Planning on taking out a NYSLRS loan? Applying through Retirement Online is fast and convenient.

Eligibility for a NYSLRS loan is based on your tier. Generally, you’ll need to be on the payroll of a participating employer, have at least one year of service and have sufficient contributions in your account. (Note: Retirees are not eligible for NYSLRS loans.)

Retirement Online is the Fastest Way to Apply

When you use Retirement Online, NYSLRS receives your application immediately and can process your loan more quickly. It’s also an easy way to check the amount you are eligible to borrow, your balance on any outstanding loans, and more.

To apply:

- Sign in to Retirement Online.

- In the ‘I want to…’ section, click the “Apply for a Loan” button.

- Follow the prompts.

As you work your way through the online application, you’ll see:

- How much you are eligible to borrow;

- The minimum repayment amount;

- The expected payoff date; and

- How much you can borrow without tax implications.

If you apply for a loan and you already have an existing loan (or loans), you’ll choose one of two options:

- Multiple loans: With multiple loans, you are taking a new loan, and each of your outstanding loans has a separate five-year due date and minimum payment. The minimum payments for each of your loans are added together for one total minimum payment. This combined minimum payment amount is higher than the minimum would be if you choose a refinanced loan, but with multiple loans, as each loan is paid off, your total minimum payment goes down.

- Refinance your existing loan: Refinancing your loan adds your new loan amount to your existing balance and consolidates the entire amount as one loan instead of taking separate loans. Minimum payment amounts for refinanced loans are lower than the minimum for multiple loans because when you refinance, we combine your existing loan balance with your new loan and spread out the repayment over a new five-year term. However, this increases the portion of your loan that may be considered a taxable distribution, and federal withholding can significantly reduce the loan amount that you receive.

There is a service charge of $45 that will be deducted from your loan check when it is issued. The current interest rate is 5 percent. The interest rate will remain fixed for the term of your loan.

NYSLRS loans are exempt from New York State and local income taxes. But the Internal Revenue Service (IRS) may consider all or part of a NYSLRS loan taxable – for instance, if you borrow above certain limits. The Retirement Online loan application will show you the maximum amount you can borrow without tax implications.

When Will I Receive My Loan Check?

Loan checks are mailed out from NYSLRS once a week. To check the status of your loan application:

- Sign in to your Retirement Online account.

- Scroll down to ‘My Cases.’

- If your case status says “Closed” before close of business on Wednesday, your check will be in the mail that Friday.

You will also receive a confirmation letter when your loan case has been completed. You can find it in your Retirement Online account under “View Documents.”

Repaying Your NYSLRS Loan

Loan payments are deducted from your paycheck. If you choose to repay the minimum amount, your payroll deduction may be increased periodically to ensure your loan will be repaid within the required five-year repayment term. You can increase your payroll deduction amount, make additional payments or pay your loan in full at any time with no prepayment penalties. Retirement Online is the easiest way to manage your loan payments. Sign in to your account and select “Manage my Loans.”

