It may not come up during your career, but if you leave public employment before you are eligible to retire, you should know what happens with your NYSLRS membership and benefits. Your options will depend on how many years of service you have. It’s also important to keep your account information up to date. If you remain a member of NYSLRS after you leave public employment, you can regularly review your account information and keep it up to date by using Retirement Online.

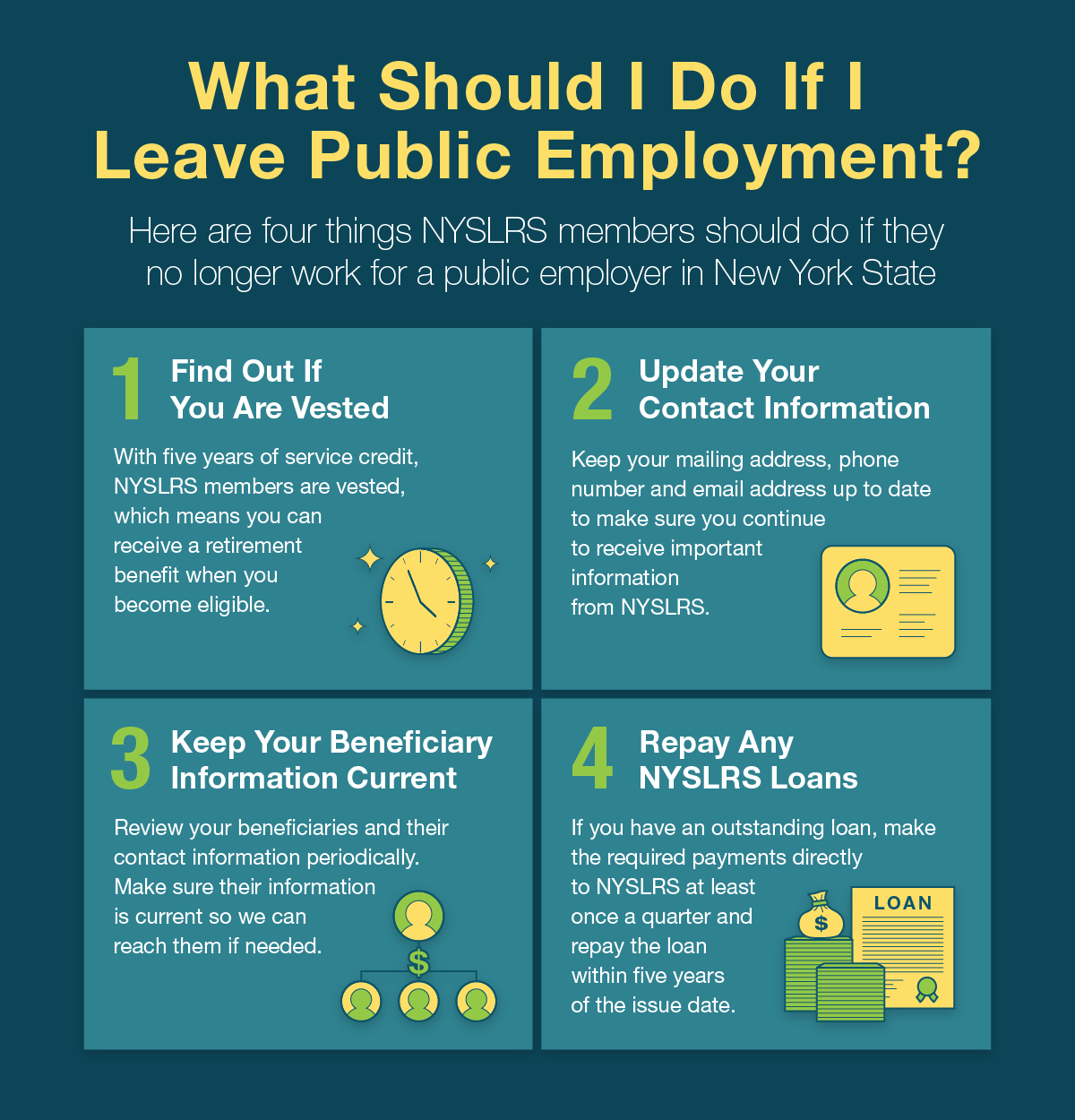

Find Out If You Are Vested

NYSLRS members are vested when they have five years of service credit. Sign in to your Retirement Online account to see your total estimated service credit.

