(We know that’s two, but let us explain.) When you join the New York State and Local Retirement System (NYSLRS), you’re assigned a tier based on your date of membership. There are six tiers in the Employees’ Retirement System (ERS) and five in the Police and Fire Retirement System (PFRS). Your tier determines such things as your eligibility for benefits, the calculation of those benefits, death benefit coverage and whether you need to contribute toward your benefits.

Our series, NYSLRS – One Tier at a Time, walks through each tier and gives you a quick look at the benefits in both ERS and PFRS. Today’s post looks at ERS Tiers 3 and 4. Of our current 650,251 ERS members, 263,561 are in Tiers 3 and 4, representing 40.5 percent of ERS membership.

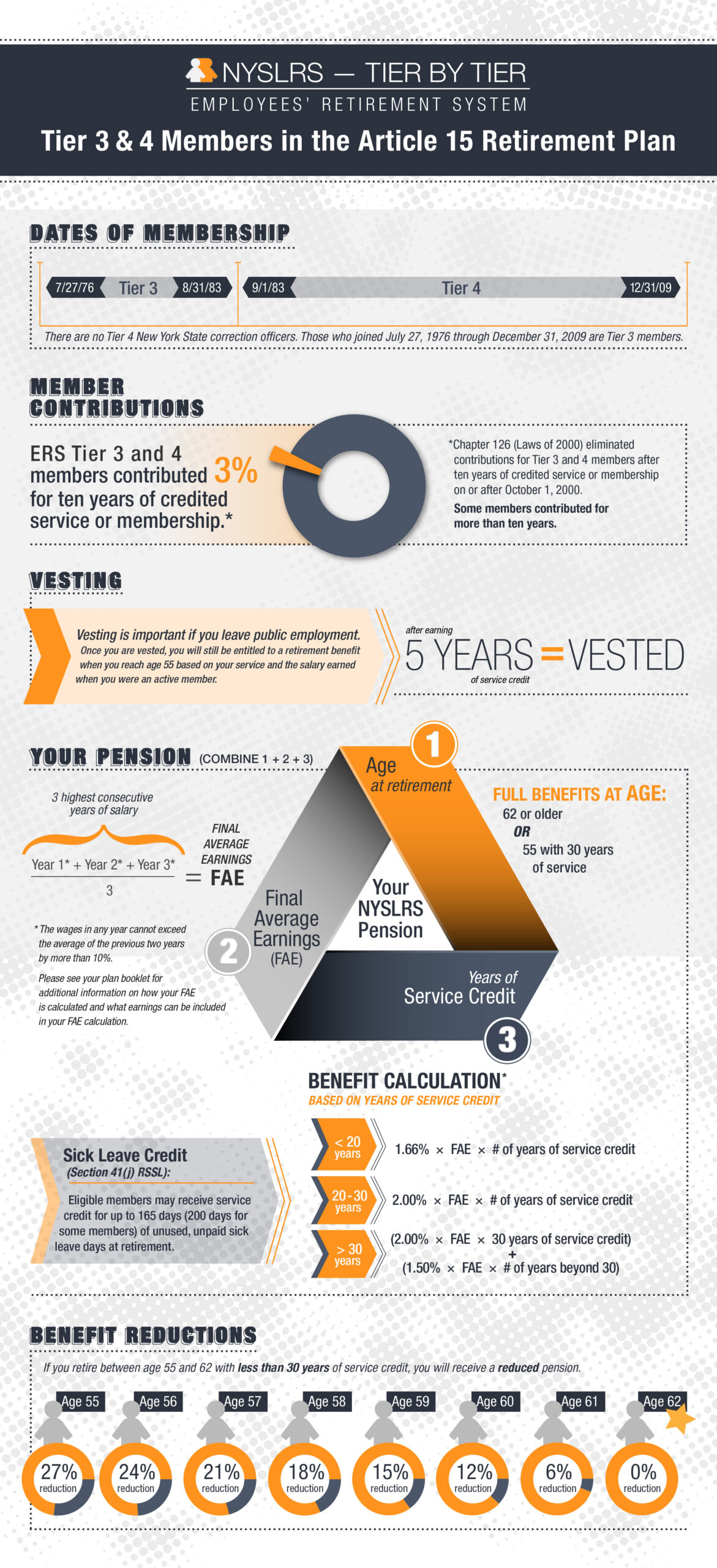

Most ERS Tier 3 and Tier 4 members (unless they are in special retirement plans) retire under the Article 15 retirement plan. Check out the graphic below for the basic retirement information for Tiers 3 and 4 members in this plan.

