When you joined the New York State and Local Retirement System (NYSLRS), you were assigned to a tier based on the date of your membership. There are six tiers in the Employees’ Retirement System (ERS) and five in the Police and Fire Retirement System (PFRS) — so there are many different ways to determine benefits for our members. Our series, NYSLRS – One Tier at a Time, walks through each tier and gives you a quick look at the benefits members are eligible for before and at retirement.

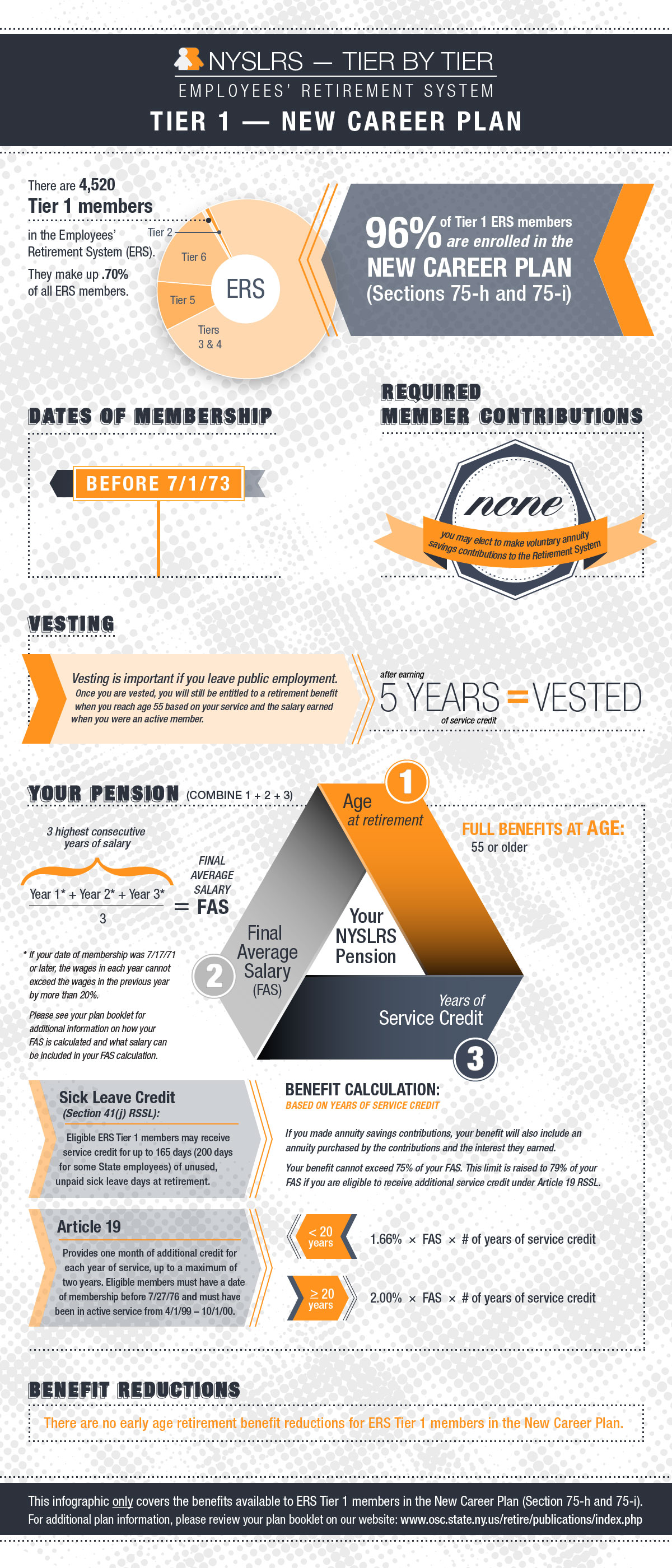

One of our smallest tiers is ERS Tier 1, which represents 0.7 percent of NYSLRS’ total membership. Overall, there are 4,520 ERS Tier 1 members. Today’s post looks at the major Tier 1 retirement plan in ERS – the New Career Plan (Section 75-h or 75-i).

