Most State and municipal employees are required to join the New York State and Local Retirement System (NYSLRS) when they are hired. But for some employees, such as part-time and seasonal workers, membership is optional. If you’re a member and you know someone who could join NYSLRS, consider sharing this piece with them.

What is NYSLRS?

NYSLRS is the third largest retirement system in the nation, with more than 1.1 million members, retirees and beneficiaries. State Comptroller Thomas P. DiNapoli administers the Retirement System and is trustee of the New York State Common Retirement Fund, which holds and invests NYSLRS assets. The Fund had a value of $210.5 billion as of March 31, 2019.

Why Join NYSLRS?

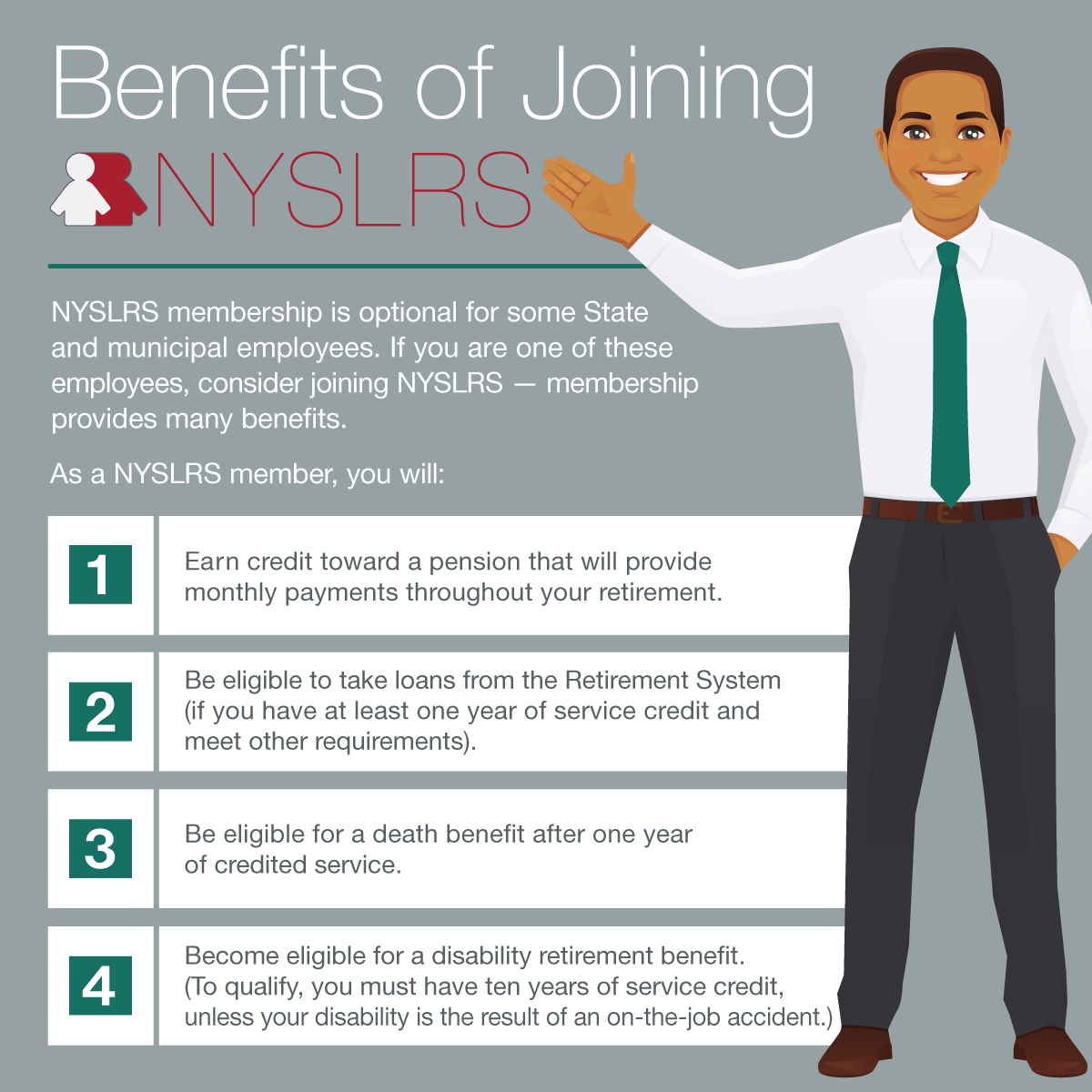

Joining NYSLRS will improve your chances of a secure financial future. You’ll earn credit toward a pension that will provide monthly payments throughout your retirement. But NYSLRS also provides other important benefits.

What Does NYSLRS Offer?

As a NYSLRS member, you’ll be eligible for a pension after you earn ten years of service credit. (This is called being vested.) If you work part-time, service credit is pro-rated. For example, if you work half of the hours that a full-time employee works, you’ll receive six months credit for every year you work.

Also, as a NYSLRS member you’ll be able take loans from your contributions if you’ve earned a year of service credit and meet other requirements. You’ll be eligible for a death benefit once you have one year of service credit, and disability benefits after you have ten years of service credit. (If your disability results from an on-the-job accident, not due to your own willful negligence, there is no minimum service requirement.)

Over 3,000 employers participate in NYSLRS, allowing you to continue to build on your benefits if you go to work for another government employer. Your benefits also may be transferable to six other public retirement plans in New York.

Making Contributions

As a Tier 6 member, you’ll contribute between 3 and 6 percent of your earnings to the Retirement System. Tier 6 contribution rates vary based on each member’s annual compensation. If you don’t join NYSLRS when you first start working and later decide to purchase your previous service credit, you will need to contribute 6 percent of those earnings plus interest, even if your salary level for the prior time period would have resulted in a lower contribution rate.

Your NYSLRS pension will be based on your service credit and salary, not on the amount you contribute. A NYSLRS pension is a lifetime benefit. Unlike a 401-k, there is no risk that your pension benefits will be reduced during your retirement.

But what if you join NYSLRS and decide to leave public service before you are vested? You won’t lose your contributions. In fact, you can withdraw your accumulated contributions, plus interest, and roll that money into a retirement savings plan at your new job.

More Information

If you would like to join NYSLRS or just want more information, please contact your employer’s human resources (personnel) office. You may also be interested in our booklet, Membership in a Nutshell.