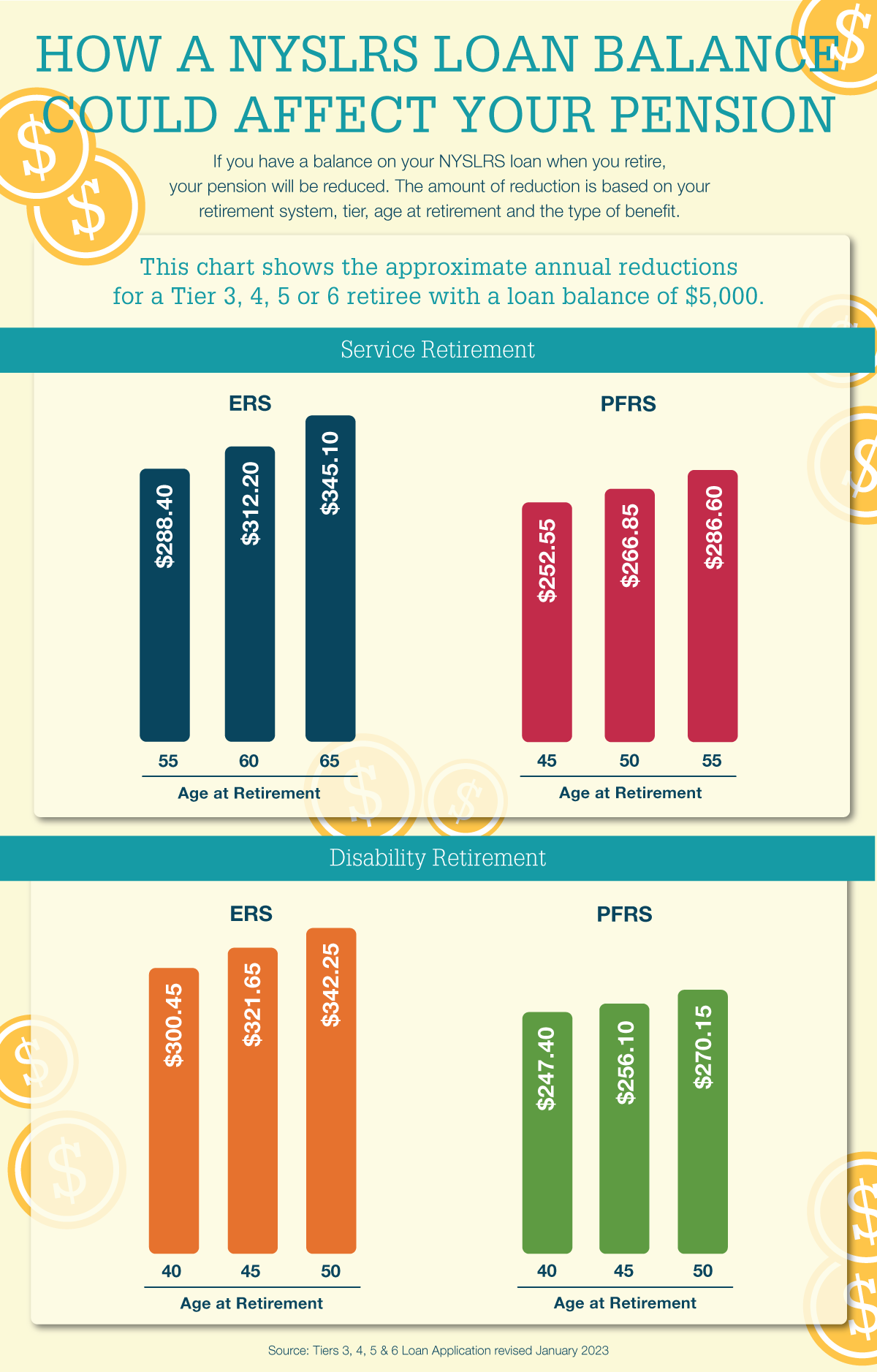

Retiring With an Outstanding NYSLRS Loan

If you retire with an outstanding loan, your pension will be reduced. You will also need to report at least a portion of the loan balance as ordinary income (subject to federal income tax) to the IRS. If you retire before age 59½, the IRS may charge an additional 10 percent penalty. If you are nearing retirement, be sure to check your loan balance. If you are not on track to repay your loan before you retire, you can increase your loan payments, make additional lump sum payments or both in Retirement Online.

Note: Employees’ Retirement System (ERS) members may repay their loan after retiring, but they must pay the full amount (that is, the amount that was due on their retirement date) in a single lump-sum payment. Once you do, your pension benefit will increase from that point on, but it will not be adjusted retroactively back to your date of retirement.

Visit Our Website for More Information

For more information about NYSLRS loans, including what happens if you go off payroll or default on your loan, visit our Loans page. Need help with Retirement Online? See our Tools and Tips blog post.