If you’re an ERS Tier 1 member in an alternate plan, you can find your retirement plan publication below for more detailed information about your benefits:

- New Career Plan for ERS Tier 1 Members (VO1504)

- Career Plan for ERS Tier 1 Members (VO1503)

- State Correction Officers and Security Hospital Treatment Assistants Plan for ERS Tier 1 Members (VO1525)

- Sheriffs, Undersheriffs and Deputy Sheriffs Special Plan for ERS Tier 1 Members (VO1840)

- Legislative and Executive Retirement Plan for Tier 1 Members (VO1861)

- Non-Contributory Plan With Guaranteed Benefits for ERS Tier 1 Members (ZO1502)

- Non-Contributory Plan for ERS Tier 1 Members (ZO1501)

- Basic Plan for ERS Tier 1 Members (ZO1500)

Be on the lookout for more NYSLRS – One Tier at a Time posts. Want to learn more about the different NYSLRS retirement tiers? Check out some earlier posts in the series:

Is long term care insurance a retirement benefit for people who were in Tier 1 for at least 25 years and are currently retired?

NYSLRS does not provide health care benefits, including long-term care insurance, for its retirees.

As a Tier 1 non contributory retiree, I have questions. 1. Will be beneficiary receive a death benefit upon my passing? If so, how is it calculated? 2. Am I eligible to apply for a loan?

Retirees are not eligible for NYSLRS loans.

There are a few possible death benefits that may be available to NYSLRS retirees depending on your retirement plan.

For information about your benefits, please email our customer service representatives using the secure form on our website (http://www.emailNYSLRS.com). One of our representatives will review your account and respond to your questions.

I am a widower and plan to remarry. My first wife was my beneficiary. Will my second wife continue to receive medical insurance benefits upon my death?

Unfortunately, NYSLRS doesn’t administer health insurance programs for its retirees. For New York State retirees, the New York State Department of Civil Service administers the New York State Health Insurance Program (NYSHIP). You can contact the Department of Civil Service (http://www.cs.ny.gov/home/contact.cfm) or visit their website at http://www.cs.ny.gov to learn more.

If you retired from a public employer other than New York State (a county, city, town, village or school district), your former employer’s benefits administrator should be able to answer your questions.

Greetings, If someone has 8 years of Tier 1 service and recently became a state employee again, do they receive 12 hours of annual leave accruals a month due to the fact that they put over 7 years of service in the 1970’s?

How you accrue vacation time depends on your employer. Your employer should be able to answer questions about accruing annual leave.

I have time missing that Suffolk county states the records were destroyed. It was 1975-1977 and I do not know how to correct this. I’m tier 1 membership and getting ready to retire. This time is vital.

Any suggestions? Thank you

When records are unavailable, we can accept documents such as W-2 forms from your tax returns, or Social Security earnings records.

You can request “Non-Certified (Itemized) Detailed Earnings Information” directly from the Social Security Administration (SSA) by completing form SSA-7050-F4, however there is a cost.

We recommend you first email our customer service representatives (http://www.emailNYSLRS.com) to find out if you are missing this service. Please include the month (and day, if possible) that you started working with Suffolk County.

For more information about getting credit for past service, please see our Service Credit for Tiers 2 through 6 guide.

Thanks for this summary. There is a lot of confusion out there about how the various tiers work.

I need my original award letter….

Thank you

Comment edited by NYSLRS to remove personal information

You can request that we mail you a copy of your original award letter by emailing us through our secure contact form. Filling out the secure form allows us to safely contact you about your personal account information

Let us know what information you need and be sure to provide your phone number and all of your personal verification information when you submit your email. In most cases, a reprint of your original award letter can be mailed out within 5 to 7 business days.

I am in Tier 1 section 70 plan and don’t understand the FAS calculation of credited time + prior service time, which seems to different tan the usual FAS for Tier 1. Please explain. Thank you.

The infographic above references the calculations used for the Tier 1 members in the New Career Plan (Sections 75-h and 75-i). If you are covered by Section 70, your FAS calculation would be the same, but how your service credit factors into your benefit calculation may be different.

Credit for prior service is treated differently from regular service when calculating a pension benefit in the Section 70 plan. Prior service is employment with a participating employer before that employer chose to participate in NYSLRS. Members can receive credit for prior service.

You can find out more details about your retirement benefit and FAS calculation in our Basic Plan for ERS Tier 1 Members plan publication.

We recommend that you submit a Request for Estimate form (PDF) to us. An estimate shows you what your pension could be, based on the salary and service information in your account. It’s also a good way to make sure we have all your public employment history on file before you retire.

Please recheck info about vesting in Tier 1; I recall that ten years’ service was required. I would hate to mislead current members that it was so easy back then.

Julia, thank you for your concern, but members who joined the System prior to January 1, 2010 (Tiers 1, 2, 3 and 4) only need five years of service to be vested and eligible for a Service Retirement Benefit.