If you’re planning to retire soon, it’s a good idea to take inventory of any debt you owe. Paying down your debt can give you flexibility to enjoy the type of retirement you want.

NYSLRS Loan Debt

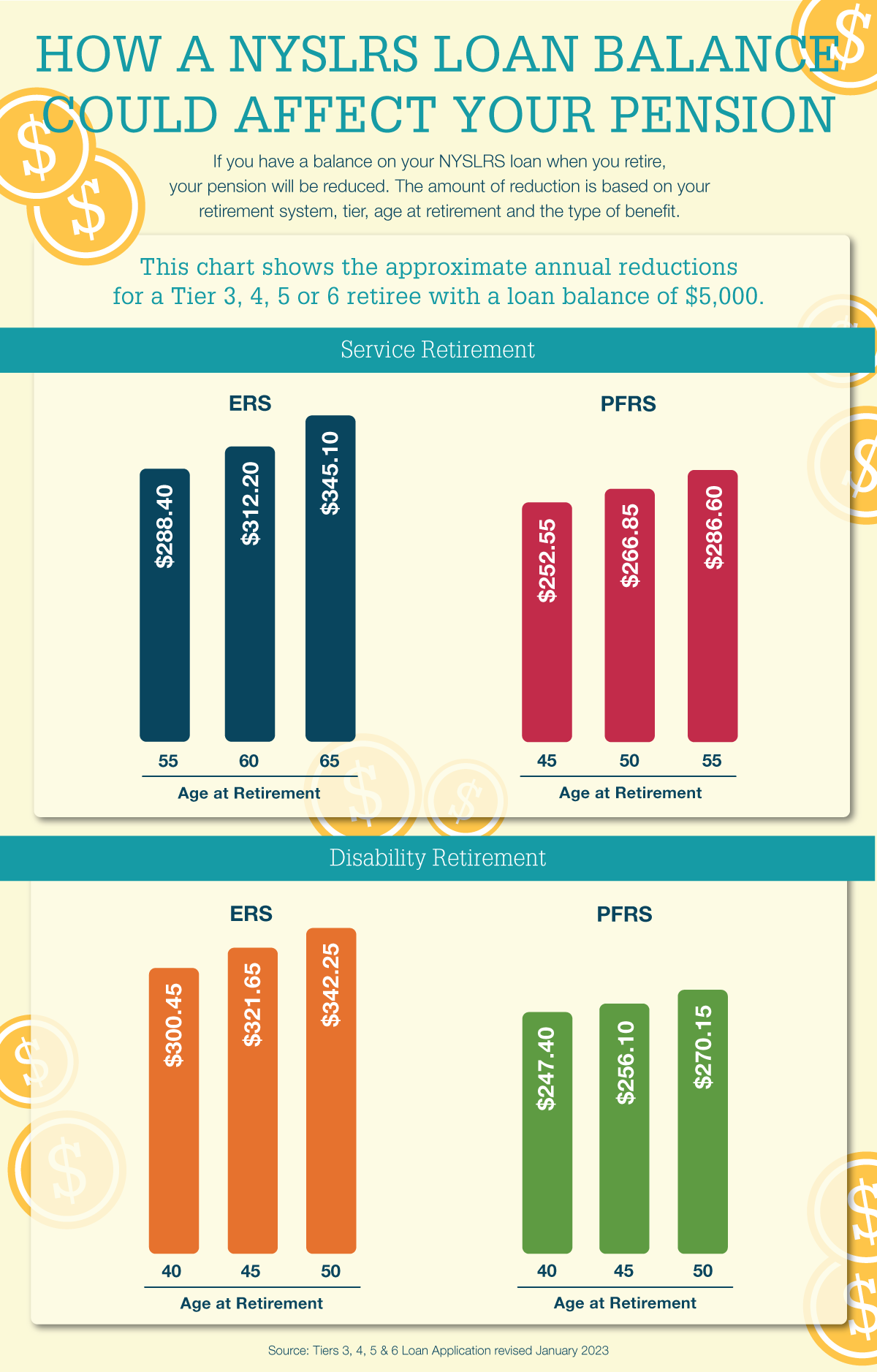

If you have an outstanding NYSLRS loan balance when you retire, it will reduce your pension. The amount of your reduction is based on:

- Your retirement system — Employees’ Retirement System (ERS) or Police and Fire Retirement System (PFRS);

- Your tier;

- Your age at retirement; and

- Whether you retire with a service retirement benefit or a disability retirement benefit.

The pension reduction does not go toward repaying the outstanding loan balance — it’s a permanent reduction. And, at least part of the loan balance at retirement will be subject to federal income taxes.

When you apply to retire using Retirement Online and have an outstanding NYSLRS loan balance, the pension reduction amounts are provided to you. They are also listed on the loan applications on our Forms page. If you are nearing retirement, be sure to check your loan balance. If you are not on track to repay your loan before you retire, you can increase your loan payments, make additional lump sum payments or both (see the Change Your Payroll Deductions or Make Lump Sum Payments section of our Loans page.)

Although ERS members may repay their loan after retiring, they would have to pay the full balance that was due at retirement in a single lump sum payment. Then, going forward, the pension would be increased to the amount it would have been without the loan reduction. However, it would not be increased retroactively back to the date of retirement.

Other Debt to Check

Credit Cards

Another priority is paying off credit cards. Credit card statements carry a minimum payment warning that tells you how long it will take, and how much it will cost, to pay off your balance making only minimum payments.

If you have more than one credit card balance, many financial advisors recommend you pay as much as you can on the card with the highest interest, while making at least the minimum payments on lower-interest cards. Once you’ve paid off the high-interest card, focus on the one with the next-highest rate, and so on. Other advisors say it might be better to pay off the card with the smallest balance first. The idea is to gain a sense of accomplishment, and make the process seem less daunting.

Mortgages

Should you try to pay off your mortgage before you retire? Advice varies on that question. It would eliminate a major expenditure and let you spend your retirement income on other things. On the other hand, if your mortgage interest rate is relatively low, you may want to focus on paying off other high-interest debt or boosting your retirement savings. What works best for you will depend on your situation.