April is National Financial Literacy Month, a time dedicated to helping people make informed financial decisions and manage money effectively. Financial literacy means understanding and using skills such as budgeting, investing and managing your personal finances.

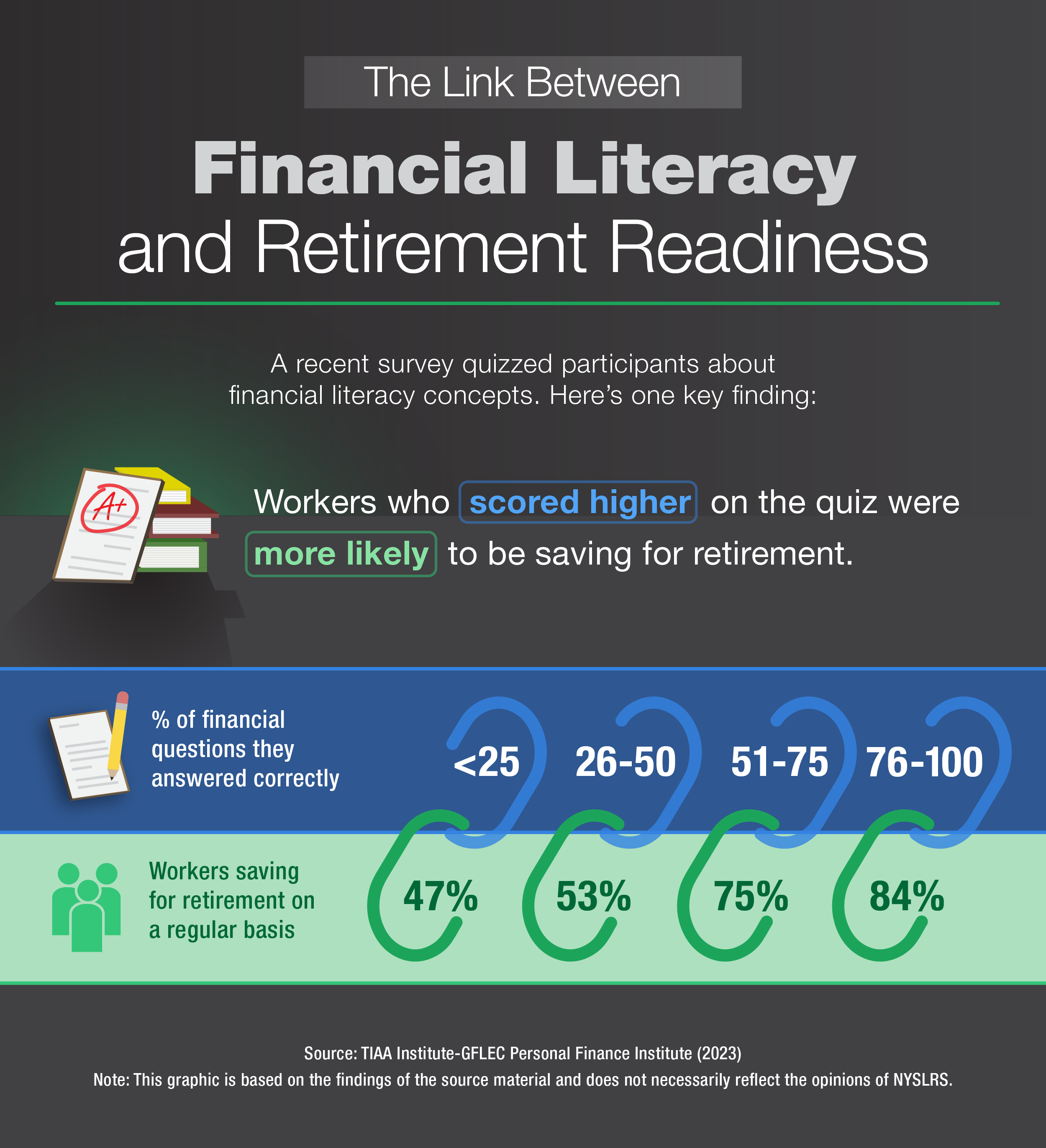

Greater financial literacy generally translates into greater financial well-being, according to a recent report from the TIAA Institute-GFLEC Personal Finance Index. TIAA’s research also finds a connection between financial literacy and saving for retirement.

Financial Literacy and Planning for Retirement

Increase your financial literacy and make a good plan for retirement by understanding your NYSLRS benefits, your other sources of retirement income and your current financial situation. Once you know where you stand, you’ll be in a better position to plan.

Understand Your NYSLRS Benefits

As a NYSLRS member, you are enrolled in a defined benefit plan, also known as a traditional pension plan. If you are vested and retire from NYSLRS, you will receive a monthly pension payment for the rest of your life. Your pension will be calculated using a formula based on your earnings and years of service, your retirement plan, and your tier.

Find your retirement plan publication for comprehensive information about the benefits you are entitled to receive as a member of the Employees’ Retirement System (ERS) or the Police and Fire Retirement System (PFRS).

Depending on your tier and retirement plan, certain membership milestones will affect how your pension is calculated and how much you’ll receive at retirement. Read our milestones blog posts for general information about the retirement plans that cover most NYSLRS members:

Consider Other Sources of Retirement Income

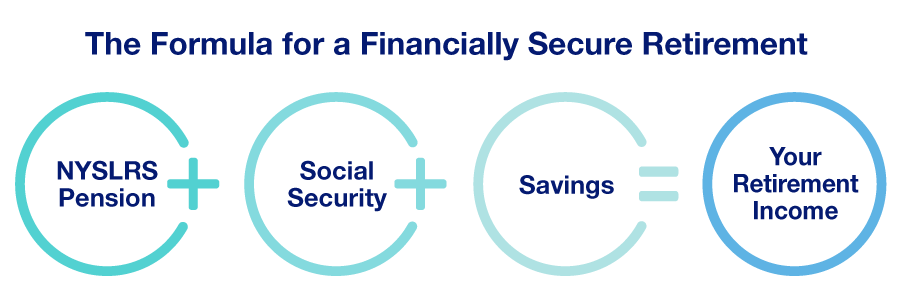

Your pension will provide you with monthly payments for the rest of your life. But there is more to a financially secure retirement than having a pension. Understanding your potential sources of income will help you plan for your future and boost your retirement confidence. Think of retirement security as a three-legged stool. Each leg is a source of income to help support you when your working days are done.

Retirement savings can be an important financial asset when you retire. Savings can provide money for you to travel, continue your education, pursue a hobby or start a business. The money you set aside can also be a resource in case of an emergency, act as a hedge against inflation and boost your retirement confidence.

Evaluate Your Current Financial Situation

Estimate Your Retirement Income

An estimate of your NYSLRS pension benefit is essential for effective retirement planning. Most members can create their own estimate in minutes using Retirement Online. Your estimate will be based on the most up-to-date account information we have on file for you. You can enter different retirement dates to see how those choices would affect your benefit.

There are also a variety of online calculators that can help you estimate the retirement income you might expect from Social Security or personal retirement savings.

Create a Budget

Use our Monthly Income & Expenses Worksheets to help you track your current spending habits and project your future needs. Remember to account for non-monthly expenses, such as car insurance, property taxes and school taxes.

Pay Down Your Debt

If you’re planning to retire soon, it’s a good idea to take inventory of any debt you owe. Debt is not necessarily bad but paying it down can give you more flexibility to enjoy the type of retirement you want.