percent limit will be excluded from your FAE calculation. You can visit our Final Average Earnings page for more information and an example of an FAE calculation.

I worked as an intern in NYSERDA in 2008, and during my employment I was not offered the opportunity to join the retirement system. I started my fulltime employment with OSC in 2017. This is when I found out that NYSERDA was obligated to provide me an opportunity to join the retirement system. I did manage to buy back the service credits. However, how do I reinstate my tier??

Unfortunately, in most cases, if you did not join NYSLRS during your previous employment, you cannot change your date of membership or tier, even if your employer did not offer you NYSLRS membership.

The exception would be if your NYSLRS membership was mandatory for that employment. Generally, membership is not mandatory for part-time, temporary or provisional employment.

I am a tier 4 not 5

If you signed up for blog notifications, you receive an email each time we post. Often our posts cover topics of general interest, but we also provide information about benefits for specific tiers or retirement systems. We also post information of interest to retirees. As a Tier 4 member you may be interested in some of our other posts:

This email is incorrect for me, I’m not in tier 5. I’m tier 4.

We’re sorry for the confusion. If you signed up for blog notifications, you’ll receive an email each time we post. Often our posts cover topics of general interest, but we also provide information about benefits for specific tiers or retirement systems. We also post information of interest to retirees.

As a Tier 4 member you may be interested in some of our other posts:

Hello. I see that the FAS benefit calculation changed in this overview compared to the previous Tier 5 overview. Tier 5 members now receive 1.75% rather than 2% at 20 years of service?

Thank you for pointing this out. We have updated the infographic to show the correct Tier 5 benefit information – they receive 2 percent of their final average earnings for each year of service if they retire with 20 to 30 years. We apologize for any confusion this may have caused.

Thank you for the clarification!

I worked 7 years Tier 1 then went back in system at higher Tier. I applied for Tier one bridge at retirement but don’t know if successful. How do I check?

To check the status of your tier reinstatement request, please call our customer service representatives at 866-805-0990. You can also message them using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

can i retire at 55 and with 30 yrs in the system with out any penalty

Tier 2, 3 and 4 Employees’ Retirement System members who are in the Article 15 retirement plan and have 30 years of service credit can retire at age 55 without a benefit reduction.

For account-specific information about your retirement plan, please email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

Reductions still apply after benefit calculation after 30+ yrs?

Benefit reductions do not apply to ERS Tier 2, 3 or 4 members and Tier 5 Uniformed Court Officers and Peace Officers employed by the Unified Court System who retire between 55 and 62 with 30 or more years of service credit. You can find more information on our Benefit Reductions page.

can I get a break down of Tier 4 in this format?

You can find our One Tier at a Time: ERS Tiers 3 and 4 blog post and other posts in the

One Tier at a Time series online.