- If you have 5 or more years of service when you leave public employment, and you leave public employment before you are eligible to retire, you can receive a vested retirement benefit when you become eligible.

- If you leave with between five and ten years of service, you can either remain a member and receive a vested retirement benefit when you become eligible or terminate your membership and receive a refund of your contributions.

- If you leave with more than ten years of service, you cannot withdraw your NYSLRS membership and you can receive a vested retirement benefit when you become eligible and apply.

- If you leave with less than ten years of service, you can end your membership and receive a refund of your contributions.

Keep Your Contact Information Updated

It’s important to make sure we have your current mailing address, phone number and personal email address, and let us know about any future changes. That way, you won’t miss important information from us, such as your Member Annual Statement.

To update your contact information, sign in to Retirement Online. Go to ‘My Profile Information,’ find your address, phone number or email address under ‘My Profile Information’ and click “update.”

Keep Your Beneficiaries Updated

If you leave public employment, your beneficiaries may still be eligible for a death benefit, so you should review your beneficiary designations periodically. Sign in to Retirement Online, go to the ‘My Account Summary’ area of your Account Homepage and click “View and Update My Beneficiaries.” Your beneficiary changes will be considered filed on the day you submit them.

Repay Any NYSLRS Loans

If you leave public employment, you will no longer be able to pay off your NYSLRS loans by payroll deduction. If you have any outstanding NYSLRS loans, you must make payments directly to NYSLRS at least once every three months and repay your loan within five years of when it was issued, or you will default on the loan. Defaulting on a loan may carry considerable tax consequences: You’ll need to pay ordinary income tax and possibly an additional 10 percent penalty on the taxable portion of the loan. You can make loan payments to NYSLRS via Retirement Online.

You aren’t eligible to take a new NYSLRS loan once you are off the public payroll.

Receiving a Vested Retirement Benefit

If you are vested, once you reach retirement age, you can receive a lifetime pension based on your salary and service from when you were working in public employment. It’s your responsibility to apply for retirement — NYSLRS will not pay out your pension benefit unless you apply for it.

The earliest date you can receive your retirement benefit depends on your tier and retirement system.

- Tier 1 and 2 members are eligible for a vested retirement benefit as early as the first of the month following your 55th birthday.

- Tier 3, 4 and 5 members and Employees’ Retirement System (ERS) Tier 6 members are eligible for a vested retirement benefit as early as your 55th birthday.

- Police and Fire Retirement System (PFRS) Tier 6 members are eligible for a vested retirement benefit on your 63rd birthday.

For most members, however, if you retire before your full retirement age, you would face a permanent early retirement benefit reduction. The full retirement age is 62 for Tier 1 – 5 members, and age 63 for ERS Tier 6 members and off-payroll PFRS Tier 6 members.

Most members can estimate your pension amount using the benefit calculator in Retirement Online. Sign in to your Retirement Online account, go to the ‘My Account Summary’ area of your Account Homepage and click the “Estimate my Pension Benefit” button. You can also apply for your retirement benefit using Retirement Online.

If You Leave Public Employment with Less than Ten Years of Service

With less than ten years of service credit, you can choose to end your membership and request a refund of your contributions. If you withdraw your contributions, however, you will no longer be eligible to receive a pension benefit. You can withdraw by signing in to Retirement Online, going to the ‘My Account Summary’ area of your Account Homepage, and clicking “Withdraw My Membership.”

You cannot withdraw from NYSLRS once you have ten years of service credit.

(Note: Tier 1 and 2 members and PFRS Tier 3 (Article 11) members covered by a non-contributory retirement plan can make voluntary contributions. These members can withdraw their voluntary contributions without ending their membership. Contact us if you have questions.)

If you have less than five years of service credit (aren’t vested) and don’t withdraw your contributions, they will continue to earn 5 percent interest for seven years. After seven years off the public payroll, your membership ends automatically, and your contributions will be deposited into a non-interest-bearing account until you withdraw them.

For more information, including tax implications of withdrawing your membership, read Life Changes: What If I Leave Public Employment?.