Most NYSLRS members contribute a percentage of their earnings to the Retirement System. Over time, those contributions, with interest, can add up to a tidy sum. But what happens to that money? Will you get your contributions back when you retire? The answer to that question is “no.” Let’s look at what happens to your NYSLRS contributions.

How NYSLRS Retirement Plans Work

NYSLRS plans are defined benefit pension plans. Once you’re vested, you’re entitled to a lifetime benefit that will be based on your years of service and final average earnings. The amount of your contributions does not determine the amount of your pension. (Use Retirement Online to estimate your pension.)

Your NYSLRS plan differs from defined contribution plans, such as a 401-k plan, which are essentially retirement savings plans. In those plans, a worker, their employer, or both contribute to an individual retirement account. The money is invested and hopefully accumulates investment returns over time. This type of plan does not provide a guaranteed lifetime benefit and there is the risk that the money will run out during the worker’s retirement years. Experts recommend that workers who have defined contribution plans contribute anywhere from 10 to 20 percent of their income to their plan. NYSLRS members, in contrast, contribute between 3 and 6 percent of their income, depending on their tier and retirement plan.

Where Your Contributions Go

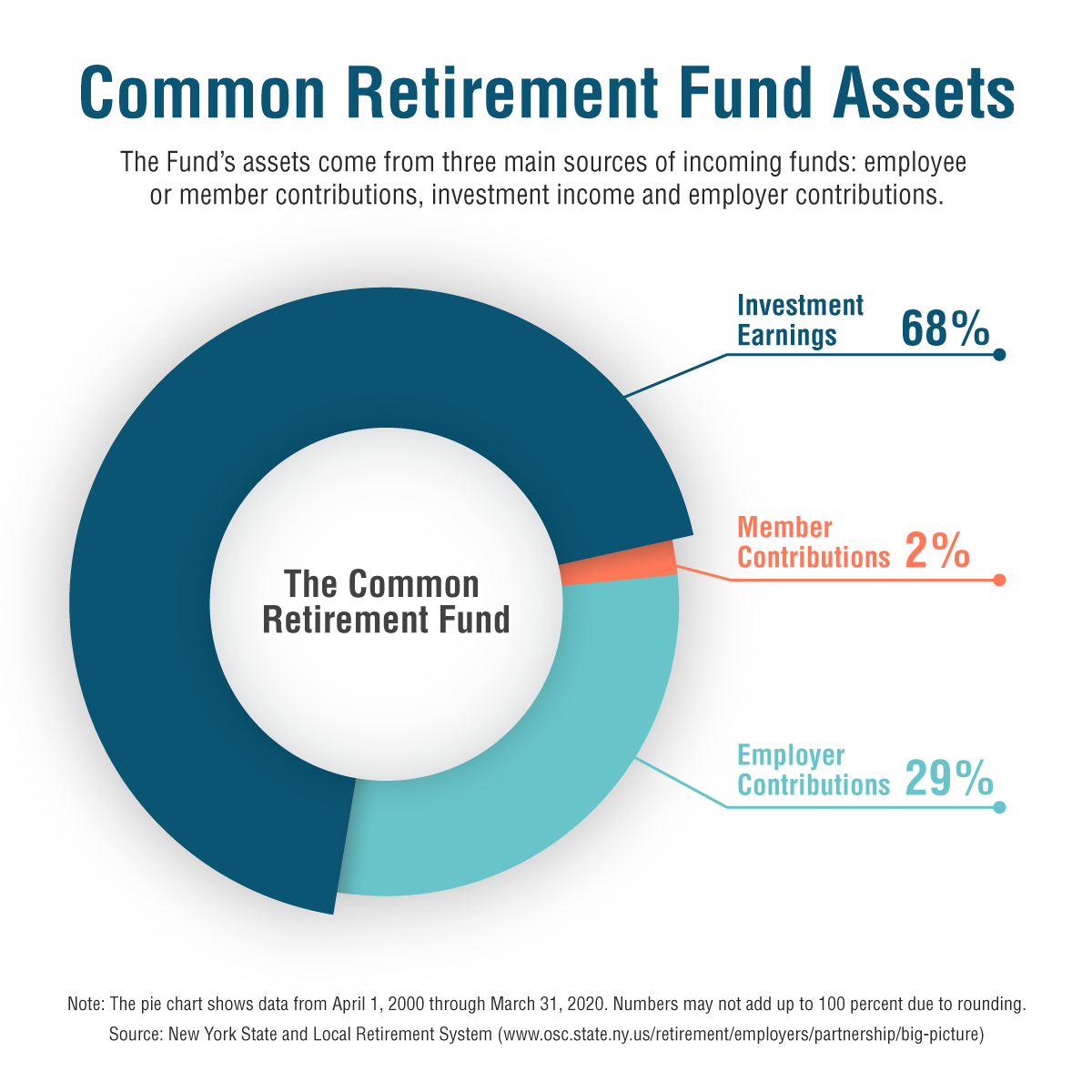

When you retire, your contributions go into the New York State Common Retirement Fund. The Fund is the pool of money that is invested and used to pay retirement benefits for you and other NYSLRS members.

Your Contribution Balance

You can find your current contribution balance in Retirement Online. But if your contributions don’t determine your pension, what difference does it make what the balance is? For one thing, your contribution balance helps determine the amount you can borrow if you decide to take a loan from NYSLRS. Also, you may be able to withdraw your contributions, with interest, if you leave the public workforce before retirement age.

Withdrawing Your Contributions

You cannot withdraw your contributions while you are still working for a public employer in New York State. If you leave public employment with less than ten years of service, you can withdraw your contributions, plus interest. If you withdraw, you will not be eligible for a NYSLRS retirement benefit.

