Retirees, brush up on your Retirement System knowledge!

- Get Your 1099-R Tax Form in Retirement Online

Starting in 2024, your 1099-R tax form will be available in Retirement Online! Get yours faster and help us ‘go green’ — update your delivery preference now to receive an email when it’s ready, instead of waiting for it in the mail. (If you choose to receive your 1099-R by email, you will not receive a printed copy in the mail. Regardless of your delivery preference, you will be able to view and print your 1099-R by signing in to Retirement Online at the end of January.) - Change Your Federal Tax Withholding in Retirement Online

Retirement Online is the fastest way to update your withholding. Changes submitted by the middle of the month will generally appear in that month’s payment. Most NYSLRS pensions are subject to federal income tax (some disability benefits are not taxable). - Not Taxed by New York State

Your NYSLRS pension is not subject to New York State or local income taxes. Visit our Taxes and Your Pension page for more information. If you move to another state, your pension may be subject to that state’s income tax. If you’re thinking of moving to another state, check with that state’s tax department. - Get Your Retiree Annual Statement in Retirement Online

Starting in 2024, you can use Retirement Online to view and print your annual statement. Help us go green and update your delivery preference to receive an email when it’s available, instead of waiting to receive it in the mail. - Manage Your Direct Deposit in Retirement Online

Use Retirement Online to securely update your direct deposit bank account information. Whether you’ve switched banks or need to move your deposits to a different account, you can make those changes quickly with Retirement Online. Changes are generally applied within one to two payments. You can find out when your next pension payment is coming by checking our online pension payment calendar. - Prove Your Pension Income Using Retirement Online

You may need proof of your retirement income for housing or as part of an application for the Home Energy Assistance Program (HEAP). With Retirement Online, you can print or save an income verification letter any time you need one. - Receiving Your Annual Cost of Living Increases

Once you become eligible for a cost-of-living adjustment (COLA), you will receive a permanent increase to your pension amount every September. When your net benefit amount changes, NYSLRS will inform you. - View Your Pension Payment “Pay Stub” in Retirement Online

Sign in to Retirement Online to access full pay stubs for your pension payments. Select the date of the payment you want to review to see a breakdown of your pension payment, including your most recent COLA amount as well as any deductions made for health insurance, union dues, tax withholding or disbursements under a domestic relations order. - You May Leave a Death Benefit

Your survivors may be entitled to a death benefit after you die. Retirement Online makes it easy for eligible retirees to view their beneficiary selections, choose different beneficiaries or change contact information for an existing beneficiary. Anyone can report the death of a retiree by using our online death report form. - Best-Funded, Best-Managed

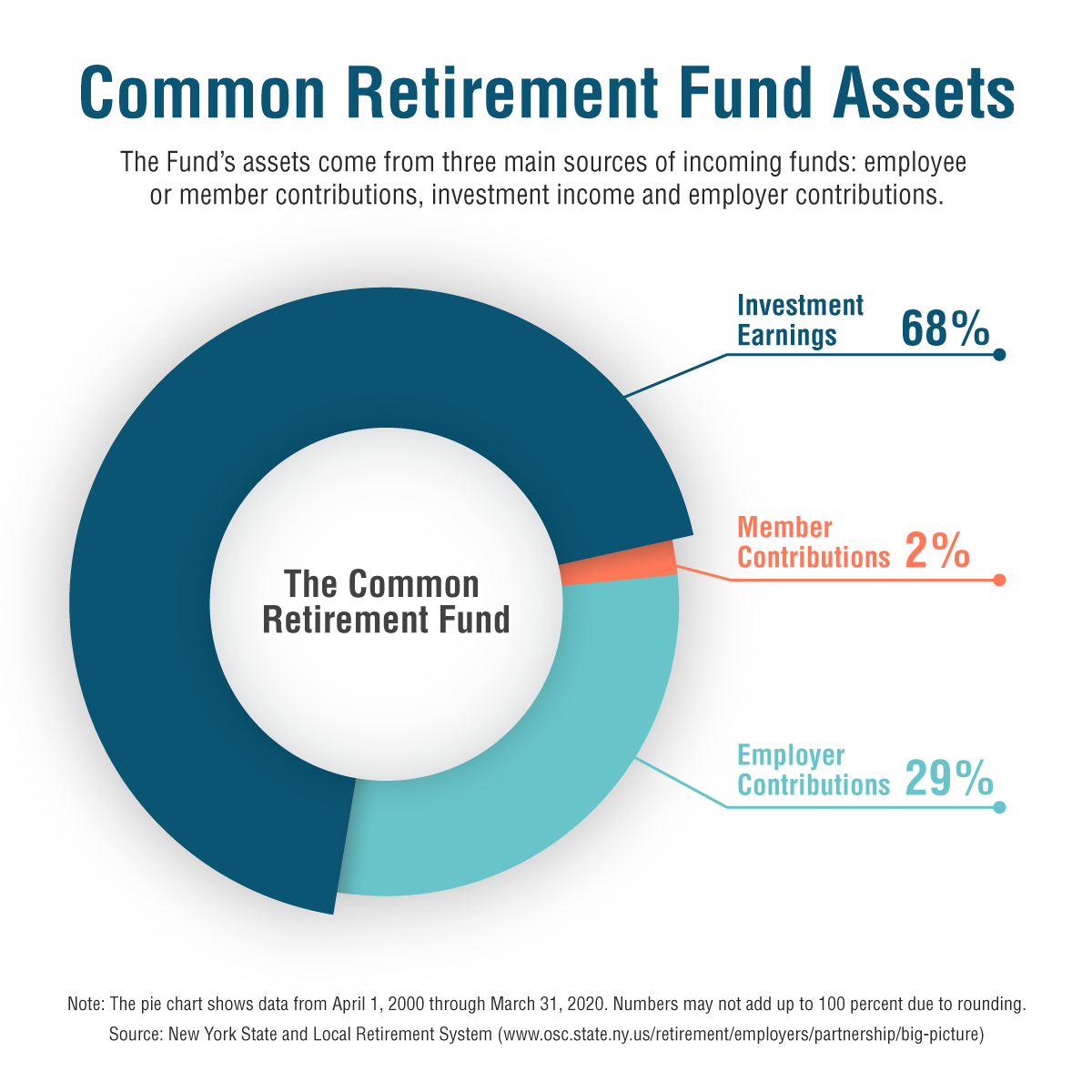

The New York State Common Retirement Fund holds and invests the assets of NYSLRS on behalf of members, retirees and their beneficiaries and continues to be one of the best-funded and best-managed public pension funds in the nation. Comptroller Thomas P. DiNapoli is the administrative head of NYSLRS and trustee of the Common Retirement Fund.

Not retired yet? Read our blog post 10 Things All NYSLRS Members Should Know.

Since taking office, New York State Comptroller Thomas P. DiNapoli has fought against the abuse of public funds. One of his top priorities is to protect the New York State and Local Retirement System (NYSLRS) from pension scammers.

Since taking office, New York State Comptroller Thomas P. DiNapoli has fought against the abuse of public funds. One of his top priorities is to protect the New York State and Local Retirement System (NYSLRS) from pension scammers. Since taking office,

Since taking office,  Since taking office,

Since taking office,