Tier 3 and 4 members in the Article 15 retirement plan qualify for retirement benefits after they’ve earned five years of credited service. Once you’re vested, you have a right to a NYSLRS retirement benefit — even if you leave public employment. Though your pension is guaranteed, the amount of your pension depends on several factors, including when you retire. Here is some information that can help you determine the right time to retire.

Three Reasons to Keep Working

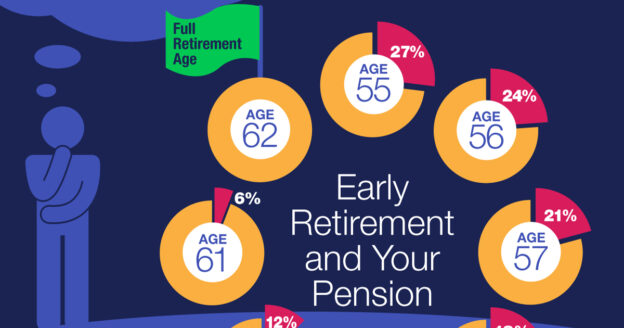

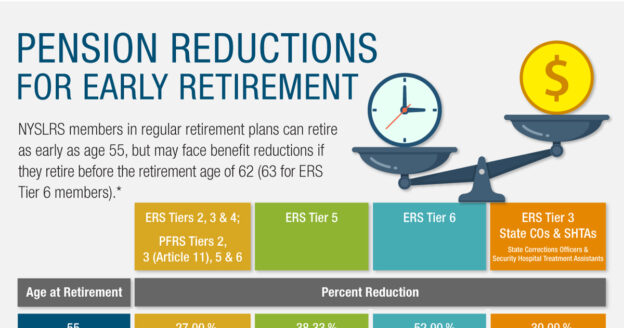

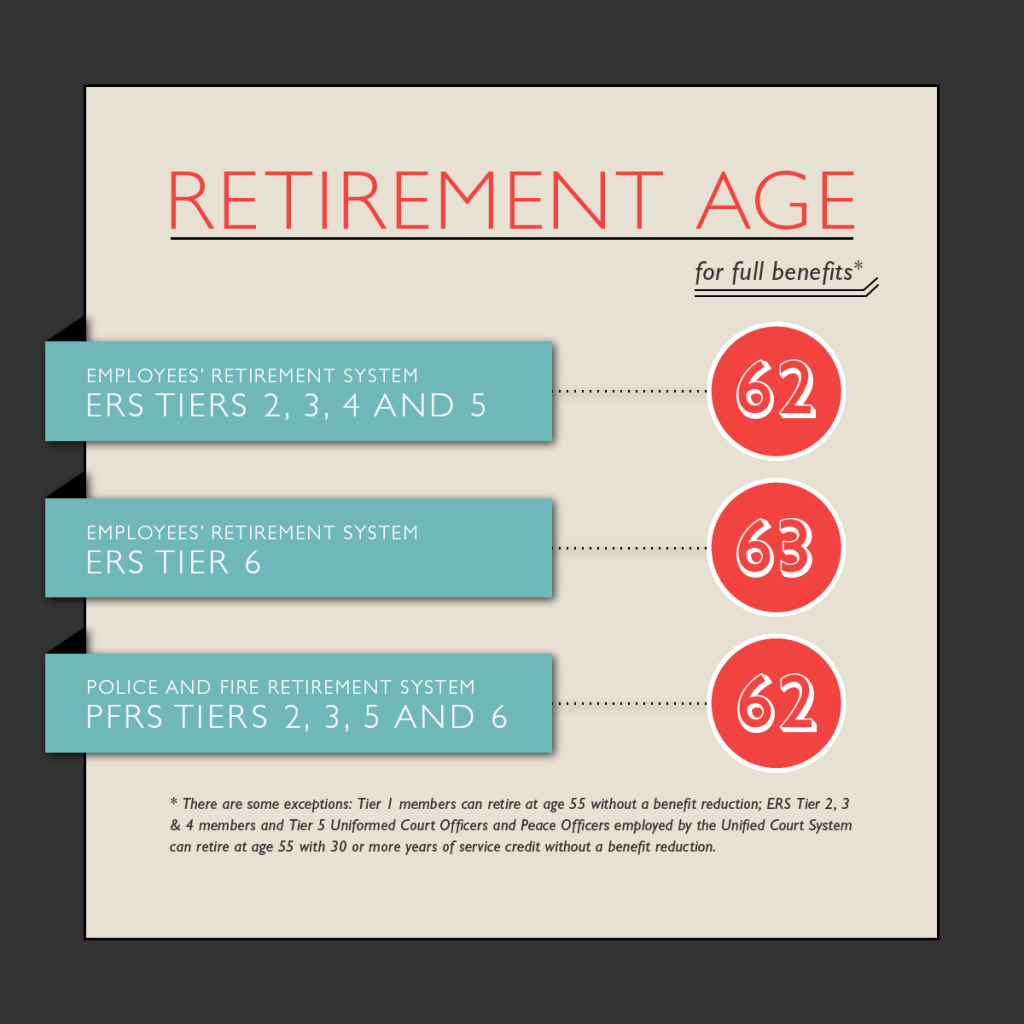

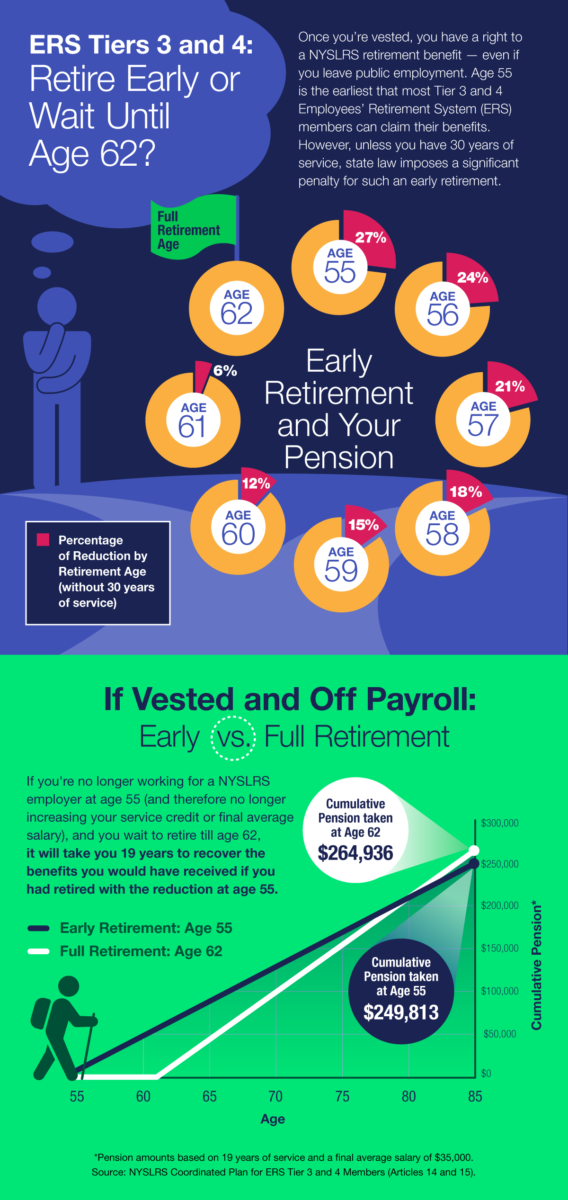

- Tier 3 and 4 members can claim their benefits as early as age 55, but they’ll face a significant penalty for early retirement – up to a 27 percent reduction in their pension. Early retirement reductions are prorated by month, so the penalty is reduced as you get closer to full retirement age. At 62, you can retire with full benefits. (Tier 3 and 4 Employees’ Retirement System (ERS) members who are in the Article 15 retirement plan and can retire between the ages of 55 and 62 without penalty once they have 30 years of service credit.)

- Your final average earnings (FAE) are a significant factor in the calculation of your pension benefit. Since working longer usually means a higher FAE, continued public employment can increase your pension.

- The other part of your retirement calculation is your service credit. More service credit can earn you a larger pension benefit, and, after 20 years, it also gets you a better pension formula. For Tier 3 and 4 members, if you retire with less than 20 years of service, the formula is FAE × 1.66% × years of service. Between 20 and 30 years, the formula becomes FAE × 2.00% × years of service. After 30 years of service, your pension benefit continues to increase at a rate of 1.5 percent of FAE for each year of service.

If You’re Not Working, Here’s Something to Consider

Everyone’s situation is unique. For example, if you’re vested and no longer work for a public employer, and you don’t think you will again, taking your pension at 55 might make sense. When you do the math, full benefits at age 62 will take 19 years to match the money you’d have received retiring at age 55 — even with the reduction.

An Online Tool to Help You Make Your Decision

Most members can use Retirement Online to estimate their pensions.

A Retirement Online estimate is based on the most up-to-date information we have on file for you. You can enter different retirement dates to see how those choices would affect your benefit, which could help you determine the right time to retire. When you’re done, you can print your pension estimate or save it for future reference.

If you are unable to use our online pension calculator, please contact us to request a pension estimate.

This post has focused on Tier 3 and 4 members. To see how retirement age affects members in other tiers, visit our About Benefit Reductions page.