If you have more than ten years of service, you cannot withdraw, but you will be entitled to a pension when you reach retirement age. But remember, you will not receive this pension automatically; you must file a retirement application before you can receive any benefit.

I was hired on 2/25/88 as a Temp; on 5/19/88 I was hired as a permanent employee w/ NYS as a KBS. I went to 1991 w/o knowing that I could join the retirement system. Now I am getting ready to retire I started to look closely at all my paperwork and noticed that on my recent NYSLRS Member annual statement that my membership date is 01/11/1991. I bought back three years and need help proving this. Can anyone help me please? I have called the 866-805-0990 for days; today I received a call back and they couldn’t hear me for some reason. I WOULD TRULY APPRECIATE SOMEONE TO HELP ME W/ THIS VERY IMPORTANT MATTER. Thank You!!

We apologize for the trouble you are having. Your message is important to us and we have sent you a private message in response.

I have 20 years with NYS and if there’s one thing I have learned over the years, regardless of which agency I work/ed for or how unethical/ineffective the leadership may be at times, state employees are some of the most entitled, ungrateful, whiney people I have ever met! Where would any of you retirees be right now, had you not worked for NYS?! Still working to make ends meet (possibly more than one job), having to borrow money to pay your bills, living paycheck to paycheck on a very tight budget because you have no pension and your 401K didn’t make it quite as far as you’d hoped, being in poor health/not being able to see the doctor when you’re not feeling well because you have no health insurance or it’s just too expensive, having to sell your home or take out a 2nd mortgage just to survive??!! Depending on when YOU decide to retire, you could have full pension benefits FOR LIFE…depending on how YOU decide to use your sick time, you could have full health benefits FOR LIFE AND add to your service credits…depending on how YOU decide to use your vacation time, you could receive a lump sump payment when you retire OR have a little extra time off before you retire, to ease into retirement…depending on how YOU decide to contribute to your Deferred Comp account, you could have an extra added nest egg to supplement your pension and give you the added security that you may need in retirement…if you receive lump sump longevity payments, you can use those to boost your FAS…I could go on!! Complaining about having to contribute to YOUR pension for a little longer than you feel you should have…really?! If you worked in the private sector, you would most likely have to contribute to a 401K FOR THE DURATION of your employment, and would ONLY be entitled to those contributions/interest in retirement…think about that the next time you feel like complaining about contributing to your pension!! And if you’re a current NYS employee, where else could you CONTINUE to receive all of those same benefits WHILE ON GOVERNMENT MANDATED SHUTDOWN FOR 3+ months??!! STILL receiving your full paycheck…STILL accruing all of your vacation & sick time, without having to charge ANY of your accruals during that time, STILL maintaining full health insurance benefits…being allowed to continue to “work from home” indefinitely, after the shutdown …and most important of all, STILL HAVING A JOB!!! All of these benefits are a PRIVILEGE, not a right, and it angers me (as a taxpayer), when I hear a co-worker or another state employee comment that they’re going to take full advantage of said benefits because NYS “owes them!” NYS doesn’t owe you or any other employee anything, beyond what you already received or are receiving in the multitude of benefits provided…so please, take a moment to think about all of your wonderful benefits, appreciate everything that they have afforded you, realize how very fortunate you REALLY are, and GET OVER YOURSELVES ALREADY!!!

Who promised what Anthony B? Vague verbal talk among the shop coworkers or was it someone from the NYS LRS because I asked the same question at a CSEA local information event directly to the NYSLRS reps who made the presentation and there is NO making anyone “whole”.

Because the elected leaders in the NYS Senate and Assembly did nothing that is the way it is. We contributed for more years than others. I am Tier 3.

Did you know Tier 6 workers now contribute for their entire career?

I am thankful I am getting a great NYS LRS pension and wont be whining about it. I intend to live long and healthy and bank many monthly pension payments. I deserve it after working as long as I did.

I realized that being angry and bitter won’t prolong my life. Think about it.

Stay positive. Live long and healthy. Be active, eat smart, breath, enjoy, be lucky.

Peace.

ELIO GIULIANI

I agree with Elio G. So I contributed for a few extra years beyond the 10 years required under Tier 4. No big deal. I got out before my 56th birthday. Have collected nearly 4 years of pension checks. Maximum single life benefit. No health insurance premiums. No state income tax due on the pension. What more can you ask for? By the time I am Medicare eligible my former rotten

agency will have covered me on the Empire Plan for 9 1/2 years without a single penny in

premiums coming out of my pension. I maxxed out oy pension and health benefits. I have no complaints.

Just enjoy not having to go to these lousy public sector jobs any longer, Cash your checks, stay

healthy and be happy. The goal is to collect your pension for at least as many years as you

worked for the government. After 20 years, the average retiree has collected $1 million in

pension benefits.

Tom DiNapoli is doing a great job. He protects our pension funds from incompetent

politicians who would love to “borrow” some of the billions to balance the state budget.

DiNapoli should primary Emperor Cuomo in 2022, and he should definitely run for

Governor if Cuomo leaves next year to become a janitor in the Biden administration.

Please note: when you add up the annual investment returns your contributions actually generated during your term of service the portion of your pension funded by you is substantially more than what you think it is.

And should you withdraw your contributions with statutory interest you are being shortchanged.

PROPOSAL: Make the system non-contributory with the member contributing at his/her full pension rate to the Deferred Compensation Plan of the State of New York.

Amen !!! I concur 110%…DiNapoli will get my vote

The tier 4 stopped contributions in 2000. Some employees contributed for only 10 years , but a LARGE group of employees contributed for well over 10 years. This group was NEVER duly compensated for the over contribution payments. As we were promised we are ALL still waiting and many of us are retired and still not whole yet.