Membership Milestones for ERS Tiers 3 and 4

ERS members in Tiers 3 or 4 need five years of service credit to become vested. Once vested, they’re eligible for a lifetime pension benefit as early as age 55. However, if they retire before the full retirement age of 62 with fewer than 30 years of service credit, their benefit will be reduced. Some Tier 3 and 4 members, such as sheriffs or correction officers, can retire with 20 or 25 years of service, regardless of age and without penalty.

You can check your service credit total and estimate your pension using Retirement Online. Most members can use our online pension calculator to create an estimate based on the salary and service information NYSLRS has on file for them. You can enter different retirement dates to see how your choices would affect your potential benefit.

For more information about Tier 3 and 4 membership, find your NYSLRS retirement plan publication. It’s a comprehensive description of the benefits provided by your specific plan.

I’ve been a NYS employee since 3/18/04. I’ve be considering my retirement options (55 yoa or 60, 61, or 62 yoa). When I retire, my monthly retirement amount would be based on my years of NYS service + the highest-3-consecutive years of my earnings, correct? What what happens to my contribution amount when I retire? Does it get paid to me in a Lump Sum?

For information about your membership — including the calculation used for your retirement benefit — find your NYSLRS retirement plan publication. It’s a comprehensive description of the benefits provided by your specific plan.

When you retire, the mandatory contributions that you paid into NYSLRS will not be refunded to you. NYSLRS pensions are defined benefits, which means your pension amount is a lifetime pension based on your years of service and earnings. Member contributions support the benefits earned by current and future retirees. For more information, visit our Defined Benefit Plan page.

As you think about when to retire, you may want to create a pension estimate in Retirement Online. A Retirement Online estimate is based on the most up-to-date account information we have on file for you. You can enter different retirement dates to see how those choices would affect your benefit. When you’re done, you can print your pension estimate or save it for future reference.

If you have account-specific questions, you can call our customer service representatives at 866-805-0990. Press 2, then follow the prompts. You can also message them using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

My 680 hrs of sick time only gave me $55 towards my health insurance when I retired. I would of got more $ if I used the sick time by calling in a 4 dayer aat 1 mark d in the books. THINK ABOUT IT

Welcome to the club.

I retired in October of 2019.

I’m in total agreement with you.

It’s just crazy that the final determinations are taking up to 3 years. Can you imagine when you were working telling your customers that it would be that long before you could deal with them? We understand that the estimates are close, but we paid into this system, and the system is doing well. If need be, hire more employees or update that awful computer system. We deserve nothing less!

I retired on April 25, 2018 and have yet to have my final payment figure finalized it will be 5 years this coming April 25th and have not had my final retirement figure finalized yet. I have called and even sent a certified letter to no avail

Your message is important to us, and we have sent you a private message in response.

I am Tier 4 and I retired 18 months ago. My monthly pension benefit is still the original estimated amount. About how much longer should I expect to wait before a final determination is made on my monthly benefit figure?

When you retire, your pension payment is based on the salary and service information we have on file for you at retirement. In some cases, slight adjustments are made to the initial amount after we receive and process final payroll information from your employer. These recalculations are processed in date order and are generally minimal compared to the overall benefit amount.

Once we have all the information we need and we finalize your benefit amount, if your payment increases, you will receive a retroactive payment for the amount you are owed back to your date of retirement.

Is this a normal period to wait? A year and a half so far.

For more information, you can email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

Good luck!

I’ve been retired 36 most.and still waiting for recalculation.

I have always esteemed and respected the work of Comptroller DiNapoli and the NYSLRS staff team, HOWEVER, it is appalling that the final determinations are so backlogged that NYSLRS staff are no longer even providing timeframe estimates! The delay used to be about 6 months and is now years. I retired in August of 2021, and cannot find out when to expect my final determination. I was informed that eventual retroactive payments will not include interest, as the retirement system benefits from the float, rather than retirees… ENTIRELY UNACCEPTABLE.

Virtually all initial pension payments are made timely by the end of the month following retirement. These payments are closer than ever to a retiree’s final calculation. NYSLRS often receives adjustments to earnings for retirees well after the date of retirement and is working hard to recalculate pension amounts and provide retroactive payments as quickly as possible. We apologize for the length of time this has taken for some retirees. Thank you for your patience.

So sorry for all the complaints! Understandable but worker shortage plus surge in retirements have backlogged many companies.